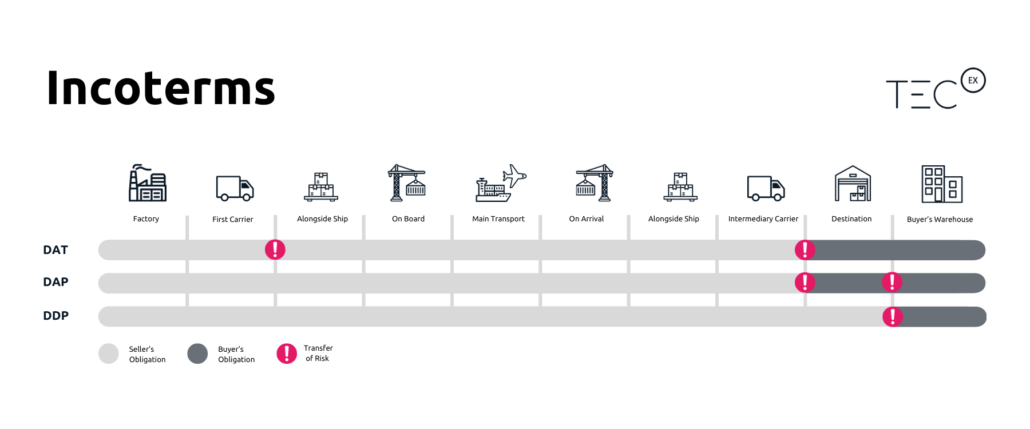

Understanding the difference between the international trade terms DDP, DAP, and DAT is important when contemplating your international shipping process.

It is important to note that DPU (Delivered at Place Unloaded) replaced the incoterm DAT. The significant difference is that the buyer can designate any location as the unloading point.

This knowledge can impact the incoterms you negotiate with your supplier and help you manage the import clearance process more efficiently. And, in any transaction, sellers and buyers should always be aware of the point at which they become responsible for shipping costs.

Although DDP, DAP, and DAT are similar, there are key distinctions in what they entail and how they are used.

This handy FAQ guide explains what the commercial terms DDP, DAP, and DAT mean, runs through the differences between each, and explores how working with an expert Importer of Record (IOR) can make your operation smoother. With this information in mind, you can better understand any potential impact each incoterm might have on your business.

What is DDP (Delivered Duty Paid)?

In international shipping, DDP (Delivered Duty Paid) is an incoterm that refers to a shipment for which the seller (or appointed IOR or customs broker) has the financial responsibility for all connected costs and risks. These costs may include import duties, local taxes, or any other costs from the beginning of the transaction to the end.

In essence, this means that not only is it the seller’s obligation to arrange the sale of the goods logistically, but also any associated costs that may come along as a result. Until the goods reach the destination country and are handed over for unloading, all logistic responsibility lies with the seller, including packing, labeling, and organizing modes of transport.

DDP is typically chosen by buyers who either want to protect themselves or do not want to handle transportation logistics themselves. This incoterm allows them to use a third party to handle all financial responsibilities associated with the shipment until final delivery in the buyer’s country.

Indeed, navigating international import and export can be a complex and challenging process with many legal requirements. To ensure a smooth delivery process when shipping goods to the importing country, it’s often recommended to use a professional DDP shipping service such as TecEx.

What is DAP (Delivered at Place)?

DAP, meanwhile, describes a shipping incoterm in which the seller is only partly responsible for goods being delivered to a named place of destination.

Here, the seller is responsible for the delivery of goods to a named destination, but they are not responsible for costs like import taxes or duties. Neither are they responsible for unloading of the goods, which is also the case in the DDP incoterm.

So, the seller still has a large amount of responsibility for the transportation and delivery of the cargo, but the buyer takes on more of the burden at the destination port in terms of customs clearance and handling the goods.

DAP shipping is widely considered cheaper than DDP shipping for the seller because the buyer takes on more financial responsibility until the risk transfers.

What is DAT (Delivered at Terminal)?

In international trade, a Delivered At Terminal (DAT) shipment means that the buyer is in charge of paying transportation costs such as import duties and taxes, as well as unloading the shipment at the final destination. However, the seller is responsible for getting the items to the terminal. This terminal may be a quay, warehouse, container yard, rail, or air cargo terminal¹.

This means that the buyer is in charge of customs clearance and unloading the products from the transportation vehicle, while the seller organizes the modes of transport and bears all associated costs and risks until the goods are delivered to the designated terminal.

Because the buyer assumes a greater portion of the costs and hazards related to the shipment, DAT is thought to be a less expensive alternative than DDP.

What is the Difference Between a DDP Agreement and DAP Agreement?

There are key differences between DDP and DAP that buyers and sellers should bear in mind when considering which incoterm to ship with. The main distinction concerns the level of responsibility both parties have in a transaction.

On one hand, a DDP seller is in charge of paying all shipping-related expenses and risks, including import taxes and duties. Whereas, when products are delivered via DAP (Delivered at Place), the buyer assumes responsibility for import fees and taxes as well as unloading the merchandise.

This means that up to the time the items are delivered to the buyer at the predetermined location, the seller coordinates all the details of the supply chain, such as transportation of the goods, paying for all associated expenses and risks, and handling customs clearance. Only the unloading of the products from the transportation vehicle is the buyer’s responsibility.

What is the Difference Between DAP and DAT?

The DAP and DAT incoterms are similar, but there are some subtle differences. The main difference between DAP (Delivered at Place) and DAT (Delivered At Terminal) is the place at which responsibility for the goods transfers from the seller to the buyer.

In a DAT transaction, the buyer is in charge of paying import duties, taxes, and unloading the products off the transportation vehicle. The seller organizes for transportation of the items and bears all associated costs and risks up until after the commodities are unloaded at the designated terminal.

Meanwhile, with DAP, the seller is simply in charge of getting the items to a designated location and incurs any financial losses that may happen in the process. From this point, the buyer is responsible for handling customs clearance and unloading the products from the transportation vehicle.

What is the Difference Between DDP and DAT?

Next on our list of shipping term comparisons is DDP and DAT. Again, some key distinctions have to be considered when carrying out the import customs process.

Firstly, with DDP (Delivered Duty Paid), the seller has the burden for all shipping expenses, up until the point of delivery at the port of destination. This means not only import taxes and customs clearance but also handling transportation and any associated costs that may arise. It can be difficult to summarize the costs² involved with this method.

However, in the case of a Delivered at Terminal (DAT) transaction, the buyer takes control of paying the customs duties and taxes. The only thing the seller is responsible for is the transportation and delivery of the cargo to the terminal.

What are the Risks Associated with DDP, DAT, and DAP Incoterms?

Although each incoterm has been designed to protect the interests of the buyer, some risks come along with DDP, DAT, and DAP transactions that are worth bearing in mind when you consider your shipping options.

With each deal, there may be miscommunications that occur between the different parties, which lead to costly delays or even disputes. It’s always important to establish who is responsible for documentation, such as insurance, cargo information, and customs clearance.

Naturally, with the transportation of any goods, there is an inherent danger of goods becoming damaged during transit, which can lead to financial losses and compensation depending on the severity of the damage. There is also the potential that a buyer fails to pay for the shipment, or the seller does not deliver the cargo on time.

Compliance risks can also occur in instances where the buyer does not adhere to the location-specific rules and regulations. This may lead to fines, penalties, or in the worst cases, even legal action.

To ensure these risks do not become a reality, all parties involved in shipping transactions of this nature should take the time to review all documents and communicate clearly with the buyer/seller in question throughout the process.

Overcome International Trade Obstacles with TecEx

As your international trade partner, TecEx helps you sail through the choppy waters of global shipping with ease and efficiency.

We provide a full DDP service, meaning we take responsibility for all goods up to the point of delivery to the named destination. What’s more, we also act as your Importer of Record, meaning that from the beginning of the transaction to final delivery, tricky compliance issues are all taken care of. When TecEx is your partner, choosing between DAT vs DDP vs DAP shipping methods doesn’t have to be a hassle.

Now You Know:

The first set of Incoterms was created in 1936 by the International Chamber of Commerce (ICC). The name ‘Incoterms’ is an abbreviation for International Commercial Terms.

References

¹ ICC. n.d. “Incoterms® 2010 – ICC.” International Chamber of Commerce. https://iccwbo.org/resources-for-business/incoterms-rules/incoterms-rules-2010/.

² O’Leary, Holly Jade. “How to Use INCOTERMS® Proficiently: Risk, Responsibility, and Transfer Operations.” Trade Finance Global, https://www.tradefinanceglobal.com/posts/use-incoterms-risk-responsibility-transfer-operations/.

³ “International Trade Contracts and INCOTERMS.” Great.gov.uk. https://www.great.gov.uk/advice/prepare-for-export-procedures-and-logistics/international-trade-contracts-and-incoterms/.

Let’s find a solution that

works for you

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.

Let’s find a solution that works for you

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.