As an international tech company, you have probably needed to figure out how to showcase products, conduct research or provide services across borders for a limited time before getting them back. This is what is known as a temporary import and if done correctly, it can save you from having to pay any duties and taxes on your shipment.

What Are Temporary Imports?

Temporary imports refer to the shipment of goods into a country for a limited period, after which the goods are returned to their origin or re-exported. This process is essential for businesses engaged in international trade, particularly those in the tech industry, where equipment may be needed for short-term projects, exhibitions, or repairs.

Key Scenarios for Temporary Imports

Trade Shows and Exhibitions:

Many tech companies import equipment and displays for showcasing their innovations at international trade shows. These temporary imports must be managed carefully to ensure compliance with local regulations.

Product Demonstrations:

When launching a new product in a foreign market, tech firms may bring prototypes or demonstration units to provide firsthand experience to potential clients.

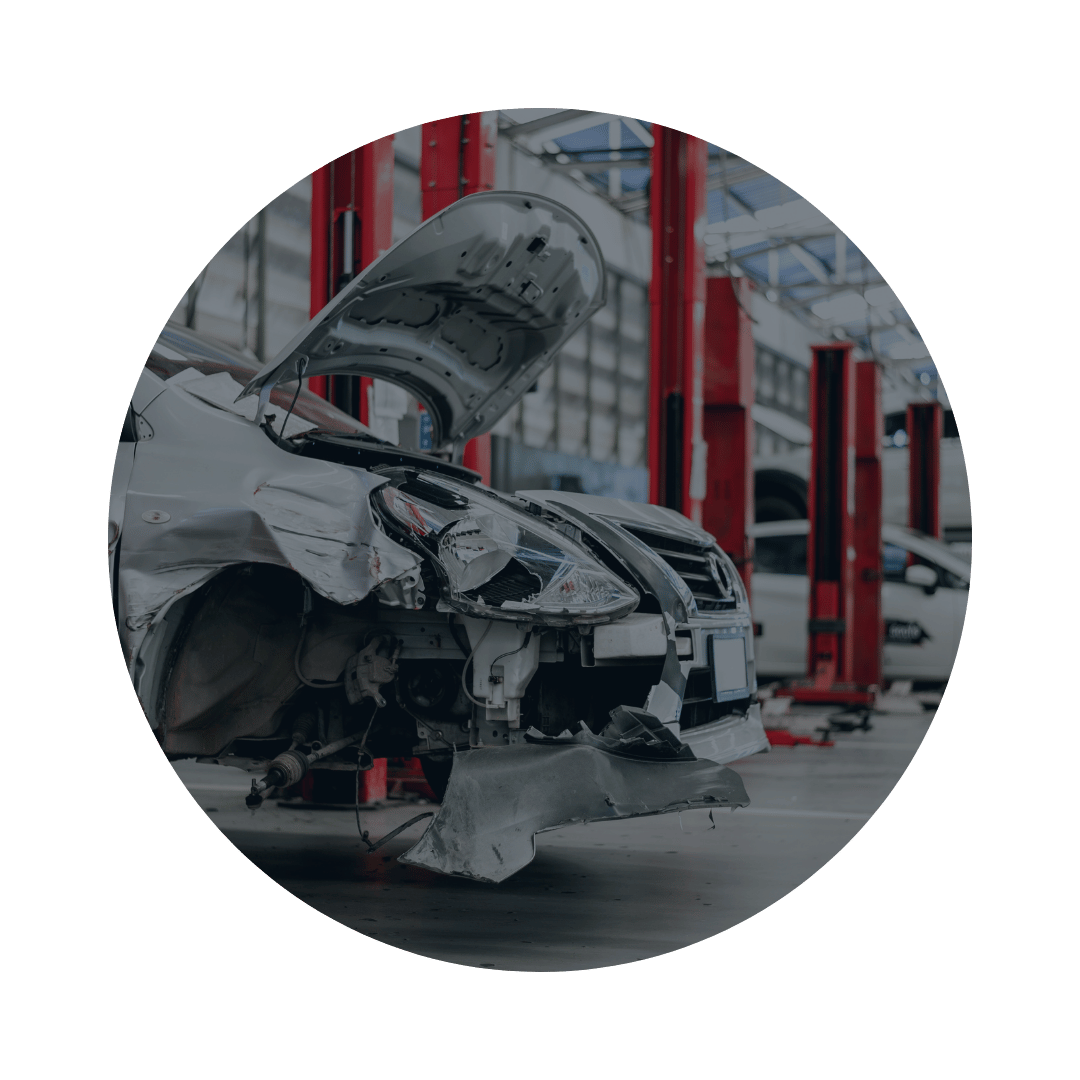

Repairs and Maintenance:

High-value equipment may require temporary importation to specialized repair facilities. This allows companies to minimize downtime and maintain operational efficiency.

Research and Development:

Companies may temporarily import goods to conduct market research or testing before a full-scale product launch in a new region. This is particularly relevant for pharmaceutical companies running global clinical trials.

What is a Temporary Import Under Bond?

A temporary import under bond occurs when goods are imported into a country for a temporary period without paying import duties or taxes. The importer provides a bond to the customs authorities as a guarantee that the goods will be re-exported or destroyed within a specified timeframe.

The Impact of Temporary Imports on Tech Companies

Temporary imports can significantly affect how you manage your international shipping logistics. Understanding the rules and regulations surrounding temporary imports ensures compliance and reduces the risk of unexpected costs. The complexities of temporary imports can have the following implications on your business:

Cost Management

Without proper compliance, companies may face unexpected taxes and duties. Understanding the temporary import regulations can help in planning budgets more accurately.

Operational Efficiency

Ensuring timely returns of goods can prevent delays in projects and enhance overall efficiency.

Risk Mitigation

Non-compliance can lead to fines, confiscation of goods, and damage to a company’s reputation. Knowing the regulations helps mitigate these risks.

Benefits of Using Our Temporary Import Compliance Services

Ease of Return: We help streamline the return process, ensuring your goods can be shipped back without unnecessary delays.

Compliance Assurance: Our experts navigate complex regulations, ensuring you meet all local and international compliance requirements.

Cost-Effectiveness: Avoid unexpected taxes and duties by properly utilizing temporary import regulations.

TecEx Temporary Import Use-Cases

Scenario 1: Temporary Import with Potential Permanent Import

Overview

TecEx helps an Original Equipment Manufacturer (OEM) temporarily import high-value demo IT equipment to Europe, with the option for permanent import.

Challenge

The OEM needs to defer taxes and duties until deciding whether to return the equipment or keep it in Europe, requiring an entity to assume liability.

Solution

TecEx acts as the Importer of Record (IOR), managing compliance and taking on tax responsibilities, allowing the OEM to pay only a minor percentage of duties while the equipment was in Europe.

Outcome

TecEx’s expertise turns a complex challenge into a successful strategy, enabling the OEM to manage costs effectively while ensuring compliance with international trade regulations.

Scenario 2: Temporary Import of a Prototype Robot

Overview

An established robotics company seeks to temporarily import a prototype robot from the US to Bangladesh for demonstration.

Challenge

The company faces complex regulations surrounding the temporary import, including compliance with customs, health and safety standards, and potential liability issues during the exhibition.

Solution

The client engages TecEx as a compliance specialist. TecEx secures an ATA Carnet, manages customs declarations, handles the liability concerns and ensures adherence to complex regulations, allowing for smooth importation and exhibition setup.

Outcome

With TecEx’s support, our client successfully showcases the robot while efficiently navigating compliance requirements, paving the way for potential partnerships in the destination country. The robot is then seamlessly re-exported back to the origin country.

Do You Pay Taxes and Duties on Temporary Imports?

In many cases, temporary imports are exempt from certain taxes and duties, provided they are re-exported within the specified time frame. However, the rules can vary significantly from country to country. Here’s a quick breakdown:

- Duty-Free Status: Many countries allow temporary imports to be duty-free as long as the goods are re-exported.

- Time Limits: There are typically defined periods (e.g., 6 months) within which the goods must be returned. Failure to comply can result in the assessment of duties and taxes.

- Documentation: Proper documentation is crucial. It ensures that all imports are accounted for and that goods are eligible for duty exemption.

Does your shipment need a carnet?

roof-of-Concept Shipment and Temporary Imports

A proof-of-concept (POC) shipment serves as a crucial trial run for businesses launching new products or services. This strategy allows companies to assess feasibility, functionality, and market viability before committing to a full-scale rollout.

Where do Temporary Imports Fit In?

Proof-of-concept shipments are especially beneficial for testing new products, optimizing supply chains, showcasing technological innovations, or assessing customer experiences. This risk-mitigation strategy allows businesses to make informed decisions while minimizing financial exposure.

Temporary imports further enhance the effectiveness of proof-of-concept shipments. By allowing businesses to test products in foreign markets without long-term commitments, temporary imports offer several advantages:

- Reduced Costs: Lower customs duties and taxes make testing more affordable.

- Flexibility: Companies can adjust shipments based on market response, adapting quickly to feedback.

- Limited Commitment: Businesses can explore new markets without the risk of significant financial loss if the proof of concept doesn’t succeed.

- Faster Time-to-Market: Temporary imports expedite the introduction of products, allowing quicker feedback loops.

Utilizing temporary imports in proof-of-concept shipments enables companies to gather essential market insights, refine their offerings, and strategically plan for future expansions. This dual approach not only mitigates risks but also enhances the likelihood of success in a competitive marketplace.

Which Countries Allow Temporary Imports and Why do Some Not?

Many countries allow temporary imports, often under specific conditions and regulations. This typically applies to goods that are not intended to remain in the country permanently, such as:

Industry Expertise

Professional Equipment

Goods for Repair or Alteration

Personal Effects of Travelers

Countries that allow temporary imports include:

- Developed nations: The United States, Canada, the European Union, Australia, New Zealand, Japan, South Korea, and Singapore.

- Developing nations: Many countries in Africa, Asia, and Latin America also have provisions for temporary imports.

Countries That May Restrict Temporary Imports

While most countries allow temporary imports under certain conditions, some may have restrictions or limitations. These restrictions can be due to various factors, such as:

National Security Concerns

Trade Policies

Environmental Regulations

Domestic Industries

Regulations and requirements can differ greatly between countries. It’s crucial to engage with customs authorities in the destination country or a short-term import specialist like TecEx to get precise and current information.

TecEx | Your Partner in Temporary Import Compliance

“We can help you unlock savings with our temporary import solutions, reducing your taxes and duties while effortlessly testing new markets.”

– Rael Szewach, TecEx Senior Sales Associate

We specialize in navigating the intricate landscape of temporary imports for tech companies. Our dedicated team is committed to ensuring your short-term imports are compliant, efficient, and cost-effective. Whether you’re preparing for a major trade show or conducting crucial R&D, trust us to facilitate smooth sailing through the temporary import process.

Temporary Imports Frequently Asked Questions (FAQs)

What is the typical duration for a temporary import?

The duration varies by country but often ranges from a few days to up to a year, depending on the nature of the goods.

What happens if I fail to return the goods on time?

If goods are not returned on time, you may incur duties, taxes, and potential penalties.

Can I convert a temporary import into a permanent import?

Yes, but this requires following specific customs procedures, including paying applicable duties.

What is the difference between a temporary import and a carnet?

A temporary import allows goods to enter a country for a limited time without paying full duties, usually for specific purposes like exhibitions. In contrast, a carnet is an international customs document that permits multiple temporary imports into various countries without duties, typically valid for up to a year. While temporary imports are country-specific, carnets offer broader flexibility and recognition across participating nations. For more on carnets click here.