North America

Importing to Thailand

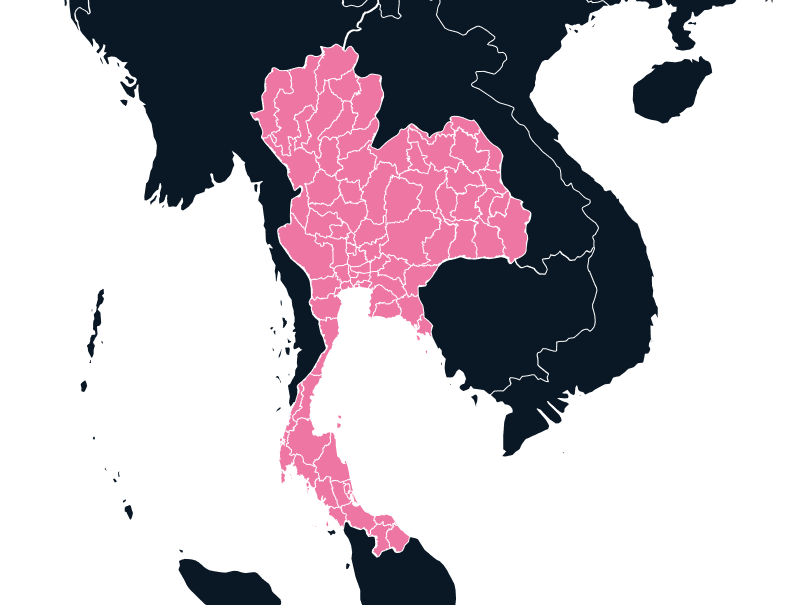

Thailand is expanding its ICT presence across Asia, making it an attractive location for importing and exporting goods. Yet, navigating customs controls in Thailand can be complex, as the import regulations are stringent. Having an Importer of Record makes these shipments easier to control.

Tax

up to 7%

Duties

up to 43%

Lead Times

2 - 3 weeks

Restricted Items

Second-hand Goods, Refurbished Goods, Batteries

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

Thai

Exporting and Importing To Thailand

Thailand exports primarily to the United States, China, and Japan. Its central location within Southeast Asia is near major shipping routes, making it an attractive location for imports and exports from nearby trade hubs such as China and India.

Furthermore, Thailand has implemented an “Act West” policy, strengthening its ties with India by increasing its cooperation through trade. Although Thailand is a developing country, there has been a gradual shift towards digital transformation after the COVID-19 pandemic, which the Thai government has encouraged and is pushing for Thailand to become an ICT hub. The Thai government has also recently eliminated its requirement for a certificate of origin on certain products, such as IT imports, pursuant to the WTO Information Technology Agreement, boosting the digitization of imports and exports in Thailand.

This digital transformation boom has further led to growth within the IT sector for tech giants like Huawei, Intel, and Samsung while unlocking new opportunities for new players. To fully capitalize on this potential, effectively navigating Thailand’s high tariffs and duties is crucial. With TecEx’s expertise and guidance, we can streamline Thailand’s customs processes and minimize complexities.

Population

70 M

Biggest Industry by Export

Electronics and Machinery

Capital City

Bangkok

Biggest Industry by Import

Electrical machinery and Equipment

Specialized Solution for Importing to Thailand

The TecEx Delivered Duty Paid shipping solution is an in-depth door-to-door shipping service that covers customs compliance, import management, and logistical project management. TecEx has over 10 years of experience importing and exporting to and from Thailand, and our extensive industry experience will provide you with extreme value.

Thailand is very strict about correct goods classifications, thankfully TecEx has vast experience dealing with Harmonized System (HS) code, ensuring everything is done correctly to avoid any forms of delays. Thailand also has strict security standards concerning importing certain technologies, which may require various approvals from governmental authorities. TecEx is able to ensure all documents and approvals are in place to ensure smooth customs clearance.

Unique Trade Pain Points for Importing to Thailand

Corruption and Transparency

Thailand is currently trying to address issues of corruption and lack of transparency. However, this has caused various concerns from countries like the United States due to the unstable government and unpredictable shipping costs that may be incurred. Using an Importer of Record like TecEx will ease any uncertainties, as we have tremendous experience facilitating smooth customs clearance despite these challenges. We take on your importing and auditing risks, plus offer liability cover, so all risks are transferred to us.

Customs Laws

The International Trade Administration has emphasized that Thailand’s customs laws can pose challenges for importers, as Thailand is not part of the Kyoto Convention. However, Thailand does enforce the Thailand Customs Penalty Regime. Violation of this regime due to an undervalued shipment, for example, can lead to 10 years of imprisonment. Correctly valuing items is, therefore, crucial, and TecEx can ensure all valuations are accurate before shipments go live to avoid severe penalties.

Countries Associated with Thailand

Asia

China

Asia

Japan

Import to Thailand | Compliance Regulations

Packing List

A packing list is required when shipping to a client’s commercial invoice. This list includes information such as the item’s Net weight, the shipment’s gross weight, and the total number of packages.

Proof of Value

When importing into Thailand, proof of value is required to ensure that authorities can accurately assess a goods’ value for tax purposes and to prevent fraudulent activities.

Certificate of Origin

A certificate of origin is needed on certain items. This states where the goods are manufactured and shipped from.

Harmonized Tariff System

In order to categorize goods correctly, shipments going into Thailand need a Harmonized Tariff system.

Bill of Lading

A bill of lading is needed to serve as a receipt for the goods and as a contract between the importer and exporter.

Your global trade solution for Thailand

Fill in the form to get in touch with us, and one of our experts will contact you with a customs compliance solution to suit your needs.