In the dynamic world of international trade, where goods travel across borders and continents, ensuring the safe delivery of shipments is paramount – especially if these goods are high-value tech products. Despite the implementation of various measures and standards, the reality is that accidents and unforeseen events can still occur, posing risks to the integrity of consignments. Explore the significance of shipping insurance in protecting businesses against such risks.

What is Shipping Insurance?

Shipping insurance provides a vital shield for your shipment, offering financial protection in the event of mishaps during transit. It serves as a safety net, particularly for high-value goods, guarding against potential loss, damage, or theft en route. The coverage period for shipping insurance typically begins and ends at specific points during the shipping process, albeit with slight variations depending on the carrier and policy terms.

Typically, coverage starts once you hand your package over to the carrier at a physical location or during carrier collection. Once the package is scanned and accepted into the carrier’s system, your insurance coverage activates. Subsequently, coverage stops upon delivery to the recipient and your goods are signed for as proof of receipt.

Although shipping insurance provides basic protection, it often comes with limitations based solely on the weight of the goods, rather than their value. Additionally, it may impose restrictions depending on the origin and/or destination of the package. Consequently, it may not be suitable for valuable cargo such as high-end and delicate dual-use goods, which carry a high risk of loss or damage. Choosing TecEx’s Liability Cover offers a more extensive safety net for both local and international shipments, covering values exceeding $30 million and reaching over 200 destinations.

Is Shipping Insurance Worth It?

Whether shipping insurance is worth it or not depends on the value of what you’re shipping and your risk tolerance. Consider your own comfort level with risk. If you’d be devastated by the loss of the item, opting for insurance is a good way to manage that risk. Shipping insurance is generally recommended for:

High-Value Items

Shipping insurance is a wise investment for high-value tech gear. Whether it’s a cutting-edge semiconductor chip, a top-of-the-line laptops, or goods for your e-commerce business, insurance provides financial protection in case of loss or damage during shipping. Even basic coverage can ensure you get reimbursed for the item’s value, saving you from a major financial blow.

Fragile Items

Data centers are filled with sensitive equipment. Imagine a delicate server rack or a powerful graphics processing unit (GPU) getting banged around during shipping and sustaining damage. Shipping insurance is a lifesaver for fragile data center gear. The peace of mind you get from knowing you’re covered for repairs or replacements if something breaks is invaluable.

Irreplaceable Items

Imagine a prototype for a cutting-edge self-driving car being shipped to a testing facility or an RMA demo item. While insurance can’t replace the prototype itself or the irreplaceable data it holds, it can help recoup the significant financial investment. This can help the company move forward without the added stress of a lost, one-of-a-kind device.

The Advantages of Shipping Insurance

Shipping insurance offers several advantages that can give you peace of mind and financial protection when sending packages:

Financial Security

Reimbursement for Loss or Damage

The primary benefit is safeguarding yourself financially in case your shipment gets lost, damaged, or stolen during transit. Without insurance, you’d bear the entire cost of the lost or damaged item.

Reduced Risk

Knowing you’re covered can alleviate the stress and worry associated with potential mishaps during shipping. This allows you to focus on other aspects of your business or personal transaction.

Increased Customer Satisfaction (For Businesses):

Enhanced Credibility

Having shipping insurance as a business can project an image of reliability and customer focus. It demonstrates your commitment to ensuring customers receive their orders in good condition.

Reduced Disputes and Chargebacks

By reimbursing customers for lost or damaged packages, you can minimize disputes and chargebacks, leading to smoother business operations.

Peace of mind

Confidence in Shipping Valuable Items

When shipping high-value items like tech equipment, shopfitting installations, industrial machinery, large project cargo or aerospace items, insurance provides peace of mind. You know you’ll be compensated for the item’s worth if something goes wrong.

Protection for Fragile Goods

For items susceptible to damage during transport, such as high-end and delicate tech equipment, insurance offers valuable protection. It can cover repair costs or replacement in case of breakage.

Did you know?

TecEx can provide cover for shipment values up to $30million, never risk it again.

Consider the value of your items and your risk tolerance when deciding if shipping insurance is necessary. Learn more about TecEx Global Shipping Cover solution

How Does Shipping Insurance Work?

Shipping insurance safeguards your valuables during transport by reimbursing you for loss, damage, or theft. Most carriers offer basic coverage while your goods are in transit. Coverage is often based on the weight of your shipment and not its actual value.

For higher-value items such as high-end tech equipment and encrypted goods, you can safeguard the total value of your goods by opting for TecEx’s door-to-door Liability Cover instead. We have you covered even when your consignment is stored in a warehouse.

With traditional freight shipping insurance, the onus is on you to file a claim with the carrier and prove they are at fault. The carrier will then investigate and potentially reimburse you for the insured amount, minus any deductible.

On the other hand, we take on this admin burden and submit the claim on your behalf should anything go wrong along the way.

With us, you are immediately covered for value!

Lost Packages

Imagine your package vanishing into thin air. With shipping insurance, you’ll receive reimbursement for the item’s value, mitigating the financial blow.

Damaged Goods

Did your shipment arrive looking like it went through a mosh pit? Insurance can cover the cost of repairs or even a complete replacement, ensuring you receive your items in the intended condition.

Theft

Insurance provides compensation if your package gets stolen, offering peace of mind during the delivery process.

While most carriers will technically provide cover should the above incidents occur and impact your goods, you will however have to prove that the incidents took place during the international freight portion of the journey – which is not a straightforward process.

This is not the case with TecEx. We provide cover throughout the entire import journey – from pick up to final delivery.

With TecEx there are no hidden terms and conditions with our liability cover.

What is Not Covered by Shipping Insurance?

Insufficient Packaging

If your package is damaged due to poor packing on your end, most insurers won’t cover the loss. Carriers typically expect proper packaging to withstand standard shipping rigors.

Inherent Vice

This refers to inherent defects within the item itself that cause spoilage or damage during transport. For example, certain data center equipment, like high-performance batteries, naturally degrade over time and lose capacity. If a battery nearing its end-of-life suffers a more significant performance decline during shipping, inherent vice might come into play. The insurance company could argue that the decline was due to the battery’s natural state, not mishandling.

Wear and Tear

Shipping insurance safeguards against accidental damage, not gradual deterioration. If your item arrives with minor scratches or scuffs typical of handling, it likely won’t be covered.

Acts of God

Events beyond human control, like natural disasters (floods, earthquakes, droughts), are often excluded.

War and Civil Commotion

Losses due to war, riots, or political unrest typically fall outside the scope of coverage.

Intentional Acts

If the shipper or recipient intentionally damages the package, the insurance won’t apply.

Specific Items

Certain high-risk or valuable items like dual-use items, AI goods, and more might require specialized insurance or be excluded altogether. Your tech goods will enjoy smooth travels with TecEx’s Liability Cover.

TecEx’s Cover covers everything.

From goods in a warehouse to domestic travel – your shipments are protected.

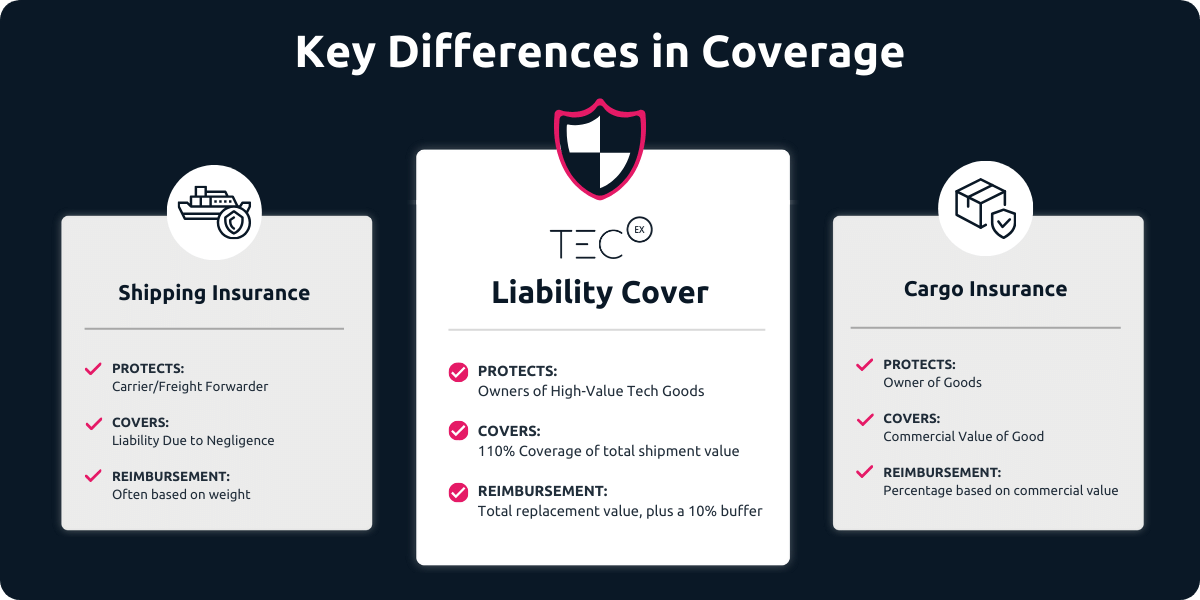

What is the Difference Between Shipping Insurance and Cargo Insurance?

In international trade, shipping insurance and cargo insurance are two separate concepts, and understanding the difference is crucial for protecting your goods during transport.

Don’t be Blind-Sided: Risks of Cross-Border Trading Without Shipping Insurance

There are several risks you take on when engaging in cross-border trade without shipping insurance:

- Financial Loss Due to Damaged or Lost Goods: This is a major concern. If your shipment is damaged or lost in transit, you’ll be responsible for the cost of the goods, potentially including any lost profits. Liability for damage can vary depending on the incoterms (international commerce terms) used in your sales contract, but standard carrier liability often falls short of the actual value of the goods.

- Theft: Cargo theft is a major risk in international shipping, especially for high-value goods. Without insurance, you’ll be on the hook for the entire value of the stolen goods.

- Border Delays and Customs Issues: Shipments can be held up at borders due to incomplete paperwork, customs inspections, or other unforeseen issues. This can lead to additional storage fees and missed sales opportunities. Using an expert IOR provides the full end-to-end solution – no customs clearance issues and risk-free shipping.

- Higher Costs in Case of Problems: Without insurance, dealing with issues like damage or loss can be a complex and expensive process. You may need to hire legal counsel to navigate foreign regulations and recover your losses.

- Loss of Customer Trust: If a shipment is lost or damaged and you can’t fulfill your obligations to a customer, it can damage your reputation and lead to lost business.

In essence, skipping shipping insurance means you’re self-insuring and taking on the full financial risk of any problems that might arise during your cross-border trade.

Opt for TecEx Liability Cover

Rest assured with our comprehensive cover for shipments with values of and exceeding $30 Million. Whether it’s high-value tech equipment, encrypted technology, or aerospace gear we’re your trusted coverage partner for mitigating risks in the worldwide tech movement. Our comprehensive solution spans from pickup to final delivery, serving both local and international routes across 200+ destinations.

Enjoy peace of mind knowing we cover the full replacement value, including freight, tariffs, and import fees, with an extra 10% buffer!

Fun-Ship Fact

Insurance history is rooted in shipping

Maritime insurance boasts a remarkably rich history! Widely considered one of the oldest forms of insurance, its roots trace back to around 1200 BC. However, these early policies scarcely resemble the comprehensive coverage we know today.

Dive more into the evolution of maritime law?

FAQs: Shipping Insurance

Why do I need shipping insurance?

Although there are measures and standard conventions implemented to safeguard consignments, errors, and unforeseen events can still occur. These incidents may include loss and damage to goods or even disruptions to the supply chain caused by global events.

How much is shipping insurance?

Unfortunately, there’s no one-size-fits-all answer to how much shipping insurance costs. The price depends on several factors, such as declared value, shipping timelines, and the type of coverage specifically suited for your shipment. Contact TecEx for more accurate estimates and comprehensive quotes that bring you peace of mind.