Asia

Export and Import to the USA

The USA is a major tech hub, home to most leading industry players. Getting gear in fast and hitting project deadlines is essential for growth. Don’t let US customs compliance slow your shipments.

Tax

Up to 3%

Duties

Up to 38%

Lead Times

3-4 weeks

Restricted Items

Restrictions Placed on Certain OEM

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

English

Importer of Record USA

Most imports and exports to the USA will require an import/export license. This vital shipping document, issued by US government authorities, authorizes the trade of goods across US borders. The US Customs and Border Protection (CBP) ensures all imports comply with the relevant rules and regulations and levies any associated tariffs and taxes.

Import to the USA | Tariffs, Taxes and Duties

Significant change is on the horizon for the US and import tariffs, taxes, and duties. US import duty rates are defined using the Harmonized Tariff Schedule. For tech goods, this can range from 0% to 15%, but higher tariffs can be expected based on trade policies (e.g., goods of Chinese origin). Instead of VAT, a sales tax is applied to goods. This rate can vary from 0% to 10%. This is particularly important if the goods are sold in the country after importation.

Export from the USA

US regulations restrict the import of certain sensitive technologies, particularly those related to national security. The Bureau of Industry and Security (BIS), part of the US Department of Commerce, enforces Export Administration Regulations (EAR), which control the export and import of dual-use technologies.

The Export Administration Regulations (EAR) are a set of US government rules that govern the export and re-export of goods, software, and technology from the US to other countries. The goal of the EAR is to protect national security while advancing foreign policy interests and facilitating global trade.

Population

334,9 m

Biggest Industry by Export

Aircraft Parts

Capital City

Washington, D.C.

Biggest Industry by Import

Capital Goods

Ongoing US Trade Tensions

You can’t talk about US trade without mentioning the US-China trade war. Specific tariffs, duties, and compliance requirements remain in place. During import, most goods of Chinese origin will have increased duties. Furthermore, the CBP is working towards preventing the import of products manufactured within the Xinjiang Uyghur Autonomous Region (XUAR).

An accurate import declaration must be submitted to US Customs and Border Protection (CBP), including all necessary documentation such as commercial invoices, bills of lading, and certificates of origin. If the product is subject to specific tariffs or import restrictions, additional documentation or permits may be required.

USA Import Compliance Pain Points

When importing goods into the United States, compliance with various regulatory requirements is essential. Two important, yet distinct, compliance areas for imports are the Federal Communications Commission (FCC) regulations and the Importer Security Filing (ISF) requirements. While unrelated in their scope, both must be satisfied for shipments to enter and be distributed legally within the U.S.

What is the FCC?

The FCC is an independent agency of the US government that regulates electronic devices that emit radio frequency (RF) energy to ensure they do not cause harmful interference with radio communications. This is a product-level regulation primarily focused on public safety and technical standards.

Key Aspects of FCC Compliance

Scope: FCC regulations apply to virtually all electronic and electrical devices that emit RF energy, whether intentionally (like Wi-Fi or Bluetooth devices) or unintentionally (like computers or monitors). This applies to devices manufactured, imported, sold, or used within the US.

Requirements: Devices must comply with FCC technical standards and undergo an Equipment Authorization process. This can take the form of either a Supplier’s Declaration of Conformity (SDoC) or Certification.

Import Mandate: To legally import electronic devices into the US, the products must have the necessary FCC authorization and often carry an FCC ID label for certified devices. The US CBP has the authority to detain or seize electronic products that do not meet FCC requirements.

What is ISF?

The Importer Security Filing (ISF), also known as “10+2,” is a shipment-level security requirement imposed by US Customs. The ISF is designed to enhance cargo security and improve risk assessment before shipments arrive in the US.

Key Aspects of ISF Compliance

Scope: The ISF is mandatory for nearly all ocean cargo shipments destined for the United States, including goods transiting through US ports. It does not apply to air or land freight shipments.

Requirements: The ISF Importer must electronically submit several specific data elements to CBP at least 24 hours before the cargo is loaded onto the vessel at the foreign port. These data elements include details such as manufacturer, country of origin, and the Harmonized Tariff Schedule (HTSUS) number.

Import Mandate: Filing an accurate and timely ISF is critical. Failure to comply can result in penalties of up to $5,000 per violation, along with delays, holds, or additional inspections of the cargo.

Though both the FCC and ISF are important for imports, they serve different functions and are enforced by different agencies.

The FCC regulates what is being imported, ensuring electronic devices meet safety and technical standards to prevent radio interference. The ISF regulates how the product is imported — the shipment and logistics — ensuring that cargo security requirements are met to protect the US supply chain.

For instance, an importer bringing in Wi-Fi-enabled smart home devices by ocean vessel must meet both FCC and ISF requirements:

- FCC Compliance: Each device must have the appropriate FCC certification and labeling to confirm it meets technical standards.

- ISF Filing: The importer must submit all required “10+2” data elements to CBP electronically at least 24 hours before the cargo is loaded at the foreign port.

Failing to comply with either requirement may result in fines, shipment delays, or even seizure of goods by US authorities.

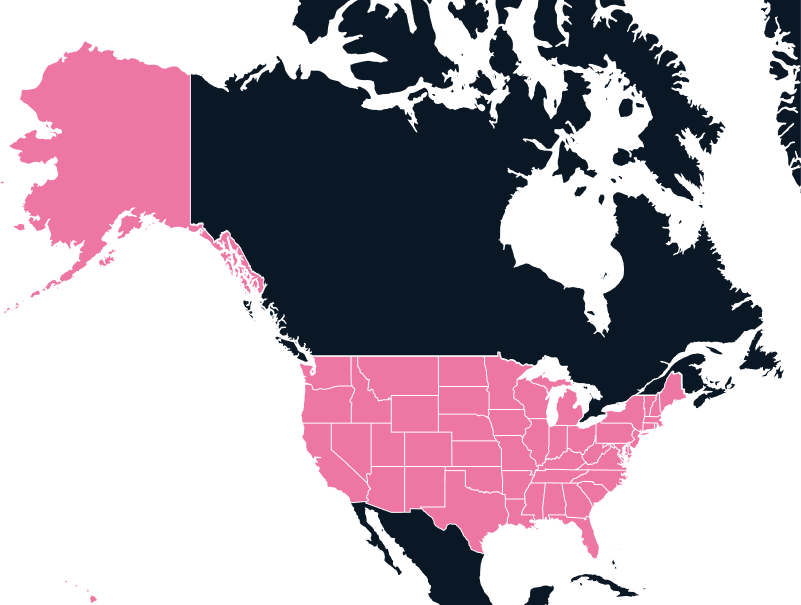

Countries That Trade with USA

North America

Mexico

North America

Canada

Getting Tech Gear to Data Centers in the USA

With Ashburne’s Data Center Alley and Silicon Valley, imports to colocation facilities are prominent in the USA. As networking equipment is a dual-use product, US Customs and Border Protection has put additional compliance steps in place. Using a trusted Importer of Record (IOR) ensures that the IOR handles all trade compliance risks.

TecEx has partnered with leading data center industry giants to make this process seamless. Through the TecEx Partnership Referral Program, we help your clients move their equipment across borders and through customs into your data center. Our services cover all pre-compliance checks, documentation collation, project management of logistical requirements, and white-glove delivery to any data center worldwide.

Customs Clearance USA

A major roadblock for many looking to import technology to the US is accurately calculating the fees required to clear customs. From duties, taxes, and licenses, it can become very overwhelming. For example, calculating the accurate import duties from Japan to the USA for a high-value shipment of racks and servers can be daunting. This is where a specialist IOR can assist. TecEx provides accurate quotations from the start—so there are no hidden fees!

We have additional value-added services that we can utilize to benefit our customers. Currently, we have warehouses located from coast to coast in the USA, which our clients often use to stage, consolidate, or deconsolidate shipments. This all ensures that the goods can clear customs the first time. TecEx’s network of US warehouses optimizes your supply chain for an efficient shipping experience.

Our comprehensive management of import and trade compliance frees you to concentrate on business growth. To secure your supply chain, choose strategic warehousing for seamless integration and deployment to data centers, Points of Presence, or beneficial owner destinations. This proactive approach safeguards your supply network and helps you avoid disruptions caused by chip shortages.

Using our Delivered Duty Paid (DDP) solution is the easiest way to focus on growing your business while we handle all import and trade compliance work for imports to the USA.

Effortless US Imports with Compliance and Duty Recovery

The US market is highly regulated, yet also one of the most rewarding markets for global trade. With high volumes of retail, apparel, technology, and promotional goods, companies need to navigate strict compliance and customs costs.

With TecEx as the IOR, businesses can import into the US even without a local entity, ensuring seamless clearance for Amazon FBA, apparel, and swag shipments. Our product compliance checks, including expedited audits and HS code reviews, safeguard against costly goods seizures, while our return logistics streamline reverse flows.

Our duty drawback program also recovers duties and taxes on re-exported goods, protecting your margins in a highly competitive market.

Trade and Economic Differences Among the US Mainland, Territories, and Freely Associated States

US Mainland

Comprising the 50 states and the District of Columbia, the US mainland operates as a single, fully integrated economic and customs area under federal jurisdiction. All states are part of the US Customs Territory, meaning that federal tariffs and customs rules apply uniformly to imports from foreign countries.

Trade within the states is completely tariff-free, and shipments to US territories are generally treated as domestic rather than export transactions. Federal income tax applies to all individuals and corporations, alongside state and local taxes. This system ensures uniformity and consistency in market access, customs enforcement, and fiscal policies across the entire domestic economy.

US Territories

The US territories—including Puerto Rico, Guam, the US Virgin Islands, American Samoa, and the Northern Mariana Islands—occupy a distinctive middle ground between domestic and international trade systems. Puerto Rico is inside the US Customs Territory, while the others are outside, allowing them to establish their own tariff schedules on foreign imports.

All territories enjoy duty-free access to the US market for their exports, fostering strong economic ties. Each territory maintains its own tax system, and residents typically do not pay federal income tax on income earned within their local jurisdiction. Some territories, such as Puerto Rico and the US Virgin Islands, offer tax incentives to attract business investment. The Jones Act applies to certain territories like Puerto Rico and Guam, increasing shipping costs due to restrictions on foreign-built or foreign-crewed vessels.

Freely Associated States (FAS)

The Freely Associated States (FAS)—the Federated States of Micronesia, the Republic of the Marshall Islands, and the Republic of Palau—differ fundamentally as fully sovereign nations linked to the United States through Compacts of Free Association (COFA). They are outside the US Customs Territory and maintain independent customs and tax regimes.

While their exports generally enter the US duty-free under COFA agreements, some goods are subject to quotas or exceptions. In place of tax and customs integration, these nations receive substantial US financial assistance and security guarantees. Citizens of the FAS can live and work in the US, reflecting the unique blend of independence and partnership that defines their relationship with the United States.

Ready to Ship to the United States?

Secure fast, accurate US compliance support today and keep every shipment moving at the speed your business demands. Partner with a compliance expert today.