Dive into the history of maritime law, how events have impacted those who trade commodities across borders, and the future of liability in such events.

“…One of the largest marine losses in history” – John Neal, chief executive of global insurer Lloyds of London.

On 26 March 2024, the Dali container ship struck the Francis Scott Key Bridge in Baltimore, USA. The entire bridge collapsed, and lives were lost in the incident. In terms of the true cost of damages, it’s impossible to know the exact amount anytime soon. It will take time to determine the extent of damage to property and cargo and the cost of the closure of one of the US eastern seaboard’s busiest ports. The families of those involved in the collapse are also expected to lay claims in the case.

Looking back at the history of maritime law, this tragic incident will now become an issue of who is liable. Taking precedence from the 1851 Limitations Act, the owner, Grace Ocean Private Ltd., and manager, Synergy Marine Pte Ltd., of the cargo ship are petitioning for limitation of liability.

It’s important to remember that the Limitation of Liability Act does limit the shipowner’s financial liability to the value of their vessel plus the cargo, but only if they can prove they didn’t know there was a problem beforehand.

Extent of Damage

As it stands, the crew and cargo remain on the ship while the investigation process continues to take place. This means a complete halt for the businesses attempting to trade commodities aboard the ship (and the port!).

Electronic machinery and electronics account for $1B of the total imports heading into the Port of Baltimore. As with any high-value commodity, but especially for high-demand tech goods , any delays can cause major disruptions. This is end-to-end – from the OEM making the products (and this means any replacement items) all the way to the end-user waiting for the shipment.

Incidents like this are not common, but it does happen. In recent years, a number of shipping accidents have caused major disruptions to global supply chains – like the Ever Given blockage in the Suez Canal or, even more recently, the Red Sea shipping attacks

However, the financial and reputational damage that can result from such an occurrence can be devastating. In cases like the Dali, shipping owners may limit their liability, putting your business interests at risk.

When shipping high-value tech gear, you must decide whether to cross your fingers and hope your goods arrive safely or consider strategies to protect your cargo and your business.

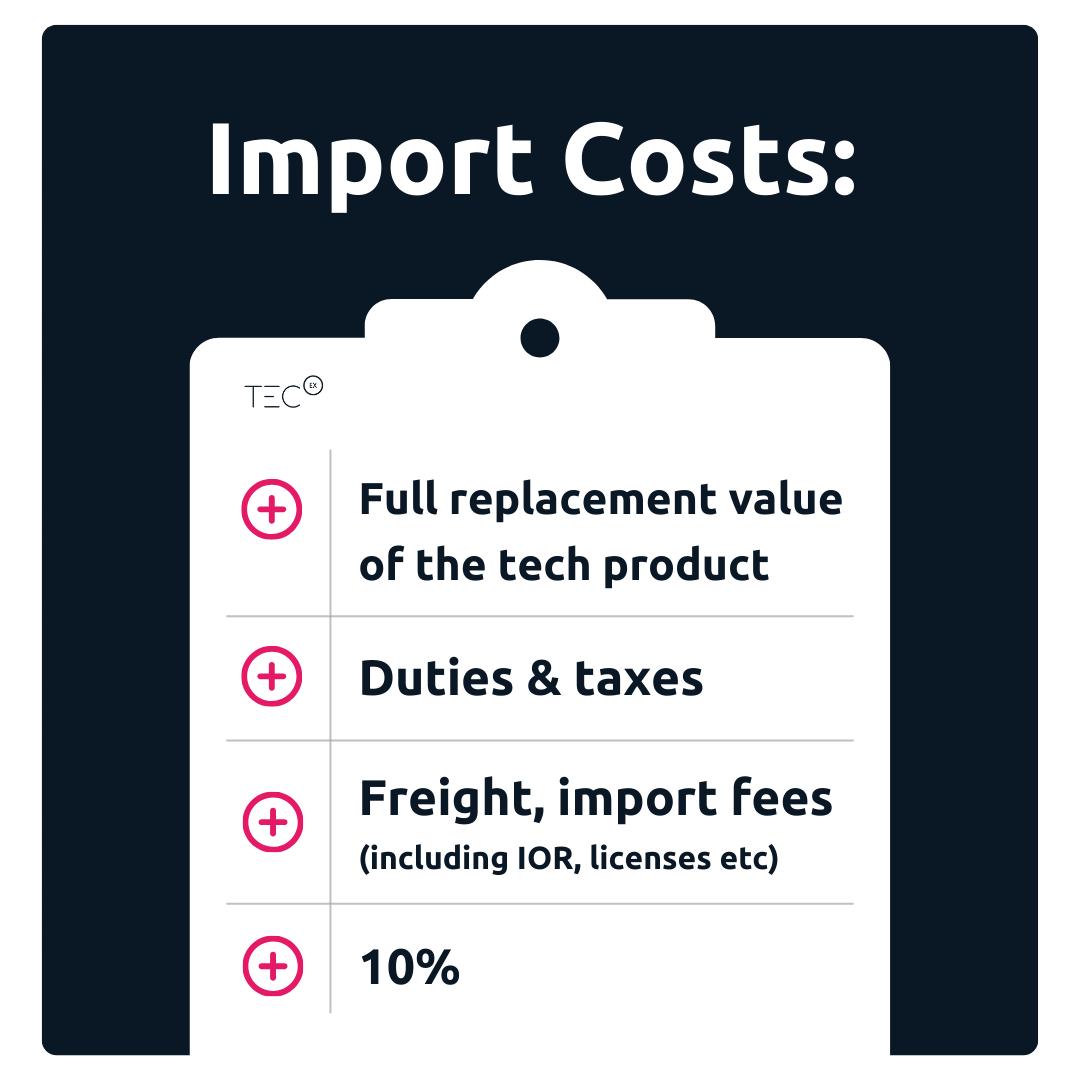

TecEx’s liability cover is completely end-to-end. We cover the full replacement value of the goods + a 10% buffer

Can history teach us anything about the way forward for maritime law?

A Historical Look at Maritime Law and Protecting Your Cargo

Maritime insurance boasts a remarkably rich history! Widely considered one of the oldest forms of insurance, its roots trace back to around 1200 BC. However, these early policies scarcely resemble the comprehensive coverage we know today.

Did you know?

The first formal marine insurance policy was created around 1350.

The need for maritime insurance arose from the inherent risks associated with long-distance trade. Journeys that spanned weeks or months exposed goods to perils far exceeding those encountered in local markets.

This reality, intertwined with the historical drive to consolidate capital and manage risk, fuelled the development of business practices to spread and mitigate these financial burdens. Consequently, as the methods of transporting goods have evolved, so too have the methods of protecting them.

However, the question remains: how evolved are current maritime laws? Described as “an ancient, often seemingly eccentric legal field that still relies on some precedents set in the Iron Age ,” maritime law is steeped in antiquity. It remains deeply entrenched in history. This status quo presents a fascinating irony. Maritime insurance, an evolved form of legal protection, exists alongside a legal framework that’s plainly archaic. As a result, the international community grapples with this contrast, with lawyers, legislators, and business owners relying on one of the oldest legal subjects to address highly complex and modern conundrums.

Are Ancient Laws Loopholes or Lifelines?

Disasters at sea have long exposed loopholes in maritime law, particularly when it comes to financial responsibility. The Limitation of Liability Act of 1851 is a prime example of a legal response to such shortcomings.

Prior to this lifeline, shipowners faced potentially crippling financial ruin for maritime incidents, even if they weren’t directly at fault. This stemmed from unlimited liability, meaning they could be held responsible for the full value of lost cargo or damaged vessels, regardless of the cause.

The story of the Limitation of Liability Act is intertwined with the development of the American shipping industry. American shipowners, competing with international counterparts who had similar liability limitations, were at a disadvantage.

The Act aimed to foster a more stable environment for American maritime commerce. By limiting a shipowner’s liability to the value of the vessel after a disaster (plus any pending freight), the Act aimed to encourage investment and growth in the industry.

This shift in liability had a significant impact. While cargo insurance remained important, the Act provided some financial protection for shipowners facing unforeseen circumstances.

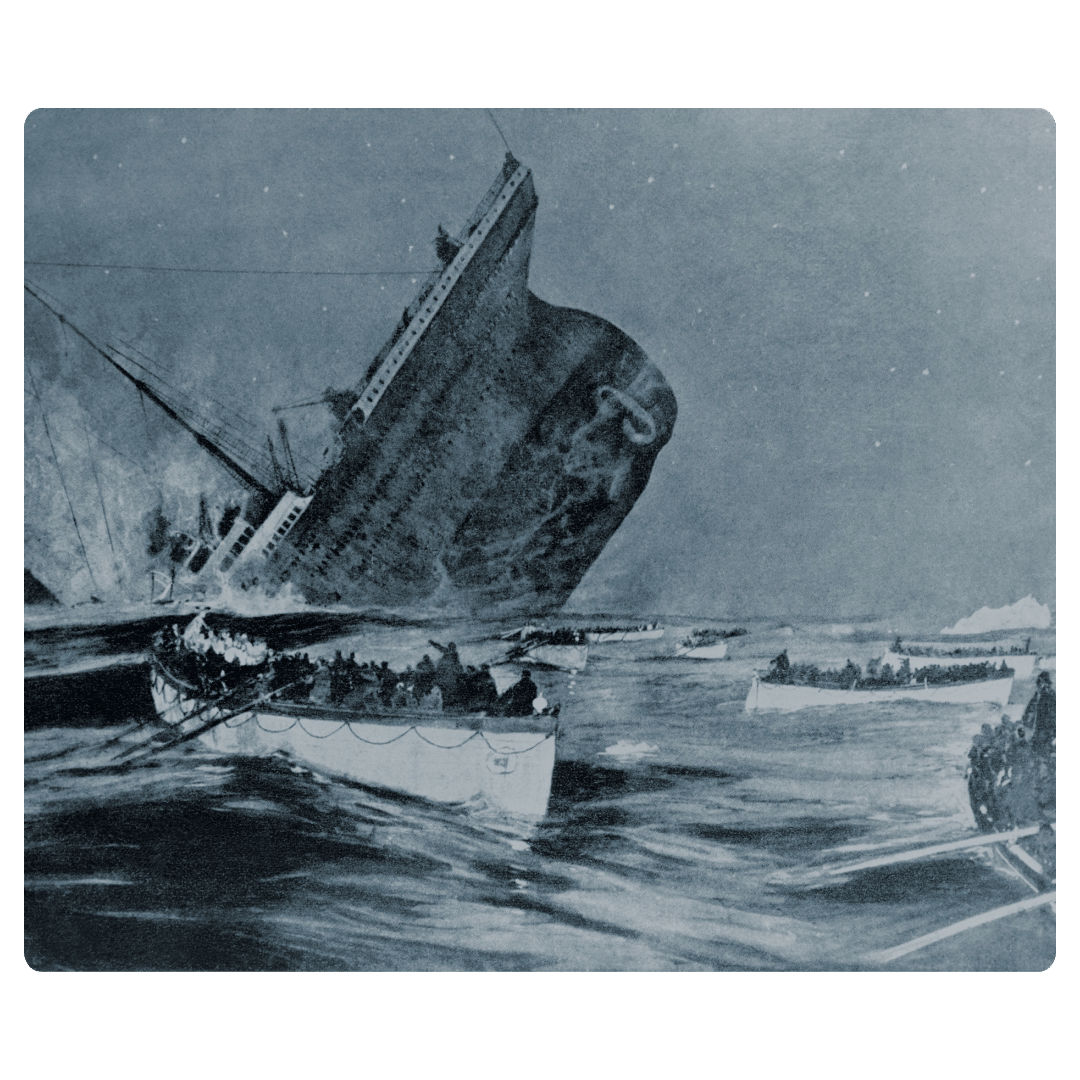

A Titanic Test for Maritime Insurance

The Limitation of Liability Act’s true test came in 1912 with the sinking of the RMS Titanic, a ship famously touted as “unsinkable.” But then, the owners of the Titanic cleverly used it to limit their own liabilities in the wake of the supposedly unsinkable ship’s sinking. This resulted in outrage, as the Act’s limitations meant families of victims and survivors could only receive compensation from the Titanic’s remaining value, a fraction of the true cost of the disaster.

The Titanic incident serves as a stark reminder of the potential consequences when such limitations are applied in situations of gross negligence.

It also emphasized the enormous financial risks involved in transporting cargo across vast distances and the importance of having proper insurance coverage in place.

So, with archaic laws and limitations, what does the future hold for those wanting to protect their shipments heading across borders?

Charting the Future of International Shipping

The Limitation of Liability Act of 1851 (US law) is a topic of debate regarding its future role in maritime law. Here’s a breakdown of its potential future and impact:

Critics contend that the law fails to keep pace with contemporary advancements in maritime safety and communication. They argue that it unfairly favors shipowners, restricting compensation to cargo shippers or senders even in instances of negligence, as we have seen with the Titanic disaster as well as potentially with the Dali.

The Limitation of Liability Act’s Impact on International Shipping

Predicting what the future will look like for international trade is tricky. However, based on both past and present maritime disasters, we can make certain assumptions.

Continued Uncertainty

Shippers may face challenges determining their compensation rights in case of cargo loss/damage. The complexities of the law and potential variations in interpretation across jurisdictions can make it difficult for shippers to predict the extent of compensation they’ll receive if their cargo is lost or damaged during international transport.

Shifting Landscape

Shippers may need to adapt their insurance strategies depending on how the law evolves. Amendments to the Act or new court rulings could alter the compensation shippers can expect under the law. This could necessitate adjustments to insurance coverage amounts or types to ensure adequate financial protection for their cargo.

Increased Scrutiny of Contracts

Shippers may need to pay closer attention to the terms of carriage contracts they enter into with shipowners. These contracts often limit shipowner liability in accordance with the Limitation of Liability Act. By carefully reviewing these contracts and negotiating more favorable terms if possible, shippers can better manage the risks associated with the uncertainties of the Act.

While the future of the 1851 Limitation of Liability Act remains uncertain, international shippers can find reassurance in TecEx’s Liability Cover.

Don’t Ship Uncovered

Full cover for your high-value tech goods.

Our global end-to-end solution ensures comprehensive coverage for high-value cargo and goods. Whether for local or international movements to over 200 destinations, our coverage spans from pick-up to final delivery. We guarantee coverage for the total replacement value, encompassing freight, tariffs, and import fees, with an additional 10% buffer