When choosing an Incoterm for international shipping, understanding how responsibility transfers between buyer and seller is critical. This guide compares DDP vs DAP vs DPU side-by-side to help you select the right structure for your shipment.

At-a-Glance Comparison

| Feature | DAP | DPU | DDP |

|---|---|---|---|

| Pays Import Duties | Buyer | Buyer | Seller |

| Handles Import Clearance | Buyer | Buyer | Seller |

| Unloading at Destination | Buyer | Seller | Buyer |

| Delivery Location | Named Place | Named Place (Unloaded) | Named Place |

| Seller Risk Level | Moderate | Moderate | Highest |

| Buyer Risk Level | Low to Moderate | Low | Lowest |

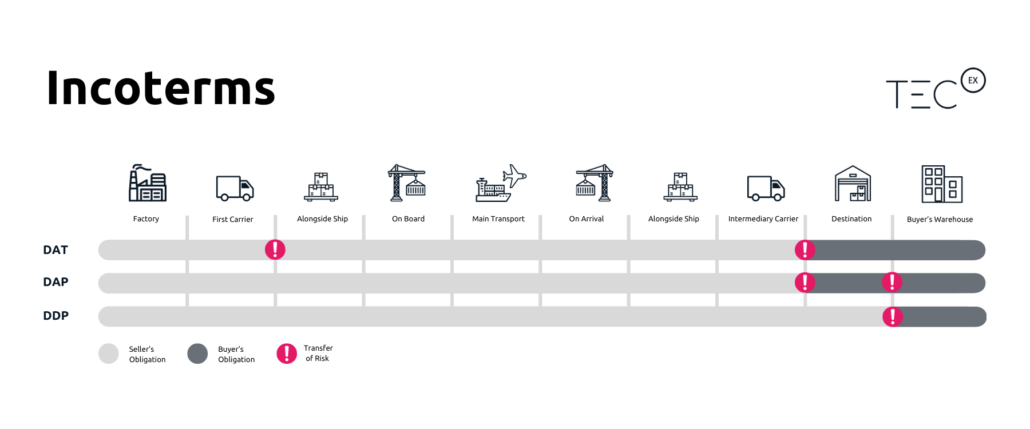

Three commonly used delivery-based Incoterms are DAP (Delivered at Place), DPU (Delivered at Place Unloaded), and DDP (Delivered Duty Paid).

Although these terms all involve delivery to a named destination, they differ in customs responsibility, tax exposure, and unloading obligations.

What Is DAP (Delivered at Place)?

Under DAP, the seller delivers goods to a named place of destination and bears risk until arrival.

DAP Incoterm Responsibilities

The DAP Seller:

- Arranges transportation

- Covers freight costs

- Bears risk until goods reach the destination

The DAP Buyer:

- Handles import clearance

- Pays duties and VAT

- Unloads the goods

DAP is often chosen when the buyer has strong customs capability in the destination country and prefers to manage tax processes locally. With DAP, the seller is responsible for delivering the goods to a named destination, but they are not responsible for costs such as import taxes or duties. Neither are they responsible for unloading the goods.

So, the seller still has significant responsibility for the transportation and delivery of the cargo, but the buyer assumes more of the burden at the destination port, including customs clearance and handling the goods.

DAP shipping is widely considered cheaper for the seller than DDP shipping because the buyer assumes more financial responsibility until the risk transfers.

What Is DPU (Delivered at Place Unloaded)?

DPU (Delivered at Place Unloaded) replaced DAT under Incoterms 2020.

The defining feature of DPU is that the seller is responsible for unloading the goods at the named destination.

DPU Incoterm Responsibilities

The DPU Seller:

- Arranges transport

- Delivers goods

- Unloads at destination

The DPU Buyer:

- Handles import clearance

- Pays duties and taxes

DPU is commonly used when delivery occurs at a terminal, warehouse, or facility equipped to receive and unload cargo.

DPU is the only Incoterm that requires the seller to unload the goods at the destination. It is crucial to specify the exact, named unloading point to avoid disputes regarding risk and costs. Sellers take on maximum responsibility during the logistics process. As DPU gives the seller control over the transportation and unloading process, it can help optimise logistics processes and save costs.

For buyers, DPU shipping is also beneficial as they have minimal responsibility during the transportation process. This means they don’t need to worry about loss or damage to goods until the seller has delivered and unloaded the shipment. The DPU buyer is only responsible for import duties and taxes and for accepting delivery at the destination.

What Is DDP (Delivered Duty Paid)?

Under DDP, the seller assumes responsibility for both delivery and import clearance.

DDP Responsibilities

The DDP Seller:

- Handles customs formalities

- Pays duties and VAT

- Delivers goods ready for unloading

The DDP Buyer:

The buyer’s obligations are minimal at delivery.

Because DDP includes import tax responsibility, it places the highest obligation on the seller.

For a detailed breakdown of DDP responsibilities and risks, see our complete DDP shipping guide.

Core Differences Between DAP, DPU, and DDP

- Responsibility

- Import Duties & VAT

- Customs Clearance

- Unloading

- DAP

- Buyer

- Buyer

- Buyer

- DPU

- Buyer

- Buyer

- Seller

- DDP

- Seller

- Seller

- Buyer

When Should You Use Each Incoterm?

When deciding which Incoterm to use, the right choice depends largely on how responsibilities for logistics, customs, and risk are allocated between the buyer and seller.

When DAP Makes Sense

DAP (Delivered at Place) makes sense when the buyer has strong local customs expertise and prefers to control duty payments directly. It is also a good option when the seller wants to avoid tax registration exposure in the destination country. DAP is commonly used when delivery is made to a warehouse or global office, allowing the seller to manage transportation while the buyer handles import clearance.

Overall, DAP provides a balanced structure in which the seller controls the main logistics process, and the buyer manages the import formalities.

When DPU Is Appropriate

DPU (Delivered at Place Unloaded) is appropriate when delivery includes unloading at a terminal or designated facility. It is particularly useful in situations where the seller must handle unloading or when the shipment requires specialized handling equipment. At the same time, the buyer may still prefer to manage customs clearance independently.

DPU works especially well for structured, terminal-based deliveries where unloading responsibilities need to be clearly defined.

When DDP Is Applicable

DDP (Delivered Duty Paid) is best suited for transactions in which the buyer wants a fully inclusive delivery model with minimal administrative involvement. It works well when the seller is equipped to manage import compliance and when the shipment requires centralized customs coordination.

While DDP simplifies the purchasing experience for the buyer, it also places the greatest level of responsibility and risk on the seller.

Risk and Administrative Comparison

- Consideration

- Seller Tax Exposure

- Buyer Customs Involvement

- Seller Compliance Burden

- Operational Complexity

- DAP

- Low

- High

- Moderate

- Medium

- DPU

- Low

- High

- Moderate

- Medium

- DDP

- High

- Low

- High

- Higher

Selecting the correct Incoterm depends on how much compliance and financial responsibility each party is prepared to assume.

FAQs | DDP vs DAP vs DPU

Does DPU replace DAT?

Yes. Under Incoterms 2020, DPU replaced DAT.

What is the main difference between DAP and DPU?

Unloading. Under DPU, the seller unloads the goods. Under DAP, the buyer does.

Is DAP cheaper than DDP?

For sellers, DAP generally involves lower tax exposure than DDP because the buyer handles import duties and VAT.

Which Incoterm gives buyers the least responsibility?

DDP assigns the least responsibility to buyers at the destination.

Choosing the Right Structure for Your Shipment

DDP, DAP, and DPU are all delivery-based Incoterms, but they allocate customs responsibility differently.

- Choose DAP when the buyer manages import clearance.

- Choose DPU when unloading must be handled by the seller.

- Choose DDP when the seller manages the full import process.

If your shipment requires end-to-end import clearance support, explore our complete DDP guide for a deeper operational breakdown.

Overcome International Obstacles with TecEx

As your international trade partner, we help you sail through the choppy waters of global shipping with ease and efficiency.

When TecEx is your partner, choosing between DDP vs DAP vs DPU shipping methods doesn’t have to be a hassle.

Let’s find a solution that works for you

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.