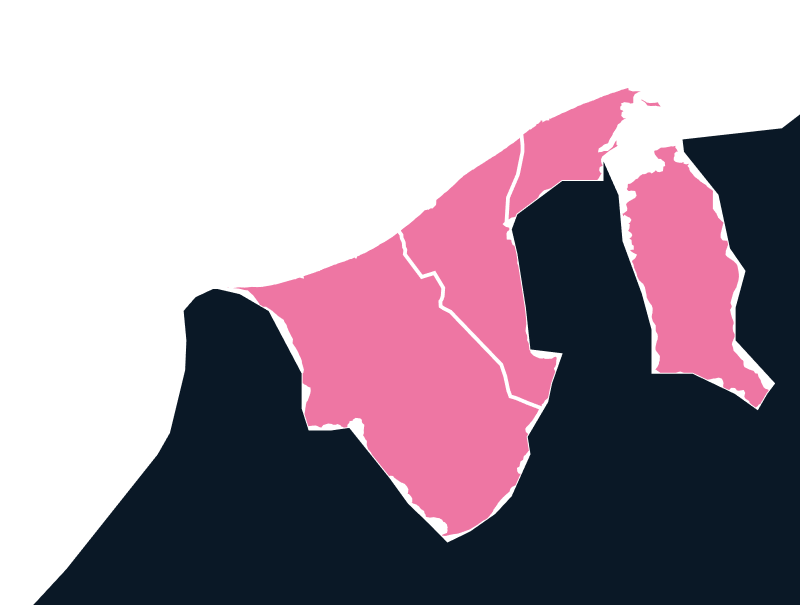

Asia

Export and Import to Brunei

Brunei Darussalam is rapidly carving out its niche in the global marketplace. While the country is famously rich in oil and gas, it’s also making impressive strides in developing its ICT and digital infrastructure, creating exciting opportunities for businesses looking to import to Brunei.

Tax

0

Duty

Up to 10%

Lead Times

4-5 Weeks

Restricted Items

N/A

Best Carrier Option

Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

Malay

Understanding the Import Landscape in Brunei

Brunei’s trade environment is shaped by its focus on economic diversification and digital modernization. As the government invests heavily in telecommunications and financial technology, importing dual-use tech gear and ICT-related products is on the rise. However, this also introduces certain compliance challenges unique to this sector.

The Royal Customs and Excise Department oversees all imports into Brunei. To legally bring goods into the country, importers must register with the port of entry and adhere to the country’s Excise Duty Orders. These laws set out how Brunei’s import taxes and duties apply, with Brunei generally offering very low tariffs to encourage trade.

To successfully import goods, you must submit completed customs declaration forms through the Brunei Darussalam National Single Window, accompanied by detailed documentation such as insurance slips, packing lists, and sometimes certificates of origin or specific import licenses.

Population

0.47 M

Biggest Industry by Export

Mineral Fuels

Capital City

Bandar Seri Begawan

Biggest Industry by Import

Crude Petroleum

Unique Pain Points When Importing to Brunei

Complex Dual-Use Goods Regulations:

Technology products that can have both civilian and military applications are heavily regulated, requiring special permits and compliance.

HS Codes Brunei Specifics:

Properly classifying your goods under the Harmonized System (HS) Codes is critical. Misclassification can lead to delays, penalties, or incorrect duty assessment.

Import Permit Requirements:

Certain categories of goods need explicit import permits or licenses from government agencies, which can vary depending on the product type.

Documentation and Compliance:

Brunei’s customs authorities are meticulous about supporting documents. Missing or inaccurate paperwork can stall shipments at customs.

Duty and Taxation Variability:

While tariffs are generally low, navigating the Brunei import tax landscape can be tricky without up-to-date knowledge of the Customs Import and Excise Duty Amendment Order and related regulations.

Top Trade Partners of Brunei

Asia

China

Australia

Australia

Why Choose Brunei for Your Import and Export Needs?

Brunei presents a highly attractive trading environment, supported by a combination of strategic, economic, and policy advantages. Its central location in Southeast Asia offers direct access to key ASEAN markets and broader international trade routes. As a member of ASEAN, APEC, and the WTO, and an active participant in RCEP negotiations, Brunei benefits from preferential tariff treatment and streamlined trade flows. The country’s low-tariff regime is specifically designed to encourage trade and attract foreign investment, with minimal duties applied to most imported goods.

Coupled with a stable political and economic climate and strong pro-business policies, Brunei stands out as a reliable and secure trading partner. Additionally, the absence of personal income tax, sales tax, and export taxes further boosts its appeal as a regional trade and logistics hub.

How TecEx Can Simplify Your Import to Brunei

As a specialist Importer of Record (IOR), we shoulder the burden of compliance, risk, and customs responsibility on your behalf. With our deep expertise in Brunei’s customs regulations and our close ties with local authorities, we ensure your shipments clear customs quickly and without unnecessary hassle.

Our tailored solutions include:

Accurate Classification & HS Codes Brunei Consultation:

We help you classify your products correctly to avoid delays and ensure proper duty payments.

Permit & License Management:

TecEx handles all necessary permits and licenses, so you can focus on your business.

Comprehensive Documentation Handling:

We prepare and submit all customs declarations and documentation through Brunei’s National Single Window.

Risk Management:

By acting as your official Importer of Record, TecEx assumes all compliance and regulatory risks.

Tech Sector Expertise:

Given Brunei’s push in ICT and digital infrastructure, our TecEx specialists understand the unique challenges of shipping technology and dual-use goods into the country.

Ready to Import to Brunei?

Whether you’re navigating Brunei import tax rules, or ensuring your tech gear clears customs without delay, our team of specialists will craft a tailor-made solution for your unique needs.