Asia

Importing to the UK

Importing and exporting from the UK involves detailed compliance with evolving trade agreements and restrictions that directly affect your supply chain performance. Gain the clarity you need to confidently manage global trade into and out of the United Kingdom.

Tax

Up to 20%

Duties

Up to 22%

Lead Times

1-2 weeks

Restricted Items

N/A

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

English

Exporting From the UK

The UK has a detailed system for regulating the export of strategic goods, software, and technology. This system is managed by the Export Control Joint Unit (ECJU), which is responsible for enforcing the UK’s export control regulations and compliance.

One massive and continual pain point for the UK is Brexit. European Union (EU) businesses now face a complex UK import system, while UK companies exporting to the EU must obtain export licenses.

Shipping Technology to the United Kingdom

Similar to the CE Marking, tech products entering the United Kingdom require a UKCA marking (post-Brexit) to clear customs. Furthermore, certain tech gear, such as encryption devices, high-frequency communication tools, or drones, may require special licenses or permits.

Another consideration for businesses importing gear for the purpose of processing or storing user data will need to meet GDPR data standards. Additional compliance requirements include ensuring compliance with WEEE regulations and ensuring proper recycling and disposal of electronic waste.

Population

68,35 M

Biggest Industry by Export

Cars

Capital City

London

Biggest Industry by Import

Refined Oil

SPIRE

The System for Processing Import and Export Licenses (SPIRE) is the UK government’s official online platform for managing export licensing.

Businesses use SPIRE to register for an export control account, apply for various types of export licenses, and register to use specific license types such as OGELs and OIELs.

OGEL

An Open General Export License (OGEL) is a type of export license that is pre-published and reusable, designed to cover low-risk export scenarios. It comes with fixed terms and conditions, allowing exporters to ship specific controlled goods, software, or technology to approved destinations and end-users.

OGELs are particularly well-suited for routine exports to countries with strong UK trade relationships or those considered low-risk. However, exporters must adhere strictly to all conditions attached to the license.

SIEL

A Standard Individual Export License (SIEL) is a custom, case-by-case license used for a specific export transaction. It grants permission to export a defined quantity or value of controlled items to a named end-user in a particular country.

SIELs are required when the export scenario doesn’t qualify for an OGEL. These licenses are typically valid for up to two years for permanent exports and may cover one or multiple shipments until the specified quantity or value is fully utilized. Each application for a SIEL undergoes individual assessment by the ECJU.

OIEL

An Open Individual Export License (OIEL) is a tailored, renewable license designed to meet the ongoing business needs of companies that export controlled goods on a frequent or long-term basis.

Unlike the more rigid SIEL, an OIEL offers greater flexibility, although not as much as an OGEL. It authorizes multiple shipments over multiple years. This license is typically used by companies that consistently ship to the same trusted end-users. Holders of an OIEL are subject to regular audits by the ECJU to ensure compliance with license conditions and reporting requirements.

You can check if your goods require a license using the UK government’s export control checker. However, you will most likely need a permit if your goods are classified as military goods and technology, dual-use items (most technology goods are considered dual-use), chemicals, waste, hazardous materials, medicines, or medical devices.

TecEx mitigates trade barriers and can make exporting from UK businesses a breeze, even post-Brexit. The difficulties in exporting IT hardware out of the United Kingdom allowed us to develop a specific Exporter of Record (EOR) solution for our clients – the UK Exporter of Record Service. TecEx offers the use of our OIEL, allowing us to act as the UK exporter. This eliminates the need for clients to apply for an SIEL, drastically reducing shipment lead times by weeks and mitigating any compliance risk.

Labeling has become extremely important for importing into the UK. As a country-specific requirement, this may mean that EU labels may not comply with UK legislation.

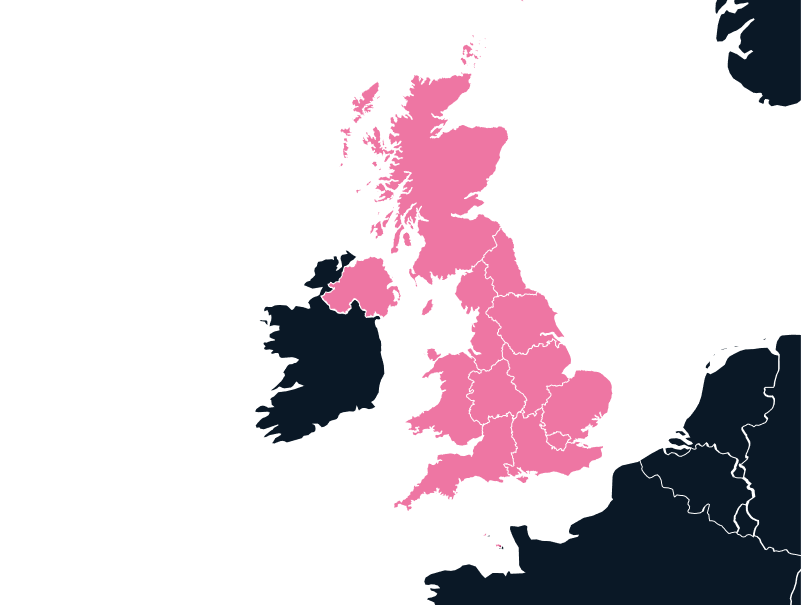

Countries That Trade with the UK

North America

United States of America (USA)

Europe

Germany

DDP Shipping to the UK

The incoterm DDP is well-utilized in global trade. For the buyer, it provides complete security, as the seller is responsible for the shipments. You do not need to take on any risks associated with shipping or customs clearance. This means that the seller of the goods is in full control over the entire process. But if this is a new destination or you do not want to take on all the risks and responsibilities of shipping tech gear, TecEx’s specialized DDP shipping service is your ultimate solution.

Our additional value-added services, such as our warehousing solution, offer extra supply chain benefits to this comprehensive end-to-end UK trade solution.

AI Hardware, Handled Like Gold

Importing cutting-edge AI equipment? We specialize in transporting mission-critical, high-value technology with full-service precision and care. From fragile components to sensitive systems, our white-glove control tower solution ensures your shipments arrive safely, compliantly, and on time—no matter the destination.

Shipping to the UK and EORI Numbers

An Economic Operator Registration and Identification (EORI) number is a unique ID required for businesses to import or export goods to or from the European Union. Without an EORI number, shipments can face delays, increased costs, or even rejection at customs. Importing into the UK requires a UK EORI number, which differs from the EU EORI numbers. Applying for EORI numbers can take time – let TecEx handle this burden for you.

Importing to the UK and VAT

With a high import VAT rate of 20% on goods, being unable to recoup this additional fee can have significant implications for your budget. TecEx can assist our clients with VAT recovery in this region, ensuring you never have to deal with this sunk cost. We work alongside you to ensure the deployment is correctly structured, manage the entire project from pick up to final delivery, and submit your VAT claims on your behalf—a full trade solution.

Brexit and Trade with the UK

The UK has become a particular global trade pain point for many companies conducting trade in this region. From varying trade restrictions to free trade agreements and the onset of Brexit, it is incredibly complex to navigate all the varying compliance requirements.

Brexit and the UK’s exit from the European Union ended free trade between the EU and the UK. EU companies must now navigate a complex UK import system, while UK companies exporting to the EU must acquire export licenses.

Trade Differences Between the UK, Overseas Territories, and Crown Dependencies

Mainland UK

The UK has become a globally independent trade actor post-Brexit, developing its own network of Free Trade Agreements (FTAs) and Digital Economy Agreements. Its policies emphasize reducing barriers for high-tech goods and services, ensuring robust data flow, and protecting intellectual property.

The country’s diversified economy—spanning fintech, AI, life sciences, and advanced manufacturing—makes it a leading exporter of high-value technology services. Governed by uniform legislation on trade, competition, and digital regulation, the UK also maintains comprehensive tax systems, including a national VAT regime.

Crown Dependencies

The Crown Dependencies (the Isle of Man, Jersey, and Guernsey) are self-governing jurisdictions with autonomy over fiscal, trade, and digital regulation. They are not part of the UK or the EU but maintain a close constitutional relationship with the UK, including participation in a shared customs and VAT arrangement under the UK–CD Customs Union.

These islands specialize in financial services, fintech, aerospace, and e-gaming, leveraging their stable political environments and competitive 0% corporate tax regimes to attract tech-based investment. Their digital economies thrive on providing infrastructure and services that support offshore finance, intellectual property management, and digital entertainment sectors.

Overseas Territories

The Overseas Territories (e.g., Gibraltar, Cayman Islands, Bermuda, Saint Helena, BVI, Anguilla, Falkland Islands, Turks and Caicos) possess even greater trade and fiscal autonomy, setting their own customs tariffs, import duties, and product standards. They are outside both the UK and EU customs and VAT areas, although their goods enjoy tariff-free access to the UK market.

Each territory’s economy is highly specialized and their low- or zero-tax environments and independent regulatory frameworks make them appealing hubs for global investment and technology-driven financial operations, though Brexit has increased their exposure to EU trade barriers.

Republic of Ireland and the UK

As an EU member, the Republic of Ireland serves as the region’s link to the Single Market and Customs Union, offering English-speaking access to EU trade and regulatory frameworks. Its competitive 12.5% corporate tax rate and pro-business policies have drawn numerous global tech and financial firms seeking to retain EU market access after Brexit.

Ireland’s alignment with EU law contrasts sharply with the UK’s independent trade path and the offshore fiscal models of the OTs and CDs. The Common Travel Area still facilitates free movement between Ireland and the UK-linked jurisdictions, sustaining cross-border collaboration in technology, finance, and professional services.

Access the UK Market with Full Compliance and End-to-End Import Support

The UK is a key destination for consumer goods, fashion, and technology. TecEx provides services that enable brands to access the UK market without establishing a local entity.

Our product compliance support covers HS code reviews and labeling checks to ensure items meet UK safety and labeling requirements. VAT & entity registrations are handled to maintain regulatory compliance, and return logistics to optimize landed costs for Amazon FBA and other similar channels.

Ready to Streamline Your UK Imports and Exports?

Act now to protect your supply chain from compliance pitfalls. Start strengthening your trade strategy before the next regulatory change impacts your operations. Reach out today.

.jpg)