North America

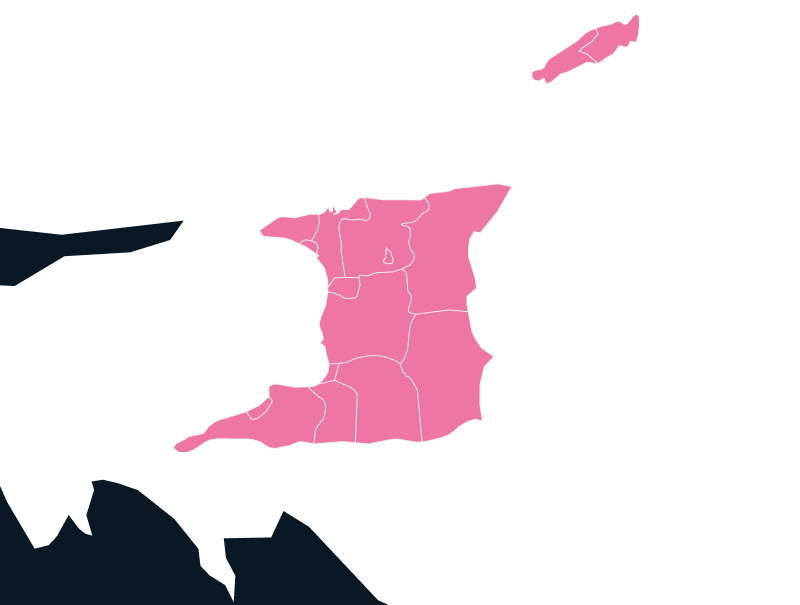

Trinidad and Tobago | Imports and Exports

Trinidad and Tobago, an island nation located in the southern Caribbean, offers an attractive market for importers, thanks to its high-income economy fueled by its oil and gas industries. As the country’s economy diversifies, the technology sector plays an increasingly prominent role in shaping its trade landscape. However, importing goods into Trinidad and Tobago comes with its own set of challenges that businesses need to navigate.

Tax

Up to 13%

Duties

Up to 20%

Lead Times

6-7 Weeks

Restricted Items

N/A

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Trinidadian Creole; English

The Export and Import Landscape in Trinidad and Tobago

Trinidad and Tobago’s trade environment has seen significant changes in recent years, particularly with the rise of digital and technological advancements. The country is a member of both the Caribbean Community (CARICOM) and the World Trade Organization (WTO), positioning it as a key trading hub in the region. Major trading partners include the United States, China, the United Kingdom, and other CARICOM countries. While the import process is relatively straightforward for many goods, businesses can still encounter several obstacles when importing into this Caribbean nation.

Population

1.51 M

Biggest Industry by Export

Natural Gas and Oil

Capital City

Port of Spain

Biggest Industry by Import

Refined Petroleum

Import Challenges in Trinidad and Tobago

Bureaucratic Processes and Administrative Hurdles

The import process involves dealing with multiple government agencies and requires a variety of forms and permits. The complexity of these requirements often leads to frustration, especially for first-time importers. It is crucial for businesses to be familiar with the various steps involved in clearing goods through Trinidad and Tobago customs to avoid costly delays and ensure compliance.

Customs Delays

Clearing goods through customs is the most frequently reported challenge for businesses operating in Trinidad and Tobago. The customs process can sometimes take weeks due to delays, inefficiencies, and inconsistent application of regulations. This can significantly affect your supply chain and overall business operations, especially if you are unfamiliar with the intricacies of the process.

Regulatory Hurdles and Compliance Challenges

While most products can be imported without issue, there are specific categories of goods that require import licenses. Some goods fall under a “negative list,” which is subject to additional import surcharges or restrictions. Certain items, such as pharmaceuticals, are subject to stringent regulations to ensure safety, efficacy, and quality. Additionally, the country’s implementation of CARICOM directives and regulations sometimes introduces further complexities that need to be navigated.

Limited Electronic Payment Options

Despite efforts to modernize trade procedures, Trinidad and Tobago’s customs system still lacks full integration with electronic payments. This means that customs duties and fees may need to be settled using traditional methods, which can be time-consuming. While the country has implemented a new portal to streamline customs procedures, not all relevant ministries are fully participating, and the platform is not yet universally adopted.

Leading Trade Partners of Trinidad and Tobago

South America

Brazil

Africa

Morocco

Trinidad and Tobago Customs Compliance

Navigating Trinidad and Tobago’s customs regulations can be a daunting task for importers unfamiliar with the country’s procedures. Below are key considerations to keep in mind when dealing with Trinidad and Tobago customs:

CARICOM Common External Tariff

As a member of CARICOM, Trinidad and Tobago applies the CARICOM Common External Tariff (CET) for imports from countries outside the CARICOM region. Import duties can reach up to 20% on certain goods, though some categories such as books, CDs, computer hardware, and scanners are tariff-free. There is also a 7% tax imposed on goods purchased online.

Customs Broker Requirement

When importing or exporting commercial goods, a customs broker is required to facilitate the clearance process. This ensures that the necessary documentation is submitted, duties are paid, and all regulations are complied with. A trusted customs broker can help expedite the clearance process and minimize the risk of delays.

Import Permits and Licensing

Before importing certain goods into Trinidad and Tobago, it’s essential to determine if an import license is required. The Ministry of Trade and Industry is responsible for issuing these licenses, and the process can take time. Importers should inquire in advance to avoid unnecessary shipping delays.

Temporary Entry and Re-Exportation

If you need to temporarily import goods into Trinidad and Tobago with the intention of re-exporting them later, it’s possible to do so with prior arrangements. A deposit or bond will need to be posted to cover the duty liability. Once the goods are re-exported, a 10% duty fee applies for every three months the goods remain in Trinidad and Tobago.

How TecEx Can Help You Navigate Trinidad and Tobago Imports

Importing to Trinidad and Tobago can be challenging, but with the right support, businesses can successfully navigate the regulatory landscape and avoid common pitfalls. That’s where we come in.

Our expert Importer of Record (IOR) services are designed to simplify the import process and ensure your goods comply with Trinidad and Tobago’s customs regulations. From handling pre-compliance checks to clearing customs and ensuring timely delivery to your designated location, we take care of everything for you.

Tailored Delivered Duty Paid (DDP) Solution

Our tailored Delivered Duty Paid (DDP) solution that covers every aspect of the import process, from pre-shipping documentation to final delivery. We handle all customs clearance procedures, so you don’t have to worry about dealing with the complexities of Trinidad and Tobago’s import regulations.

Expert Customs Support

Our in-depth knowledge of local customs procedures ensures that your goods are cleared quickly and efficiently upon arrival in Trinidad and Tobago. We work with trusted customs brokers to help expedite the clearance process and ensure compliance with all regulatory requirements, reducing the risk of costly delays.

Minimizing Bureaucratic Bottlenecks

With TecEx as your partner, you’ll have an experienced team to guide you through the bureaucratic maze of import regulations in Trinidad and Tobago. We ensure that all necessary permits, licenses, and documentation are in order, so you can focus on running your business while we take care of the logistics.

Simplify Trinidad and Tobago Imports and Eports

Don’t let the complexities of Trinidad and Tobago’s import process slow you down. Trust TecEx to handle your import and exports needs, ensuring smooth and efficient customs clearance every time.