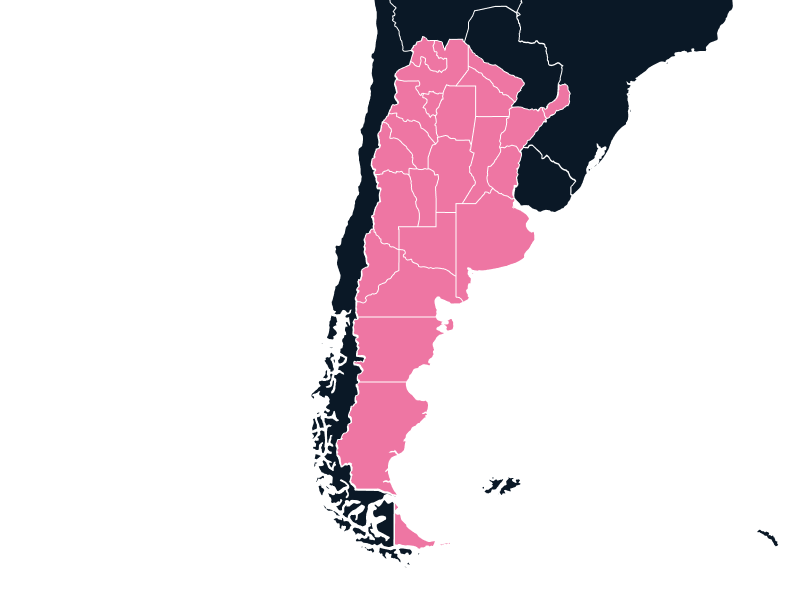

South America

Importing to Argentina

Argentina has the third-largest GDP in Latin America and is emerging as the region’s tech epicentre. Imports into Argentina have increased over the years, making the country attractive for trade, yet Navigating customs can be challenging.

Tax

up to 21%

Duties

up to 35%

Lead Times

5-6 weeks

Restricted Items

Integrated Power Systems, Certain Power Cords, Second-Hand and Refurbished Goods

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

Spanish

Importing and Exporting to Argentina

The most prominent goods imported into Argentina are from the service industry, including information, communication, and travel services, with Argentina’s top trading partners being Brazil, China, and the US. However, although its service sector is expanding, Argentina has also increased its opportunities for exporting and importing within the tech industry. This is outlined in Argentina’s digital agenda for 2023, indicating their investment in ICT and Cybersecurity.

Argentina is also seeing a rise in economic growth where exports from the US to Argentina rose by 55 percent in 2022, increasing opportunities in this field. Yet despite this opportunity, importing into Argentina does come with challenges due to the rise in efforts to protect domestic industries. This has led to various barriers to trade, resulting in inevitable delays and multiple documents and permits needed for importing into Argentina. To reduce these delays, an Importer of Record can help by ensuring all relevant documentation is obtained, and all licenses are approved; TecEx is an expert in this field.

Population

45,782,764

Biggest Industry by Export

Agriculture

Capital City

Buenos Aires

Biggest Industry by Import

Automotive Industry

Specialized solution for Importing to Argentina

Navigating various rates and different forms of taxation is challenging in Argentina. The multiple requirements for importing into Argentina cause importers and exporters to experience many hurdles. Argentina has an extensive list of documents needed for customs, all written in Spanish, which adds an extra layer of stress when gathering documents. Rest assured, TecEx is well-versed in Argentina’s custom controls and can alleviate the added stress.

TecEx’s Delivered Duty Paid (DDP), a unique door-to-door solution, helps ensure seamless and hassle-free customer experiences. TecEx will take care of the clearance of goods, import formalities, and all logistical components required. Hence, all responsibility will be taken care of by TecEx.

Unique Pain Points for Argentina

Import barriers have been implemented to protect the local Argentinian economy. This results in delays and limitations for imports into Argentina, making it more challenging and time-consuming. Furthermore, the Argentinian government has placed restrictions on power cables, used goods, and specific tech products such as laptops, desktops, and cell phones. This makes navigating tech shipments more challenging, which is why TecEx’s product compliance experts will ensure accurate classifications and smooth delivery regardless of the product type.

Argentina also has strict customs regulations, resulting in various documents and pictures required for imports. These include packing lists, pictures of the Cargo, and photographs of packages and labels that must be documented. Once again, using TecEx services will ensure that all documents are in place and correctly labelled.

Lastly, various import taxes, such as Value-Added Tax and Statistical Tax, are added to IT hardware when importing into Argentina, increasing the overall import budget. Having an Importer of Record is crucial to accelerating this clearance of goods through customs.

Countries Associated with Argentina

North America

United States of America (USA)

Asia

China

Specific Compliance Regulations

Non-Automatic Import License

Non-Automatic Import Licenses are applied to specific goods, including electrical appliances, computers, and cell phones. These licenses are valid for 90 days, and central bank approval is required, leading to long processing times due to in-depth evaluations.

SIRA

All products and services must abide by the Argentine System of Imports (SIRA), a procedure for managing imports. Therefore, products and services under this regime require a SIRA request. Companies often find this request challenging regarding what the SIRA request states and what is actually needed. Therefore, an Importer of Record is advised to make this process smoother.

Packing List

A packing list is required to describe the contents of each package, including each item’s gross and net weight. This should preferably be done in Spanish, and TecEx can step in to ensure accuracy.

Commercial Invoices

Commercial invoices must also be submitted as original copies in Spanish, containing various components such as the invoice number, date of execution, and terms of payments using INCOTERMS. TecEx is well-versed in these terms and can assist in ensuring that all documents are correct.

Sistema Integral de Monitoreo de Importaciones

The Sistema Integral de Monitoreo de Importaciones (SIMI) is an online platform monitored by the Argentinian Government to monitor imports into the country appropriately. This permit is required for every shipment into Argentina.

Seguridad Eléctrica

When importing electrical goods, various electrical specifications must be indicated through the Seguridad Electrica. These requirements are set on a per-shipment basis to ensure correct safety and quality standards for Argentina.

Your global trade solution for Argentina

Fill in the form to get in touch with us, and our experts will contact you with customs compliance solution to suit your needs.

%20(1).jpg)