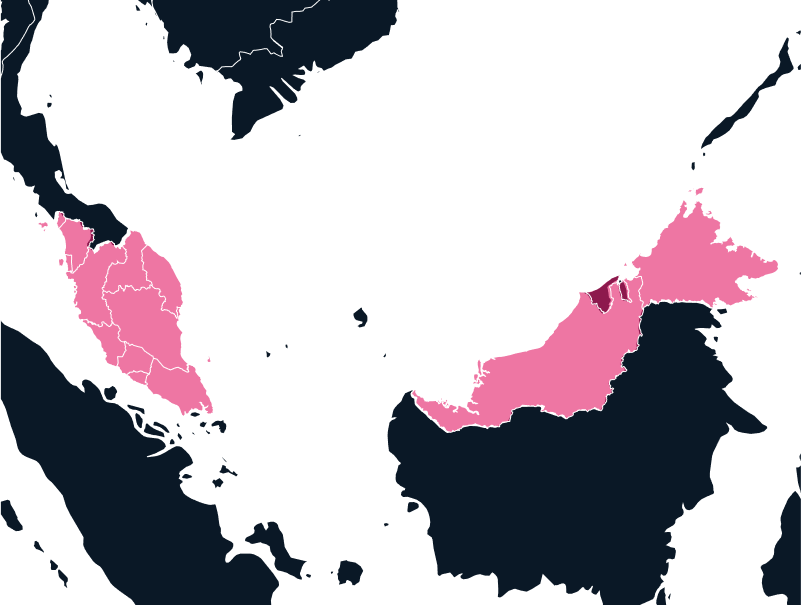

Asia

Export and Import to Malaysia

Located strategically at the crossroads of Southeast Asia, Malaysia is an essential hub for global trade. The country’s manufacturing sector, particularly in electronics, automotive, and chemicals, is a leading contributor to its exports.

Tax

up to 10%

Duties

up to 40%

Lead times

2-3 weeks

Restricted Items

Checkpoint Products and Products of Israeli Origin

Best carrier option

Freight Forwarder

Non-working days

Public Holidays

Prominent Languages

Malay, Mandarin & Tamil

Import Requirements and Regulations in Malaysia

While the Malaysian import process is generally straightforward for most items, certain products, particularly those in high-tech or regulated industries, require additional documentation and approval. This process effectively can help ensure a smooth and timely importation of goods.

The first step in the import process is completing the Customs Declaration. All goods entering Malaysia must be declared using Customs Form No. 1, which includes detailed information such as the description, quantity, weight, and country of origin of the items being imported.

When it comes to import duties and taxes, businesses should be prepared to pay an average tariff rate of around 5.6% for industrial goods. In addition, the Goods and Services Tax (GST) is applicable. These taxes must be settled before the goods are cleared and released from customs.

Required Documentation Necessary to Complete the Malaysian Import Process:

- Customs Form No. 1

- Bill of Lading or Airway Bill

- Commercial Invoice or Pro-forma Invoice

- Packing List

- Any relevant import permits or licenses, such as SIRIM certification for electronics or telecommunications equipment.

SIRIM certification is particularly important for certain tech products that must undergo evaluation by the Standards and Industrial Research Institute of Malaysia to ensure compliance with local standards.

It is also important to be aware of Restricted Goods. Depending on their nature or country of origin, goods may be subject to additional regulations or outright bans.

Import Restrictions and Regulations in Malaysia

In Malaysia, several key restrictions relate to imports, particularly in strategic sectors such as iron and steel, and automobiles. These industries require import licenses, ensuring that the government can regulate the flow of goods and maintain control over critical sectors of the economy.

Additionally, safety, religious, and moral concerns may prohibit the import of certain goods. This means that products deemed harmful or inconsistent with the country’s values or laws may be restricted or banned altogether.

Another important consideration is the rapid growth of ecommerce in Malaysia, fueled by increasing internet access and widespread use of mobile devices. While the ecommerce sector offers a convenient channel for international trade, imports related to ecommerce must still adhere to the same regulatory requirements as those in traditional import channels. This includes compliance with licensing, safety standards, and other regulations that govern the importation of goods.

Population

34.31 M

Biggest Industry By Export

Electrical and Electronic Products

Capital City

Federal Territory of Kuala Lumpur

Biggest Industry By Import

Electrical and Electronic Equipment

Export Requirements for Malaysia

Malaysia is a significant global exporter, particularly in the electronics and automotive parts industries. Although the export process is generally efficient, compliance with local regulations is necessary to avoid delays or issues.

One crucial aspect to consider is the requirement for export licenses. An export license may be needed depending on the product, particularly for sensitive items like high-tech goods. This license ensures that the goods meet legal standards and align with Malaysia’s national security and economic policies.

Another crucial step in the export process is completing customs declarations. Exporters must submit a Customs Form No. 1, which provides detailed information about the goods being shipped. This process is similar to the importation process and is essential for clearing customs.

It’s also important to note that Malaysia enforces restrictions on certain goods, particularly those deemed sensitive for national security or economic reasons. Sectors such as minerals and construction may face export limitations. Therefore, exporters should verify whether their products are subject to export controls.

Required Export Documents for Malaysia:

Commercial Invoice

Packing List

Bill of Lading or Airway Bill

Certificate of Origin (for preferential tariffs under FTAs)

Export Licenses or Permits (where applicable)

Specialized Solutions and Services for Malaysia

Navigating Malaysia’s import/export landscape can be complex, but services like TecEx’s tailored solutions can simplify the process. Here’s how TecEx can help:

In-House Compliance Database

TecEx maintains a comprehensive database of compliance requirements, which ensures first-time customs clearance for your goods.

SIRIM Registration

TecEx handles the registration process for products requiring SIRIM certification, saving you time and reducing the risk of shipment delays.

Import/Export Documentation

We manage all required paperwork, ensuring that your shipments are properly documented and compliant with Malaysian laws.

Importer of Record (IOR) Services

TecEx can act as your IOR, handling the importation process on your behalf and ensuring all taxes and duties are paid correctly.

Malaysian Compliance Regulations and Challenges

Importing and exporting goods to Malaysia is generally straightforward, but businesses should be aware of several specific challenges that could impact their operations.

One of the primary concerns for businesses is the issue of restricted goods. Malaysia has a list of banned or restricted items, such as products from Israel, second-hand goods, and certain types of electronics. Businesses must familiarize themselves with these restrictions to prevent delays or penalties when goods arrive at customs.

Missing or incomplete paperwork is a common cause of delays, and businesses must ensure that all required documents are in order. This is especially important for products that need special certifications, such as SIRIM approval for certain electronics. Failing to meet documentation requirements can cause unnecessary holdups in the import process.

Another challenge businesses may face relates to high-tech goods, particularly those classified as dual-use items. These products often undergo additional inspections. As a result, companies dealing with high-tech goods must plan for these extra checks and factor in the time required for clearance.

Malaysian compliance regulations are another crucial aspect of the import/export process. To ensure smooth trade operations, businesses must adhere to various regulatory requirements. For instance, many electronic products must pass the SIRIM QAS inspections before being sold in Malaysia. This applies to telecommunications equipment, IT hardware, and various electrical products. Failure to meet these standards can prevent goods from entering the market.

Moreover, certain products require special import or export licenses, particularly sensitive goods such as chemicals, military items, or specific food products. Businesses need to be aware of the licensing requirements for these categories, as the failure to secure the necessary permits can result in penalties or a rejection of goods at customs.

While Malaysia’s tariffs are relatively moderate, non-tariff barriers are used to regulate sensitive industries through import licensing. This is another factor businesses must consider when planning their shipments to Malaysia, as these additional regulatory steps can impact the speed of the import process. Additionally, businesses should be prepared for the 10% Sales Tax on goods imported into Malaysia, along with other applicable duties. These costs can add up and should be factored into the overall cost structure of doing business in Malaysia.

Role of the Royal Malaysian Customs Department

This agency oversees all import and export activities and ensures that businesses comply with Malaysia’s laws and regulations. Building a cooperative relationship with Malaysian Customs is essential for companies to navigate the country’s import/export system successfully.

Countries Associated with Malaysia

Asia

China

Asia

Indonesia

Malaysia’s Trade Landscape

As a member of the ASEAN (Association of Southeast Asian Nations), Malaysia plays a key role in the region’s economic landscape, bolstered by a robust infrastructure and its position along the major shipping routes of the Straits of Malacca. Malaysia’s digital economy is rapidly growing, attracting significant investments—$15.7 billion in Q3 2022 alone. Malaysia’s commitment to liberal trade policies is reflected in its extensive network of trade agreements. It is a signatory to several Free Trade Agreements (FTAs), both bilateral and regional, which offer reduced barriers to trade and improve access to markets.

Key Trade Agreements with Malaysia

Seven bilateral FTAs with Australia, Chile, India, Japan, New Zealand, Pakistan, and Turkey

Regional FTAs via ASEAN with China, Japan, South Korea, India, Australia, and New Zealand.

Participation in the ASEAN Trade-In Goods Agreement (ATIGA).

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

The Regional Comprehensive Economic Partnership (RCEP), one of the largest FTAs, covering ASEAN countries and other major trading partners.

Important Dates

During the month of Ramadan, economic activity is considerably reduced and you can expect working hours to change as well.

Your Global Import Solution for Malaysia

Fill in the form to get in touch, and our expert team will contact you with a bespoke Malaysian customs compliance solution to suit your import and export needs.