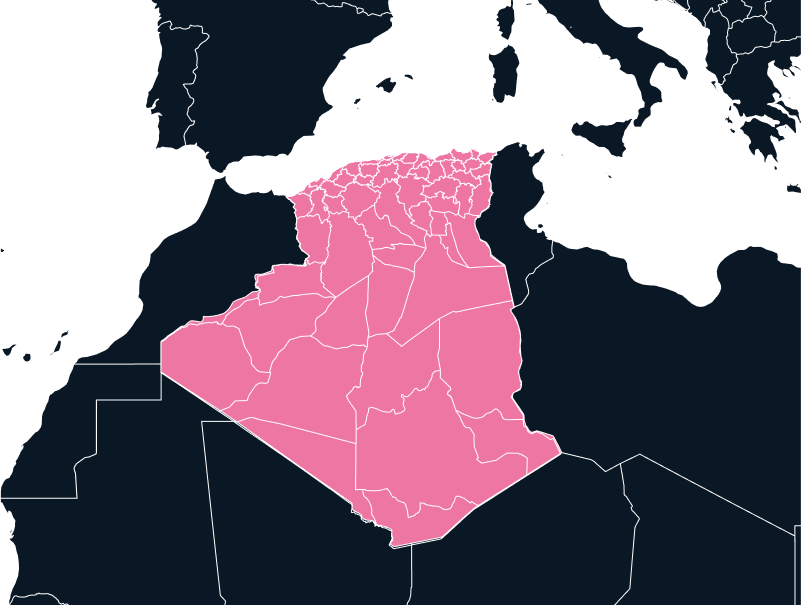

Europe

Import to Algeria

Algeria, Africa’s 4th largest economy, is quickly developing with an underexplored market. While challenging to import to Algeria, an expert IOR can navigate their obstacles. Its export diversification policies also open doors for companies to export Algerian goods and support emerging sectors.

Tax

Up to 19%

Duties

Up to 30%, DAPS Up to 200%

Lead Times

8 - 9 Weeks

Restricted Items

Certain Medical Equipment

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Arabic and Berber

Export and Import to Algeria

Algeria’s main exports are petroleum and natural gas products, accounting for nearly 30% of Algeria’s GDP, to Italy, Spain, France, the US, and South Korea. Its main imports include industrial equipment, consumer goods, foodstuffs, and electrical goods from China, France, Italy, Turkey, and Brazil. Around two-thirds of their global trade is with the European Union, with the US next in importance.

Population

45,61 M

Biggest Industry by Export

Petroleum Gas

Capital City

Algiers

Biggest Industry by Import

Agricultural Products

Import to Algeria

Importing to the Republic of Algeria is particularly difficult, as the government has various measures to reduce overdependence on imports and promote the domestic production of goods. The DAPS (Droit Additionnel Provisiore de Sauvergarde, meaning “Defence Additional Protection Tax”) introduced by Algeria in 2018 for imported products means that the Ministry of eCommerce can levy additional tariffs from 30% to 200%.

Since the COVID-19 pandemic, the Algerian government has created policies to enhance export diversification, aiming to reach $29 billion in non-hydrocarbon exports by 2030. This strives to reduce the economy’s dependence on oil, lower domestic and foreign debt, combat unemployment, and lead the way for other segments of the economy. Export diversification benefits local and foreign companies by creating opportunities to export from Algeria.

Unique Pain Points Impacting Algerian Trade

Customs clearance is a frequent obstacle for companies importing to Algeria, with delays lasting weeks or months. Documentation requirements are strict and specific. Successful imports to Algeria require a hand-written and signed customs declaration from the declarant and a customs clearance file.

Authorization from other parties is also necessary. The Algerian Ministry of Commerce must stamp all shipping documents with a “Visa Fraud” note to certify that the imported goods have been subjected to fraud inspection. Certain goods also require particular procedures to clear customs. For example, the Ministry of Telecommunication must authorize imports of items like police radios.

Importing tech goods to Algeria is particularly challenging. This is due to special requirements, such as royalties on imported computer software and customs duties on computer equipment, which have been increased from 5% to 30% in recent years.

Countries Associated with Algeria

Europe

France

Europe

Spain

Delivery Duty Paid (DDP) for Imports to Algeria

Algeria’s customs clearance process can be described as inefficient. In 2022, its Logistics Performance Index (LPI) score was 2.3 out of 5. As customs delays can last months, it’s best to use a specialist solution to import to Algeria. Our in-depth understanding of Algeria’s customs clearance requirements and in-country presence enables us to import goods as seamlessly as possible and minimize delays.

With our DDP Algeria solution, TecEx will fulfil all of your import requirements. We will complete the necessary documents, acquire certifications and authorizations, and even label products to ensure smooth customs clearance. This is a complete import solution where we take responsibility for your shipments, duties and taxes, and Algerian customs clearance.

Algeria has stringent regulations for importing most items, especially IT equipment and tech goods, so using TecEx as your IOR will ensure compliance. Our in-country presence enables you to navigate requirements such as bank domiciliation and software royalties. Telecom and wireless devices also require homologation, and encrypted cargo requires the end-user to apply for import authorization. As approval can take up to 90 days, TecEx can help you apply for these documents to simplify the process.

Once cargo arrives in Algeria, customs storage is charged after just 15 days. Allowing TecEx to handle your entire shipping process means we will represent you in Algeria and have all necessary documents prepared. When we are responsible for your goods, we can avoid additional storage and demurrage charges by moving your goods through customs as fast as possible.

Algeria also has great export potential. Our specialized Exporter of Record (EOR) solution can help you expand your business by exporting goods from Algeria. From reduced risk to minimal stress, our EOR service ensures the compliant, streamlined export of goods from Algeria to surrounding countries, Europe, and beyond.

Opportunities to Export From Algeria

Algeria is a bridge between North Africa and Europe and offers a range of untapped export possibilities for foreign companies:

Clean Production Practices

Cleaner production practices led by their export diversification goals result in lower carbon emissions, making Algerian products easier to export to destinations with carbon taxes, like Europe.

Intra-African Trade

As a member of the Arab Maghreb Union (UMA) and the African Continental Free Trade Area (AfCFTA), Algeria can smoothly facilitate intra-African trade with certain countries.

Algeria’s Government Action Plan

Algeria’s 2021 Government Action Plan has prioritized a private sector-led growth model for various improvements, such as job creation and improvements to the business environment. With recently improved finance systems, manufacturing growth, and infrastructure, Algeria is becoming better equipped to facilitate trade, supply resources, and manufacture goods.

Large Manufacturing Sector

Algeria has a large manufacturing sector with competitive production costs and a young, skilled workforce. This opens a largely untouched opportunity to source and manufacture goods for export within the country.

Foreign Direct Investment

Algeria is open to Foreign Direct Investment (FDI), and allows both foreign and domestic private entities to legally establish and own business enterprises that engage in remunerative activity in the country.

Specific Compliance Regulations for Imports to Algeria

Bank Domiciliation

Importers must register an account with a local bank at least 30 days before initiating payments, bank transfers, or customs clearance processes in Algeria. The account must maintain a minimum balance of 1.3 times the full import payment. The customs clearance file must include the invoice, payments, and bank details.

Algeria Certificate of Conformity and Quality

Importers are required to submit certifications that confirm their goods adhere to Algerian standards. These often need to be administered by a third party.

Algeria Certificate of Free Marketing

The Certificate of Free Marketing was introduced in Algeria in 2018. It is issued by a Chamber of Commerce, and it offers proof that the imported goods have previously been legally marketed in the country of origin or another country.

Algeria Software Royalties

Algerian Finance Law stipulates additional taxes and charges for various imports. For example, foreign companies without a permanent presence in Algeria must pay 24% withholding tax fees for importing computer software. With the current 30% reduction fee, the effective tax rate is 16.8%.

In addition, the importer must pay VAT under the reverse charge mechanism.

Your Global Trade Solution for Imports to Algeria

Are you ready to import to Algeria? Contact our expert team, and we will provide a bespoke customs compliance solution tailored to your needs to get your goods into Algeria.