Asia

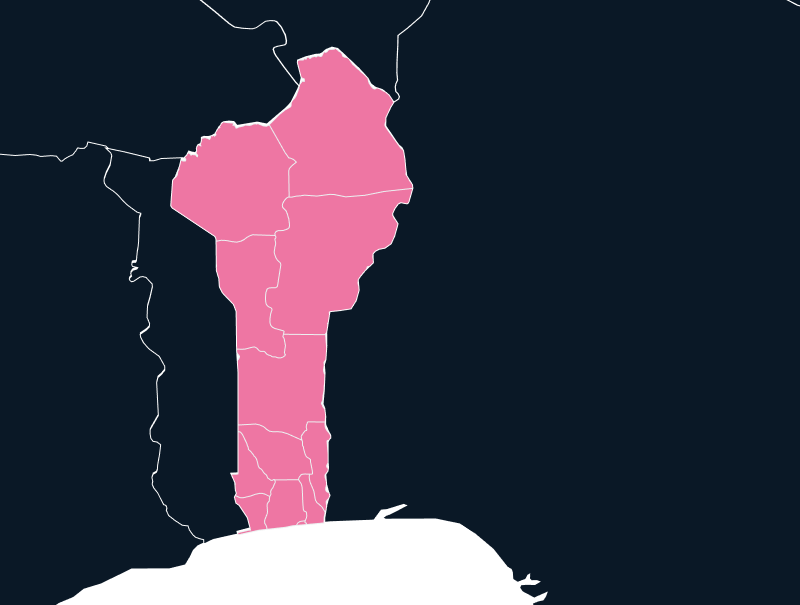

Benin | Imports and Exports

Benin, a vibrant West African nation known for its rich culture, history, and dynamic music scene, is also quietly emerging as a rising player in Africa’s tech ecosystem. If you’re eyeing Benin as a market or entry point into West Africa, understanding the ins and outs of Benin import regulations and the challenges of navigating local customs procedures is crucial.

Tax

Up to 13%

Duty

Up to 10%

Lead Times

5-6 Weeks

Restricted Items

N/A

Best Carrier Option

Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

French

Benin’s Import and Export Landscape

Benin is strategically located between Nigeria and Togo, offering a gateway into the region’s vast consumer base. Although the domestic market is relatively small, Benin’s Port of Cotonou acts as a major hub for re-exporting goods to landlocked neighboring countries and Nigeria, collectively serving an estimated 255 million consumers. This makes Benin imports not just a way to serve local demand but also a stepping stone for wider regional trade.

The tech sector in Benin is especially promising. This surge is fueled by increasing internet access, smartphone adoption, and government initiatives supporting digital transformation. With ecommerce growing rapidly, the demand for data storage and processing has sparked early development in Benin’s data center market. Factors such as a stable political climate, reliable electricity supply, and relatively low business costs position Benin as an emerging regional data center hub.

Population

14.8 M

Biggest Industry by Export

Cotton

Capital City

Porto-Novo

Biggest Industry by Import

Rice

Understanding Benin Import Regulations

Importing into Benin requires careful attention to local regulations designed to ensure consumer safety and regulatory compliance. The Ministry of Commerce and Industry mandates import licenses for specific tech categories, and certain goods, especially pharmaceutical tech, wireless, or encrypted products, need special permits from relevant authorities.

Importers must be aware of various trade restrictions and non-tariff barriers that can cause delays or seizure of goods. Bureaucratic procedures and occasional corruption in customs remain concerns, but efforts to improve transparency and prosecute offenders are underway.

A key regulatory detail is the strict labeling requirement: all imported goods must carry a clear attestation of origin and be marked as “imported.” False labeling or misrepresentation of origin can lead to confiscation and legal penalties.

Benin import regulations also encompass several compliance steps:

- Customs registrations and declarations

- Tariff classifications according to Harmonized System (HS) codes

- Product certifications, labeling, and marking in French

- Valuation details and duty payments

- Post-import document retention

Top Countries that Trade with Benin

Asia

India

Asia

China

Efficient Import Practices and Trade Environment in Benin

Recent improvements, such as the introduction of a one-stop shop for cargo clearance at the Port of Cotonou, have sped up the import process, making it easier to offload goods destined for Benin and its neighbors. However, it remains essential to be meticulous with documentation.

Value Added Tax (VAT) in Benin is 18%, applying to most activities. VAT is refundable at fiscal year-end to compliant importers, which can be advantageous if properly managed.

Why Partner with TecEx for IOR Services in Benin?

Navigating Benin imports and Benin import regulations can be daunting without local expertise. That’s where TecEx comes in. Our seasoned team understands the nuances of Benin’s import environment and offers comprehensive Importer of Record (IOR) services to help your business succeed.

What TecEx Brings to the Table:

Expert Classification & Compliance:

We ensure your products meet all local requirements, from customs documentation to product certifications.

Smooth Customs Clearance:

Our customs specialists minimize delays and optimize duty payments, helping you avoid costly holdups.

Local Representation:

Acting as your on-the-ground partner, we provide language support, cultural insights, and direct communication with Benin authorities.

Risk Management:

We help you navigate trade restrictions and reduce risks related to non-compliance or bureaucratic challenges.

Leveraging Regional Agreements:

We assist in maximizing benefits under ECOWAS, WAEMU, and other trade agreements to facilitate cost-effective imports.

With TecEx, you gain peace of mind, knowing your Benin imports are in expert hands from start to finish.

Ready to simplify your Benin imports?

Contact TecEx today to learn how our IOR services in Benin can streamline your import process and position your business for success in this promising market.