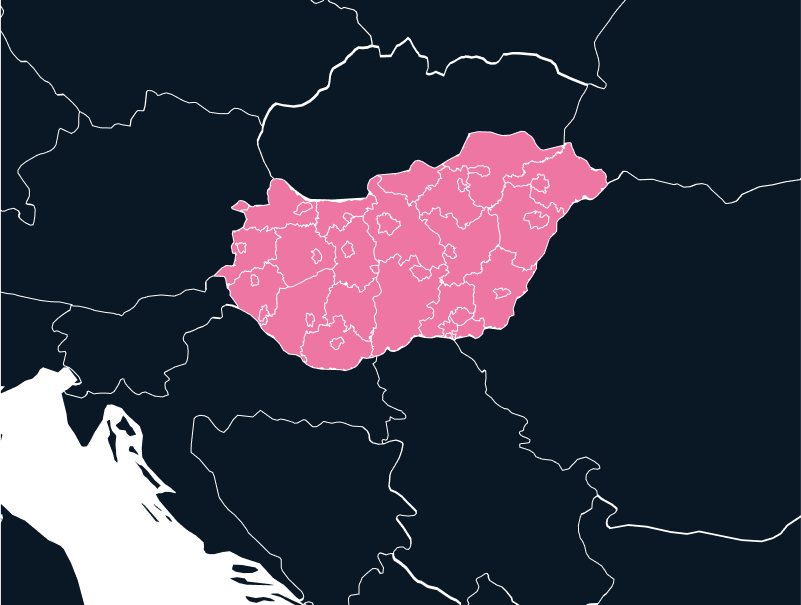

Europe

Export and Import from Hungary

Hungary is a dynamic country in Central Europe, with a strong economy and a thriving tech sector. However, like many nations, Hungary presents specific challenges for businesses looking to import and export goods, particularly in terms of compliance, paperwork, and regulations.

Tax

Up to 27%

Duties

Up to 7%

Lead Times

2-3 Weeks

Restricted Items

N/A

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Hungarian

Importing to Hungary

Hungary is an attractive destination for businesses looking to expand into Central Europe. The country has a strategic location within the European Union and is a growing hub for technology and software development. However, importing goods into Hungary is not without its challenges. Despite the EU’s common market structure, the country’s import procedures can still be complicated by regulatory requirements, licensing laws, and a variety of customs processes.

As an EU member state, Hungary’s trade relations with other EU countries are more straightforward. In fact, 71% of Hungary’s imports come from other EU member states. However, imports from non-EU countries like China and South Korea still play a significant role, with 9% and 4% of Hungary’s imports respectively originating from these nations. This means that businesses must be prepared to handle both EU and non-EU import regulations when entering the Hungarian market.

Key Compliance Regulations for Importing to Hungary

When importing goods into Hungary, businesses must comply with several regulations that are essential for smooth customs clearance. One of the most significant hurdles is navigating Hungary’s complex VAT system. VAT is levied at 27% for most goods and services, with a reduced rate of 18% for specific products. The VAT applies to all imports into Hungary, even when goods are simply transiting through the country on their way to another EU member state.

Moreover, while 95% of products imported into Hungary no longer require an import permit, licenses are still necessary for certain goods. Importers must also adhere to strict product labeling requirements. For example, consumer goods must be labeled in Hungarian, which may require additional labeling or packaging modifications. Failure to comply with these requirements can result in costly delays and penalties.

Importers also need to navigate the complexities of the Single Administrative Document (SAD), which serves as the official import declaration for goods entering Hungary. This document covers both customs duties and VAT and must be submitted to the Hungarian authorities by the importer of record or their agent.

Population

9.65M

Biggest Industry by Export

Cars

Capital City

Budapest

Biggest Industry by Import

Motor Vehicles; Parts and Accessories

Trade Compliance Challenges in Hungary

While Hungary presents numerous opportunities for global trade, the process of importing and exporting goods is not without its pain points. One of the most pressing issues faced by businesses is the significant amount of documentation required for customs clearance. In Hungary, importers often encounter delays due to incomplete paperwork or errors in submitted forms. Customs clearance can take longer than expected, which results in unpredictable delivery timelines and can incur additional costs for businesses.

Another challenge is the frequency of regulatory changes. Hungarian trade laws and export control measures are subject to periodic updates, making it difficult for businesses to stay abreast of the latest requirements. This can create uncertainty for traders and increase the risk of non-compliance.

Additionally, Hungary has specific regulations regarding product safety and environmental standards. These stringent requirements are intended to protect both consumers and the environment, but they can add complexity to the import process. Products must meet these standards before they can enter the market, and failure to do so could result in significant delays or even fines.

Countries Associated with Hungary

Europe

Austria

Asia

China

How TecEx Can Help You Import and Export to Hungary

Whether you’re dealing with regulatory hurdles, VAT challenges, or the intricacies of product labeling, TecEx is here to help you navigate the Hungarian market with ease. Let us handle the complexities of importing and exporting, so you can focus on growing your business and reaching new markets.

At TecEx, we specialize in providing comprehensive solutions to help businesses navigate the complexities of importing and exporting goods to and from Hungary. Our expertise in customs compliance, VAT recovery, and logistics ensures that your shipments are handled efficiently and in accordance with Hungarian regulations.

One of our key offerings is the role of Importer of Record (IOR), which allows us to manage your customs clearance processes and handle all necessary paperwork on your behalf. With our seamless Delivered Duty Paid (DDP) solution, you can rest assured that your goods will be cleared through customs and delivered to their final destination in Hungary without unnecessary delays or complications.

We also help businesses comply with Hungary’s unique product labeling requirements, ensuring that your goods meet local regulations before they reach the market. Our team stays up to date on changes in trade laws, so you don’t have to worry about compliance risks as you grow your business in Hungary.

For temporary imports, we offer support with the ATA Carnet system, a document that simplifies customs procedures for goods temporarily entering Hungary for trade fairs, exhibitions, or professional use. We ensure that your goods are handled correctly, stored in bonded warehouses if necessary, and re-exported without issue.

Your global trade and import solution for Hungary

Fill in and submit the form to get in touch, and our import and export experts will contact you with a bespoke customs compliance solution to suit your Hungarian trade needs.