North America

Shipping to St Martin | Imports and Exports

As Saint Martin positions itself as a digital nomad hotspot, the demand for high-quality tech imports is only going to grow. Businesses that can offer cloud services, remote work solutions, IT infrastructure, and smart city technologies will be perfectly placed to thrive if they can master the compliance landscape.

Tax

5%

Duty

6%

Lead Times

2-3 Weeks

Restricted Items

N/A

Best Carrier Option

Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

French; English

Welcome to Saint Martin | Where Caribbean Charm Meets Global Trade

Saint Martin is a growing hub for international trade, technology, and digital entrepreneurship. With its unique position as a French overseas collectivity sharing an island with Dutch Sint Maarten, this picturesque territory offers tremendous potential for tech trade and cross-border commerce.

But there’s a catch: the customs regulations for shipping to St Martin are anything but straightforward.

If you’re exploring how to successfully import technology into Saint Martin, you’re not alone. The customs and compliance landscape here can be a minefield, especially for businesses unfamiliar with the intricacies of French and EU trade laws.

Population

0.025 M

Biggest Industry by Export

Tourism

Capital City

Marigot

Biggest Industry by Import

Jewellery

Why Shipping to St Martin Is a Challenge (and an Opportunity)

Importing into Saint Martin isn’t just about moving goods. It’s about navigating a dual-jurisdiction environment, managing a maze of taxes, duties, permits, and documentation, and ensuring full compliance with Saint Martin customs regulations, which fall under French customs and European Union frameworks.

The Complex Trade Landscape in Saint Martin

A Split Island with Separate Customs Rules

Though there’s no physical border between French Saint Martin and Dutch Sint Maarten, the two operate under completely separate legal, fiscal, and customs systems.

This means:

- Goods moving between the two sides may need customs declarations.

- Businesses must understand both sides’ tax obligations and restrictions.

- Mistakes in classification or documentation can lead to delays, penalties, or seized shipments.

French Customs and EU Compliance

As an Outermost Region (OR) of the EU, Saint Martin follows most EU laws, but with a few exceptions. It’s not part of the EU VAT Area or Schengen Zone, which adds another layer of complexity to cross-border trade.

What this means for you:

- EU standards and product compliance rules apply, but VAT might not.

- Shipping tech goods requires clear documentation and proof of conformity.

- Customs procedures are subject to continuous digital transformation, requiring up-to-date expertise.

Heavy Reliance on Imports

With limited local production and no manufacturing base for high-tech goods, Saint Martin imports nearly everything—including IT equipment, networking gear, and electronics.

This creates:

- High demand for reliable import channels, especially for tech.

- A greater need for robust supply chain compliance to prevent disruption.

- An opportunity to provide essential tech services in a growing digital economy.

A Vulnerable Yet Promising Economy

Tourism employs nearly 85% of the workforce, making the economy vulnerable to external shocks, from pandemics to hurricanes. But the island is actively seeking to diversify into digital industries, creating new demand for tech infrastructure and smart solutions.

If your business provides IT hardware or digital solutions, this represents an untapped growth opportunity—provided you can master St Martin customs regulations.

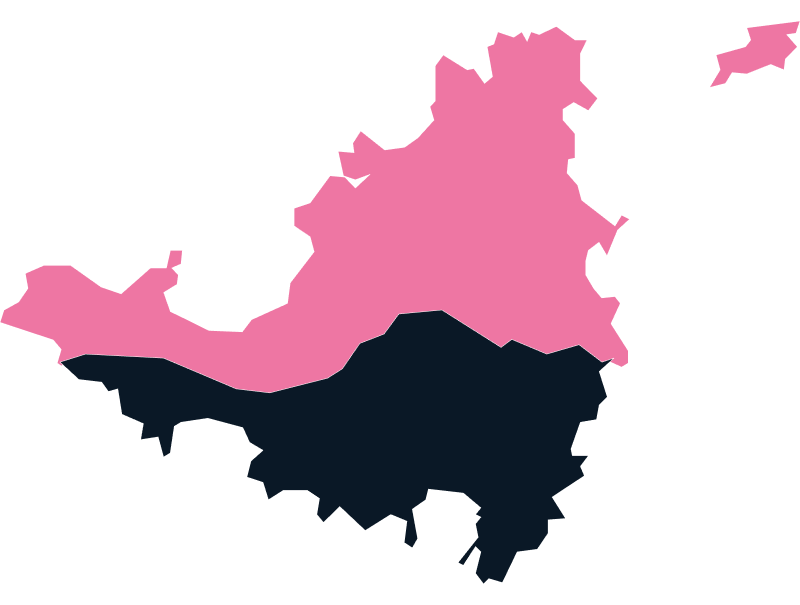

Top Countries That Trade With St Martin

North America

United States of America (USA)

Europe

France

Delivered Duty Paid (DDP) Shipping to St Martin with TecEx

TecEx specializes in simplifying complex imports into challenging markets like Saint Martin through our Delivered Duty Paid (DDP) shipping solution, taking full responsibility for your shipment from origin to final delivery.

This includes handling customs documentation, duties and taxes, permits and regulatory approvals, and final mile delivery anywhere in Saint Martin. Acting as your Importer of Record (IOR), we ensure full compliance with French and EU trade laws, eliminating surprises at the border and guaranteeing smooth, efficient trade execution.

Our deep expertise in navigating the dual customs landscape of Saint Martin and Sint Maarten, combined with turnkey handling of tech imports from pre-compliance to customs clearance, means your team can focus on core business while we manage every detail.

With our DDP solution, your shipments arrive fully compliant and cleared every time, backed by tailored support and custom compliance strategies designed around your specific goods, industry, and delivery needs, providing you complete peace of mind in Saint Martin’s complex import environment.

Ready to Ship to St Martin

With TecEx as your partner, you’ll be equipped to navigate these challenges and take advantage of Saint Martin’s growing appetite for innovation.