What is a tariff, and how does it differ from a duty? These terms are often used interchangeably, confusing consumers and businesses. While duties refer to a range of fees or taxes on imported goods, a tariff is a type of duty.

All tariffs are duties, but not all duties are tariffs.

Tariffs and duties are taxes on imported goods. They are set by governments and enforced by customs authorities. Both tariffs and duties can affect prices for importers or purchasers of goods and for consumers.

The importer must pay the import duties and tariffs and decide whether to increase the price of their goods to offset these costs when pricing the goods for sale. This is where tariffs can raise prices for consumers.

Understanding duties, tariffs, and the role of HS codes can help you confidently navigate international trade complexities.

Exclusive Webinar | 25 June 2025 | 11 am EST

Worried about how tariffs will impact you? Sign up for our upcoming webinar, Trade Under Trump: How New Tariffs Impact Your Global Tech Shipments. We’ll unpack everything from global tariff basics to the impact of the latest US trade shifts, common tariff strategies, and how TecEx can help.

What is a Duty?

A duty is a government-imposed tax levied on imported and exported goods, services, or transactions. Customs duties can be anything from standard import duties to anti-dumping duties, excise duties, VAT, or tariffs.

What is VAT?

Value-Added Tax (VAT) is a consumption tax levied on goods and services, which is applied at each stage of production and distribution. Businesses charge VAT on sales and deduct it on purchases, paying the difference to the government. The consumer ultimately bears the full cost, as it’s included in the purchase price.

Duties can be based on factors like environmental impact, safety concerns, or country of origin. They are typically higher for luxury and non-essential goods.

Britannica further classifies duties and tariffs as:

- Transit duties, which were levied on goods by a country they passed through, are no longer used today,

- Export duties, which a country levies on its exports, are now uncommon except for certain raw materials, and

- Import duties, the most common customs duties, are levied by the destination country.

What Does “Duty-Free” Mean?

Duty-free goods are goods on which buyers – or importers – don’t pay import duties.

Duty-free goods are usually sold in international spaces, like airports, sea terminals, and cruise ships. They are goods for export only, as they are expected to be taken out of the current country. This means you won’t need to pay the host country’s duties, but must declare duty-free purchases to your home country when you return.

Large-scale imports can also be duty-free if stipulated by something like an international trade agreement or trading bloc.

What is a Tariff?

A tariff is a type of duty. Tariffs are usually based on factors like Country of Origin or commodity type.

Why Would a Country Impose a Tariff?

Protect Domestic Industries

Tariffs make imported goods more expensive, encouraging consumers to buy locally produced goods instead. This can protect domestic goods from foreign competition.

Generate Government Revenue

The government collects the tariff money to fund various programs and initiatives.

Achieve Foreign Policy Goals and Change Trade Relationships

Tariffs are a trading tool that can remake global trade landscapes, from equalizing trade deficits to encouraging businesses to reshore, to effectively placing embargoes on trade partners.

Did You Know?

A country’s average tariff rate often reflects its degree of protectionism.

According to Investopedia, less industrialized countries typically have the highest average tariff rates. In 2024, some of the highest average rates were in Tunisia (19.5%), Algeria (18.9%), and India (17%). Conversely, more developed countries like Australia (2.4%), New Zealand (1.9%), and Singapore (0%) had the lowest rates in 2024.

How are Tariffs Calculated?

The final tariff cost can involve a combination of ad valorem rates, specific rates, and additional factors specific to the product category or origin country. To know how tariffs are calculated, we must first examine the most common ways they can be applied:

Tariffs are typically determined by an imported good’s value and the duty rates for that specific Harmonised System (HS) code or tariff code. While the US focuses on the purchase price, other countries may assess the value of your shipment based on the cost of raw materials, manufacturing costs, and transportation and insurance costs.

Calculating duties for an import to the US during the 2025 trade war could look something like:

Total Duties = [CIF Value × Ad Valorem Duty Rate] + [Specific Duty (per unit or weight)] + [Anti-Dumping Duty or Countervailing Duty] + [Section 232/301/201 Ad Valorem Tariffs]

The TecEx team has the expertise to provide a transparent quote using accurate duty calculations.

HS Codes and Tariff Codes

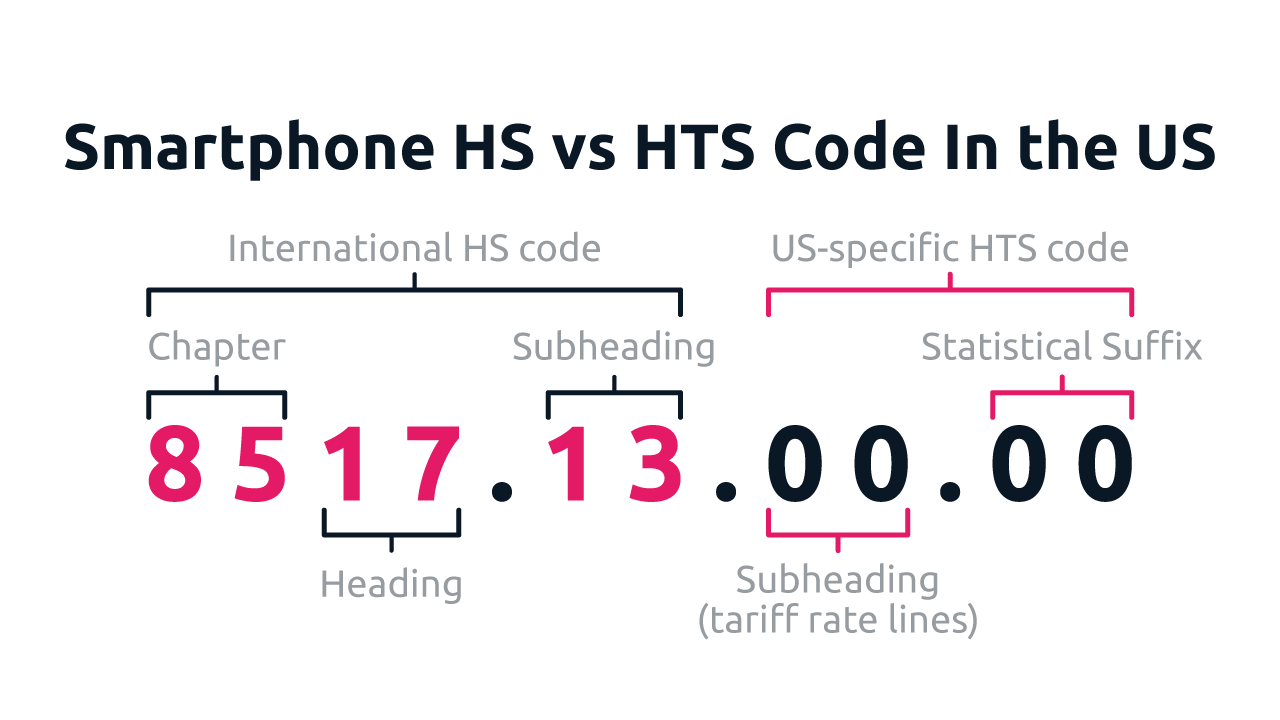

HS codes are standardized 6-digit numbers that classify goods for international trade. They form the foundation of tariff codes, helping customs apply duties, enforce regulations, and gather trade data.

Tariff codes build on HS codes with additional digits for country-specific classifications. In the U.S., the Harmonized Tariff Schedule (HTS) extends HS codes with four more digits and a statistical suffix to refine product details and support regulatory and data collection needs.

For example, HTS code 8517.13.00.00 classifies imported smartphones:

- Chapter 85 = Electrical machinery

- Heading 17 = Telephone sets

- Subheading 13 = Smartphone

- Subheading (tariff rate line) 00 = No further categorization

- Statistical Suffix 00 = No further subdivision

Product Classification, Tariffs, and the Cost of Errors

Accurate HS and HTS codes ensure correct duties and tariff payments, support trade compliance, and inform global business decisions. Misclassification can result in the overpayment or underpayment of duties, financial penalties, incorrect duty assessments, and disrupted supply chains, making accuracy essential.

Incorrect classification can cause major headaches for importers. Incorrect codes lead to shipment delays, potentially incurring storage charges or demurrage. Even worse, hefty fines, product seizure, and regulatory intervention can all occur due to misclassification. The responsibility for using the correct code falls squarely on the importer’s shoulders, so ensuring accuracy is crucial to avoid these costly pitfalls.

– TecEx Compliance Management Team

What Is a Real Example of a Tariff? | US Tariffs On China

Trump’s 2025 trade war demonstrates how tariffs can be utilized as negotiation tools when applied unilaterally and punitively. They can essentially place embargoes on trading partners.

Focusing on the US-China trade war, which began in 2018, the US implemented tariffs to make Chinese imports more expensive, balance trade relations, and address national security concerns. With the Trump administration’s all-out trade war in 2025, the US escalated tariffs on China until they reached 145% on all Chinese imports, leading to China’s retaliation of 125% tariffs on most US-made goods, and pausing trade between the two countries.

This eventually resulted in Sino-US talks and a 90-day truce to reduce the tariffs and facilitate negotiations. While a trade agreement has not been finalized, we do know that the tariffs:

- Fast-tracked US-China talks as de-escalation became dire,

- May push China to consume more US goods as the US aims to manufacture more goods, and

- Have shifted global trade landscapes and encouraged businesses and countries to re-evaluate supply chains, trade ties, risk management, pricing systems, and export markets.

Tariffs can also disadvantage the country enforcing them. According to Yale’s The Budget Lab, America’s average tariff rate reached 17.8% in May 2025, the highest rate since 1934.

If the costs of imported goods rise with no immediate locally-made replacements, this can become burdensome for importers, manufacturers, and consumers in the long term.

Conversely, Free Trade Agreements (FTAs) can lower or even remove tariffs and duties, allowing businesses to import and export goods with minimal trade barriers. FTAs are powerful tools for facilitating international trade and economic cooperation.

Partner with TecEx to Navigate Tariffs Efficiently

Now that you can explain ”what is a tariff?”, you can understand how intricate requirements and country-specific nuances impact global trade costs. Product classification and duties may seem minor, but small errors can create huge disruptions and penalties.

With TecEx’s tailored import solutions, we can seamlessly guide you through the complexities of international trade, give you transparent quotes with accurate duty calculations, and even help you optimize your tariff strategies for more efficient imports.

FAQs

What is a tariff?

A tariff is a tax levied by a government on imported goods. They are used to regulate trade between countries and can affect the pricing of products in the global market.

How do tariffs impact tech goods?

In short, tariffs can increase the cost of importing tech goods, and can affect competitiveness in foreign markets by raising prices and reducing demand for products.

Are there different types of tariffs?

Yes, there are several types of tariffs. These include ad valorem tariffs (a percentage of the goods’ value), specific tariffs (a fixed fee per unit or weight), and compound tariffs (a combination of either type).

How can I find the tariff rates for my products?

Tariff rates can be found through government trade websites, customs authorities, or trade databases. It’s important to keep up to date with tariff rates, as they can change based on trade agreements and policy updates, and you don’t want to underpay or overpay duties or risk penalties.