Europe

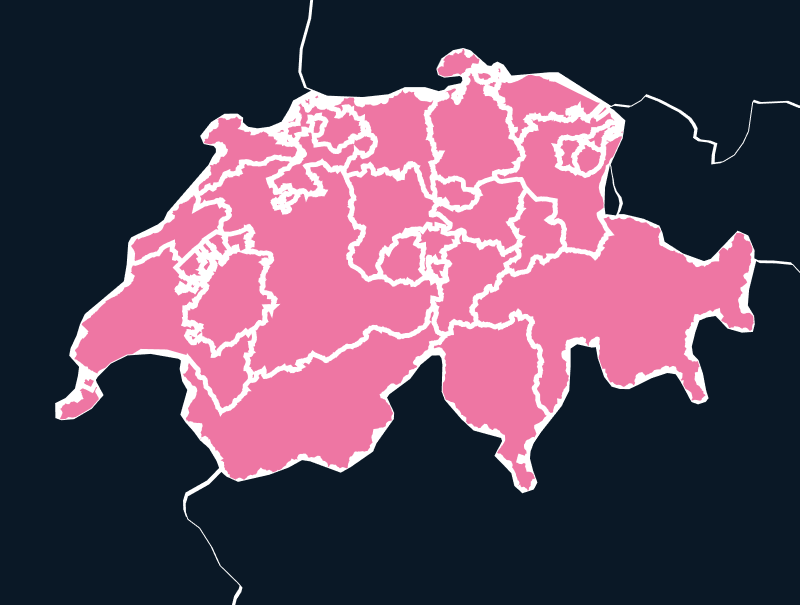

Import to Switzerland

Switzerland is a highly innovative country, with its financial industry being a driver for the country’s rapid digitalization. Switzerland’s strong automation sector also allows for high-quality goods, making it an attractive country with which to trade tech products.

Tax

up to 8%

Duties

up to 11%

Lead Times

1-2 weeks

Restricted Items

N/A

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

German, French, Italian

Exporting and Importing from Switzerland

Switzerland is located in central Europe, making it easily accessible for trading with the rest of Europe. Its most significant trading partners include Germany, the United States, and China. The country primarily imports machinery and equipment and exports Pharmaceuticals. Although Switzerland is not part of the European Union, it has achieved strong integration within Europe, with various agreements in place allowing for the easy flow of trade.

Switzerland is also a tech and innovation hub, making it a test market for IT products. It is Europe’s leader in terms of the number of billion-dollar tech startups per capita, which is supported by its affluent population and gross domestic product of 884.94 billion USD.

This has resulted in Switzerland producing high-quality products and expanding its investment in global trade. However, the high standards and quality level required in Switzerland can make navigating Swiss customs and regulations particularly challenging.

Population

8.9 million

Biggest Industry by Export

Pharmaceuticals

Capital City

Bern

Biggest Industry by Import

Machinery

Specialized Solution for Switzerland

Switzerland’s customs are stringent, with in-depth controls that can often lead to delays. The Delivered Duty Paid services offered by TecEx will simplify the importation process, eliminating all delays and ensuring that goods clear through customs smoothly.

Switzerland also has specific high-quality controls that emphasize the importance of providing all the correct documents the first time around. With all the responsibility taken off your shoulders, it will be put onto TecEx, allowing for a hassle-free experience. We will source all documentation to ensure a smooth customs clearance and avoid all potential delays.

Unique Pain Points Impacting Swiss Trade

Duties and tariffs can be hard to navigate, with customs classifying products according to the Harmonized System Code. At TecEx, we have extensive experience in navigating HS codes. However, it should be noted that Switzerland generally has low tariff rates that are product-dependent, with specific duties determined per 100 kilograms of gross weight.

The country’s strict environmental and safety regulations also add an extra hurdle when importing into Switzerland, which is required by Swiss customs due to the high quality of goods they want to maintain.

Although Switzerland is also not part of the European Union, it is part of many bilateral agreements with the EU, yet navigating trade is still somewhat challenging. This is particularly true for medical devices, as Switzerland is no longer part of the Swiss Mutual Agreement (MRA)—a situation known as “Swixit.” This has added a further challenge for importers.

Their use of the Swiss Franc instead of the Euro further makes it more prone to currency fluctuations, which TecEx is able to help and navigate.

Countries Associated with Switzerland

North America

United States of America (USA)

Asia

China

Specific Compliance Regulations for Switzerland

Complying with Swixit

Switzerland’s non-participation in the EU and the end of the MRA agreement have increased administrative requirements regarding medical equipment. You will also have to deal with additional labelling and documentation, requiring an Importer of Record to ensure the correct measures are in place.

Harmonised System Code

Swiss customs require a Harmonised System’s code to classify goods. This allows for the identification of products using a standardized system.

Commercial Invoice

A commercial invoice is needed, which describes information such as the product description, value, country of origin, and quantity.

Airway Bill

This is required for all goods transported by air and contains information such as the destination address, reference number, and description of the goods.

Certificate of origin

All Swiss customs require this, which describes where the goods come from and where they were manufactured.

Packing List

This lists all the items to be imported and contains details such as the weight and quantity of each item.

Your global trade solution for Switzerland

Fill in the form to get in touch with us, and our experts will contact you with customs compliance solution for Switzerland to suit your needs.

.jpg)