Europe

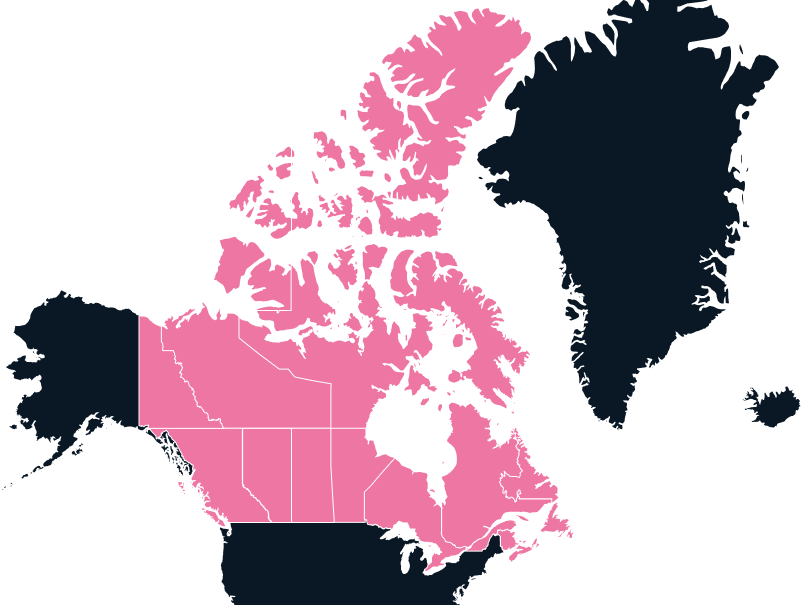

Importing to Canada

Importing into Canada can look simple—until the details hit. CARM requirements, duties, taxes, and shifting regulations can quickly slow your shipments down. Don’t risk delays and unexpected costs. Leverage proven Canadian import expertise to keep your goods moving without surprises.

Tax

Up to 5%

Duties

Up to 7%

Lead Times

1-2 Weeks

Restricted Items

None

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and public holidays

Prominent Languages

English, French

Canada’s Evolving Import Landscape | CARM and Importing Tech

The most transformative change in recent years has been the rollout of CARM—the Canada Border Services Agency’s (CBSA) digital platform for managing all commercial imports. CARM, short for CBSA Assessment and Revenue Management, is designed to modernize how duties and taxes are assessed and paid.

Trade Snapshot | How does Canada’s CARM System Impact Importing Tech?

The CARM rollout places new responsibilities on importers, but as your designated importer, we take on those obligations for you:

We act as your local, registered importer, meeting CARM’s requirement of having a Canadian business number and being active in the CARM Client Portal.

We provide CBSA with financial security for your shipments, giving you access to RPP (Release Prior to Payment) benefits.

We manage compliance with CARM’s new digital processes, reducing your exposure to delays, penalties, or administrative errors.

In short, you continue focusing on your core business while we ensure full CARM compliance as your in-country importer and partner.

Why CARM Matters?

Errors in CARM can result in delays, fines, or even denied entries.

Fortunately, TecEx understands CARM thoroughly. We specialize in making that process seamless. As a registered CARM Importer, we handle the entire process from duty calculations to clearance, so you don’t have to.

As your Importer of Record, we remove the barriers, simplify the rules, and make Canadian customs seem far less complicated than they appear on paper.

Pain Points When Importing to Canada

Canada’s import system isn’t just about paying duties; it’s about doing everything by the book. Canadian customs is known for enforcing strict compliance, and they reserve the right to inspect shipments at any time. A small paperwork or product classification oversight can quickly become a big problem.

HS Code Misclassification

Incorrect classification leads to incorrect duties—or worse, CBSA audits. TecEx leverages an extensive proprietary compliance database to ensure goods are accurately coded.

Customs Duties

Certain products headed for Canadian borders might be subject to extra duties. The Special Import Measures Act (SIMA) provides the framework for investigating and addressing unfair trade practices, particularly dumping and subsidizing imported goods. The purpose of SIMA is to protect local manufacturers and producers. SIMA imposes duties on certain products to safeguard Canadian businesses from competitive disadvantages.

Delays from Incorrect Valuation

Improper valuation leads to flagged shipments. Our valuation team applies one of six CBSA-approved valuation methods to ensure your declarations hold up to scrutiny.

Incomplete Documentation

Canada’s customs laws require complete and bilingual documentation. Incomplete paperwork results in penalties or denied entry.

TecEx mitigates this risk by using our proprietary compliance database to ensure your tech equipment is correctly documented and classified every time. And because we stay ahead of trade regulation shifts, we can also help you avoid products caught up in tariff disputes or temporary import bans.

Countries That Trade with Canada

Asia

Japan

North America

United States of America (USA)

Non-Resident Importer (NRI) | Importing Without a Canadian Entity?

As with most countries, a registered entity is required to import dual-use tech goods compliantly. If your company is based outside Canada but ships goods into the country, you’re considered a Non-Resident Importer (NRI). This role allows you to act as the Importer of Record Canada, even without a physical presence inside the country.

While this may sound ideal, it does make you responsible for full compliance with Canadian import laws, duties, complex tax structures, and documentation, and you are also liable for any future audit pertaining to your shipments.

With TecEx as your IOR/NRI, you reap all the benefits without taking on the legal burden.

Population

40.1 M

Biggest Industry by Export

Crude Petroleum

Capital City

Ottawa

Biggest Industry by Import

Cars

One Solution, End-to-End

Delivered Duty Paid Canada

Importing tech equipment to Canada? Our Delivered Duty Paid (DDP) service is your turnkey solution.

We handle:

- Pre-compliance checks

- HS code classification

- Import tax estimation and payment

- CARM compliance

- Customs clearance

- Final delivery to your destination in Canada

All under a DDP Incoterm, ensuring you avoid unexpected charges, customs complications, or compliance missteps.

When we act as your NRI and Importer of Record, you retain visibility and control. It’s the easiest way to enter or expand your footprint in Canada, and it ensures you remain fully compliant while giving your end users the local experience they expect.

Not Only Importing but Exporting from Canada

If you’re shipping high-tech goods out of Canada, staying compliant is just as important.

Canada regulates the export of sensitive or dual-use technologies under the Export and Import Permits Act (EIPA) and the Controlled Goods Program. If your product can be repurposed for military or surveillance use, you may need an export permit.

We help our clients navigate:

- Export classification

- License applications

- Document compliance

- Destination-specific requirements

Whether you’re re-exporting a repaired server or shipping telecom gear to Asia, TecEx ensures your export is smooth and compliant with Canadian and international regulations.

How Tariffs and Trade Agreements Come into Play

Global trade is never static, and Canada is no exception. Recently, US-Canada trade tensions have led to new tariffs on products like aluminum, steel, and even high-tech goods. Canada has responded with retaliatory duties.

So if you’re importing goods affected by these duties, your data—HS codes, declared values, and country of origin—must be absolutely accurate.

This is where trade agreements like USMCA (formerly NAFTA) or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) become your best friend. You could be exempt from some or all duties if your goods qualify under these agreements. Goods that qualify under USMCA remain one of the few pathways for duty-free treatment with the US.

We help you determine eligibility and apply for preferential treatment where needed.

Start Importing to Canada the Smart Way

Whether you’re a seasoned multinational from Europe, a first-time shipper from South America, or beyond, TecEx helps you import to Canada efficiently, transparently, and without the headache. With our localized knowledge, advanced compliance tools, and full-service DDP solution, we turn Canadian customs into another smooth step in your supply chain.

Streamlining Imports into Canada and Managing Re-Exports with Ease

Canada’s imports span consumer goods, retail, and vitamins/supplements, often via Amazon FBA. TecEx provides IOR/EOR services for clients without a Canadian entity, navigating customs on their behalf.

Our product compliance audits and label reviews ensure goods meet local standards. We also offer return logistics to protect margins when products are re-exported. Our duty drawback program recovers duties and taxes on re-exported goods, protecting margins.

Simplify Your Imports into Canada

Ready to simplify your Canadian imports? Partner with experts who know the regulations, the systems, and the fastest path through customs. Get support now and keep your shipments moving.

.jpg)