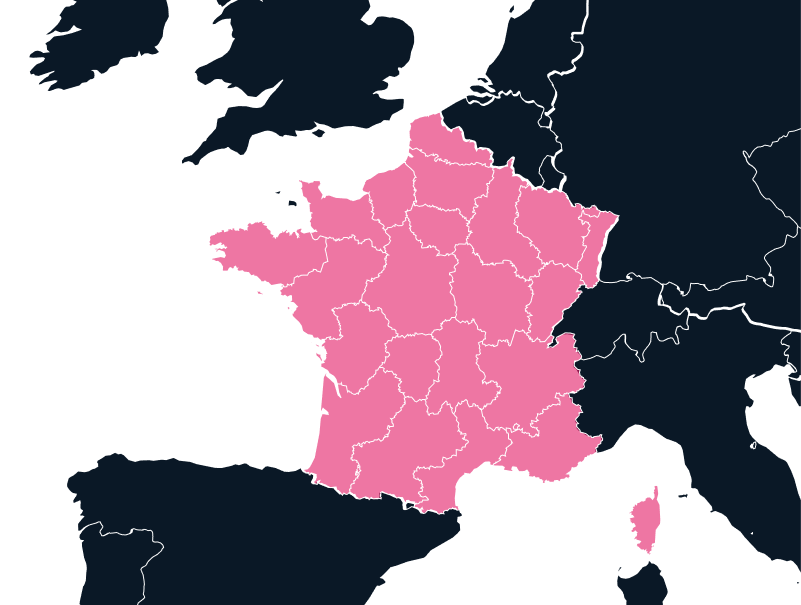

Europe

Exporting to France

When exporting to France, you gain the advantages of the EU’s single market and its seamless goods movement, yet you must still navigate France’s strict customs requirements for products arriving from outside the EU.

Tax

Up to 21%

Duties

Up to 21%

Lead times

3-4 Weeks

Restricted Items

N/A

Best carrier option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

French

Export Requirements for France

France is a leading exporter of luxury goods, pharmaceuticals, and aerospace products. Exporting from France follows EU-wide export regulations.

Export Licenses and Documentation

Certain products may require export licenses, especially goods related to defense, high technology, or sensitive materials. The most common export document is the Single Administrative Document (SAD), which is required for all EU exports.

Restrictions and Banned Items

France and the EU impose export controls on certain goods, such as military equipment, dual-use technologies, and certain chemicals. Businesses must ensure they have the appropriate import/export licenses before shipping these items.

Customs Procedures for Exporting

The export customs clearance process is similar to the import process, requiring the submission of documentation and payment of relevant duties or fees. Goods leaving France must comply with the Union Customs Code (UCC), which establishes procedures for the export of goods across the EU.

French Import Requirements

Businesses are required to obtain an EORI number when importing goods into France. This unique identifier is essential for submitting customs declarations and tracking shipments within the European Union. For non-EU businesses, the EORI number must be obtained from the customs authority of the EU country where the goods will first enter the EU.

A customs declaration is necessary for imports valued above €1,000 or weighing more than 1,000 kg. This includes submitting a Single Administrative Document (SAD) for customs clearance.

The customs clearance process involves submitting the required documentation and paying customs duties and VAT. In terms of customs tariffs and taxes, France follows the EU’s Common Customs Tariff. Additionally, a standard VAT rate of 20% is applied to most imports. Some products may be subject to additional anti-dumping duties, which are imposed to protect EU industries from unfair competition.

Certain types of goods may require specific certifications or compliance with EU regulations. For example, products subject to EU safety and environmental legislation must carry the CE marking to demonstrate conformity with the necessary standards.

Once all conditions are met, the goods are released for distribution. This process can be handled either by the Importer of Record (IOR) or by an agent on their behalf.

For goods imported temporarily, there is an option to clear them through customs under the ATA Carnet system. This system allows goods to be imported without the need to pay duties or taxes as long as they will be re-exported within a set time frame.

Unique Challenges for Importing and Exporting to France

While importing and exporting into France has many advantages, businesses should be aware of the following pain points:

High Tariffs and VAT in France

France imposes a 20% VAT on most goods, which increases the cost of imported goods.

Import duties can range from 0% to 17%, depending on the product category, and may present a barrier for some businesses.

French Customs Delays

While customs clearance in France can take as little as one week for well-prepared shipments, there are delays when goods require further inspection or documentation verification, especially for high-value items.

Complex French Regulations

France has strict import regulations, especially around high-tech products. Companies need to be mindful of additional compliance requirements such as the CE Marking, REACH, and WEEE (Waste Electrical and Electronic Equipment) regulations.

Language Barriers

While many French customs officials speak English, key documents must be in French, which could require translation services. Misunderstandings or language issues may result in delays in the import and export process.

Countries Associated with France

Europe

Italy

Europe

Spain

Specialized Import and Export Solutions for France

Our Delivered Duty Paid (DDP) solution is designed to streamline the importation process for you by taking full responsibility for all customs duties, taxes, and delivery risks. As your Importer of Record (IOR), we manage the entire process, ensuring smooth and compliant importation into France. This approach significantly reduces the chances of delays or fines, offering you peace of mind and a hassle-free experience.

A key part of our service is the comprehensive pre-compliance checks we conduct. We carefully review your products to ensure they meet all French and EU regulatory requirements, including everything from EORI registration to product certifications. By taking these proactive steps, we minimize the risk of non-compliance, allowing for a smoother entry of your goods into the market.

Population

68.17 M

Biggest Industry By Export

Machinery

Capital City

Paris

Biggest Industry By Import

Petroleum Gas

Additionally, we handle the complexities of French customs clearance on your behalf. Our expertise in managing the necessary paperwork and navigating customs regulations means your goods move quickly and efficiently without the added burden of dealing with strict local requirements. This simplifies the process and ensures that your goods clear customs without any unnecessary delays.

How French Imports Go Beyond Paperwork with VAT and EU Compliance

France is a hub for consumer goods, beauty, and software-related shipments. TecEx enables entry with IOR/EOR services, so clients don’t need a French entity.

We ensure product compliance with EU safety and labeling rules, manage VAT registrations, and offer local invoicing for smoother partner transactions.

Specific Compliance Regulations for France

Importers and exporters to/from France must adhere to a series of national and international trade compliance regulations:

Economic Operators Registration and Identification (EORI)

EORI numbers are mandatory for all entities involved in import/export operations within the EU. This system is in place to ensure accurate tracking of goods across member states.

CE Marking

Products requiring CE marking—such as electronics, toys, and medical devices—must meet EU safety standards and be tested and certified before import. This includes compliance with the EU’s Low Voltage Directive and Electromagnetic Compatibility Directive.

Product Safety

France adheres to the EU’s General Product Safety Directive, which ensures that only safe products are sold on the market. Testing and certification for product safety are essential for compliance.

WEEE Directive

The WEEE Directive mandates that electrical and electronic equipment be properly disposed of and recycled.

RoHS Compliance

The RoHS Directive restricts the use of certain hazardous materials in electronic products.

AI Hardware, Handled Like Gold

Importing cutting-edge AI equipment? We specialize in transporting mission-critical, high-value technology with full-service precision and care. From fragile components to sensitive systems, our white-glove control tower solution ensures your shipments arrive safely, compliantly, and on time—no matter the destination.

France’s Trade Landscape

France is a central player in global trade and one of the largest economies within the European Union (EU). It boasts an advanced infrastructure, high connectivity, and a competitive tech sector, making it an ideal destination for both importing and exporting goods. France is also a leading hub for ecommerce, digital innovation, and high-tech industries, with robust systems in place for handling international shipments.

France’s major trading partners include Germany, the United States, China, and Belgium, with key export sectors in luxury goods, pharmaceuticals, and aerospace.

Navigating France’s import and export landscape requires careful planning and attention to detail. France’s stringent regulations, high tariffs, and complex customs procedures demand that businesses stay well-informed and compliant. By partnering with an experienced trade compliance provider like TecEx, businesses can streamline their shipping and ensure a smooth entry into the French market.

Distinctions Between Mainland France and Its Overseas Territories

Economic and Trade Differences

Mainland France and its overseas territories, including both the Overseas Departments and Regions (DROM) and the Overseas Collectivities (COM), differ markedly in their trade landscapes, economic structures, and institutional frameworks. Mainland France has a large, diversified economy driven by high-value manufacturing, technology, and services. Although it maintains a goods trade deficit, it offsets this through a strong services surplus, especially in tourism and finance.

In contrast, the overseas territories have small, specialized, and less diversified economies that depend heavily on a few key sectors such as agriculture, fishing, mining (notably nickel in New Caledonia), and tourism. As a result, these territories face chronic trade deficits because they import nearly all manufactured goods, energy, and many food products, while exporting limited quantities of primary or niche products. Their economies are sustained largely through substantial public transfers and financial aid from the French state.

Institutional and Legal Status

Institutionally, the DROMs—such as Guadeloupe, Martinique, French Guiana, Réunion, and Mayotte—are fully integrated into the European Union as Outermost Regions (RUP), meaning they participate in the EU’s single market and customs union, though they receive special assistance to offset their remoteness.

The COMs—such as French Polynesia, New Caledonia, Wallis and Futuna, and Saint Pierre and Miquelon—are designated as Overseas Countries and Territories (OCTs). These territories are associated with the EU but lie outside its customs territory and single market, granting them greater autonomy to set tariffs and trade policies tailored to local needs.

The Unique Case of Saint Martin

Saint Martin holds a uniquely hybrid status among France’s overseas territories. As an Overseas Collectivity (COM) and Outermost Region (OMR) of the EU, it is part of the EU Customs Union but lies outside both the EU VAT and Schengen areas. This means goods traded with mainland France or other EU states are generally duty-free, while imports from non-EU countries face the EU’s external tariff.

Historically influenced by its “free port” tradition in conjunction with the Dutch side of the island, Sint Maarten, Saint Martin benefits from low import costs and a tourism-oriented economy. Its tax regime is especially distinct: it applies a 0% VAT rate, does not levy the Octroi de mer (dock dues tax), and has the autonomy to set its own local consumption and turnover taxes. These features create a simpler, more flexible fiscal environment that contrasts sharply with the fully integrated EU tax and customs systems of mainland France.

Overall, the overseas territories are far more vulnerable than mainland France to external shocks due to their geographic isolation, dependence on imports, limited export capacity, and exposure to climatic risks. While France’s mainland economy benefits from EU integration and diversification, its overseas regions and collectivities rely on structural support and special trade regimes to sustain their economies.

Ready to Ship to France?

If you’re importing/exporting to France, don’t leave compliance to chance. Let our experts guide you through every customs requirement so your goods clear smoothly and reach your customers faster.