Asia

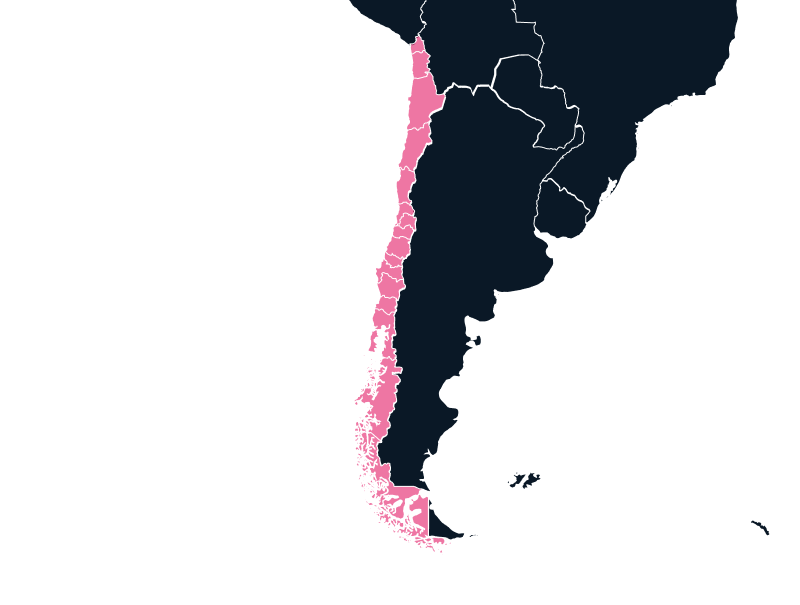

Import and Export to Chile

Chile is one of South America’s most dynamic and promising markets. However, navigating the complexities of importing and exporting goods in Chile requires a solid understanding of trade regulations, compliance requirements, and potential pitfalls that could disrupt your operations.

Tax

Up to 19%

Duties

Up to 12%

Lead Times

3-4 Weeks

Restricted Items

Second-Hand Goods; Pallet Restrictions

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Spanish

Import and Export in Chile

Chile’s trade landscape is shaped by its open market policies and extensive network of trade agreements, which includes 33 agreements with 65 economies, representing 88% of the world’s GDP. This makes Chile a highly attractive market for international trade. However, even with these advantageous agreements, businesses must still comply with a range of regulations when importing or exporting goods.

One of the most crucial steps in the import/export process is the preparation of documentation. Documents such as the bill of lading, commercial invoices, and certificates of origin are mandatory for customs clearance. Incorrect or incomplete documentation can lead to costly delays and penalties.

The average tariff rate for imports into Chile is around 6%, which is competitive compared to other South American nations. However, tariffs are not uniform and can vary based on the type of goods being traded. Essential items may enjoy reduced rates or exemptions, which can help mitigate some of the costs associated with trade.

Population

19.86M

Biggest Industry by Export

Copper

Capital City

Santiago

Biggest Industry by Import

Bovine Meats

Common Pain Points When Importing into Chile

While Chile’s trade environment offers numerous opportunities, there are also unique challenges that businesses must face. One of the most significant pain points when importing goods into Chile is the insurance requirement. If goods are uninsured upon arrival at customs or if proof of insurance cannot be provided, customs authorities will assume a value of 2%. This can significantly increase the taxable value of a shipment, leading to unforeseen costs that can negatively impact profit margins.

Another major challenge is the complexity of maintaining accurate and detailed records. The Chilean customs authorities are strict about record-keeping and impose penalties on businesses that fail to comply. In some cases, businesses may face administrative penalties such as fines or even suspension of their right to import/export if they fail to meet the necessary standards. In extreme cases, intentional violations can result in legal action, including criminal charges, which can harm a company’s reputation and operational capacity.

Top Trade Partners with Chile

North America

United States of America (USA)

South America

Brazil

Our Solution for Importing and Exporting into Chile

Given the complexities of Chile’s import and export regulations, having the right support is crucial. TecEx offers a comprehensive solution designed to address these challenges and simplify the process for businesses.

Our specialized service includes comprehensive liability coverage for all shipments, ensuring that your goods are protected from pick-up to final delivery. Unlike many other services that only cover part of the journey, we offer full insurance coverage for your shipments, mitigating the risk of unforeseen costs and ensuring peace of mind.

In addition to insurance, we also handle all the necessary documentation and compliance checks, ensuring that everything is in order upon arrival in Chile. This includes working with local customs to guarantee that all forms, including commercial invoices and certificates of origin, are completed correctly to avoid delays.

To further streamline the process, we offer a Delivered Duty Paid (DDP) shipping solution, which covers the entire import process. Our team of experts, including an Importer of Record (IOR) and trade compliance professionals, manages the entire shipment process, from logistics to customs clearance. This ensures that your tech products arrive efficiently and compliantly, with no unexpected costs or regulatory hurdles.

Chilean Compliance Regulations

Chile’s compliance regulations are a critical factor for businesses to consider when importing or exporting. While the country offers a mix of voluntary and mandatory standards, most sectors require compliance with at least basic regulations. One of the primary requirements is that all product labels must be in Spanish, with measurements in the metric system. Additionally, consumer goods must display the country of origin before being sold in Chile.

For businesses exporting tech products, these labeling requirements are essential to ensure that goods are compliant with local laws. Furthermore, companies must be prepared for inspections and audits, which can be frequent and rigorous. Chilean customs authorities require businesses to maintain records for at least five years, ensuring that any discrepancies can be resolved promptly if needed.

Chile’s open market and free trade policies create a favorable environment for international trade, but understanding and adhering to the specific rules and procedures remains vital to ensure smooth shipping.

Your Global Solution to Import and Export to Chile

Fill in the form to contact us, and our expert team will contact you with a bespoke import/export and customs compliance solution tailored to your Chilean trade needs.