Asia

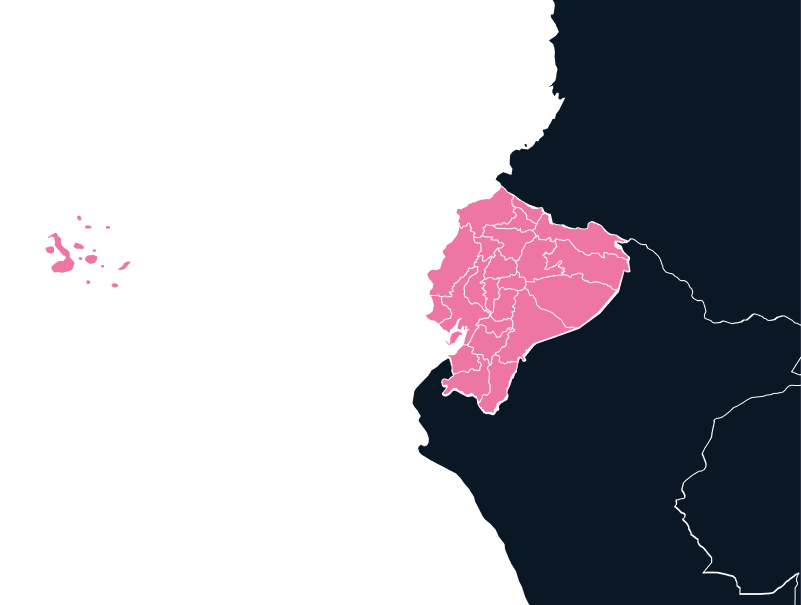

Export and Import to Ecuador

While a smaller economy in South America, Ecuador is a growing market with immense potential for international trade. However, as with any international trade landscape, navigating Ecuador’s import and export procedures comes with unique challenges.

Tax

Up to 13%

Duties

Up to 15%

Lead Times

3-4 Weeks

Restricted Items

N/A

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Spanish and Dialects of Quechua

Importing to Ecuador

Ecuador’s government has made strides to promote foreign investments, particularly in sectors like technology, where significant tax reductions on IT equipment have been implemented. While these tax breaks make Ecuador an attractive destination for tech companies, several hurdles remain. Chief among them are the logistical challenges and compliance requirements that traders must meet.

Importers must be prepared for mandatory documentation and clearance processes. The documentation required for importing goods includes a commercial invoice, bill of lading or airway bill, an insurance policy, and a certificate of origin. Importers are also required to register with Ecuador’s customs system (SENAE) and obtain a company tax number (RUC), which is essential for all trade transactions.

Population

18.23M

Biggest Industry by Export

Mineral Fuels

Capital City

Quito

Biggest Industry by Import

Refined Petroluem

Exporting from Ecuador

Exporting goods from Ecuador involves a different set of procedures, with a focus on obtaining the necessary permits and certificates. Exporters must ensure that all documents, such as the commercial invoice, packing list, and export licenses, are accurately completed and in line with Ecuadorian regulations.

It’s important to note that Ecuador’s export process is also subject to inspections by customs authorities, and exporters must ensure that the goods meet all required descriptions. Furthermore, businesses should be aware that temporary exports—such as products sent for repair—are subject to import duties only on value-added goods, such as spare parts.

Given these complexities, exporters must meticulously complete customs declarations to avoid penalties or shipment disruptions. Utilizing local customs agents can help streamline the process and ensure that shipments are not delayed.

Compliance Regulations and Trade Pain Points in Ecuador

Both importers and exporters to and from Ecuador must be well-versed in the country’s compliance regulations. The Ecuadorian Quality System Law mandates that all imported products meet local standards before being sold in the country. These standards, enforced by the Ecuadorian Standards Institute (INEN), cover everything from product labeling to technical specifications.

Moreover, the registration process with the National Customs Service of Ecuador (SENAE) is crucial for businesses engaged in international trade. The registration process includes obtaining a tax number (RUC) and using the ECUAPASS online customs platform, which is required for submitting documentation related to imports and exports.

Ecuador also imposes a 12% VAT on imports and an additional 0.5% Children’s Development Fund tax. Additionally, special documentation is required for temporary imports, such as trade shows or demonstrations, where goods can be imported duty-free for up to a year, provided they are re-exported.

Challenges For Importers in Ecuador

Understanding the regulatory framework is essential for companies looking to import into Ecuador. One key challenge is the bureaucratic nature of the importation process. The process can be time-consuming and complex, from obtaining the correct permits and documentation to meeting Ecuador’s import tax obligations. A lack of clarity about required paperwork often leads to delays and missed deadlines.

Another notable issue stems from Ecuador’s safety regulations, which require mandatory insurance for goods during customs clearance. While this is a protective measure, it adds a layer of complexity to the shipping process. Furthermore, to buy and ship from the US to Ecuador, a common origin point for goods, you may face additional costs due to the ongoing US-China trade war, making cost predictions difficult.

Challenges For Exporters from Ecuador

Exporters must ensure they comply with Ecuadorian export regulations, which require specific documentation and, often, export licenses. The bureaucratic process can result in substantial delays, especially if customs authorities identify discrepancies in the documentation.

Even after goods are cleared for export, customs inspections are a common hurdle. Customs officials inspect both the products and the paperwork to ensure everything matches the provided declarations. Exporters should be prepared for random inspections, which can delay shipments and lead to unexpected costs.

Top Countries Trading with Ecuador

South America

Colombia

South America

Brazil

Seamless Exporting and Importing to Ecuador

Navigating Ecuador’s import and export landscape can be challenging, but TecEx is here to simplify the process. We offer comprehensive end-to-end solutions that cover everything from pre-importation compliance checks to ensuring that all customs requirements are met upon arrival.

Our service provides comprehensive liability coverage to fulfill customs insurance requirements and a dedicated team to handle the documentation and coordination needed for imports and exports. This ensures your goods are well taken care of throughout their journey from origin to destination.

Whether you’re importing advanced technology equipment or exporting local products, Ecuador offers exciting opportunities for businesses willing to navigate its trade landscape. With the proper understanding of compliance requirements, you can avoid the pitfalls of bureaucracy, customs delays, and documentation errors.

Your global trade solution for Ecuador

Fill in the form to get in touch, and our team of import/export experts will contact you with a bespoke customs compliance solution to suit your Ecuadorian needs.