Europe

Latvia | Imports and Exports

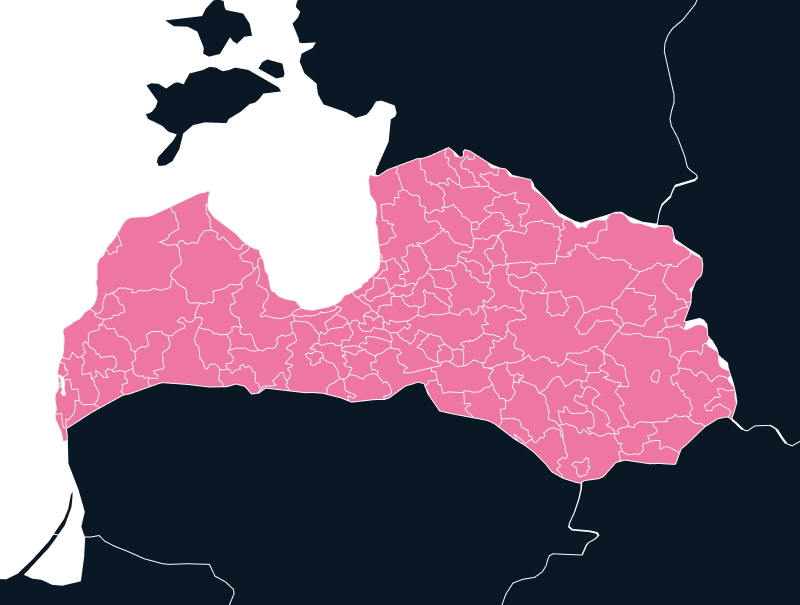

Latvia plays a significant role in global trade, especially as a member of the European Union. Its strategic location, bordered by Russia and the Baltic Sea, makes it an essential gateway for trade between Europe and Asia. If you’re considering importing or exporting to Latvia, understanding the local trade landscape is critical to ensure smooth operations, avoid costly delays, and meet all necessary regulations.

Tax

Up To 21%

Duties

Up to 7%

Lead Times

7-8 Weeks

Restricted Items

N/A

Best carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Latvian

Navigating the Latvian Import and Export Landscape

Entering the Latvian market presents both opportunities and challenges for businesses, especially those unfamiliar with the nuances of EU trade. As an EU member, Latvia follows the union’s trade standards, benefiting from tariff-free movement across the Single Market. However, companies must also navigate Latvia’s unique local regulations, making it essential to understand both EU-wide and country-specific requirements.

Population

1.86 M

Biggest Industry by Export

Forestry and Wood Products

Capital City

Riga

Biggest Industry by Import

Refined Petroleum

One of the most commonly overlooked hurdles is the language barrier. While many Latvians speak English, all official documentation, product labels, safety instructions, and user manuals must be in Latvian. Failure to comply can lead to costly delays or penalties at customs. Additionally, businesses must meet EU technical and safety standards, particularly in sectors like technology, where specific certifications, such as electromagnetic compatibility or health and safety approvals, are required.

Bureaucracy is another key factor. Latvia’s customs and regulatory procedures can be complex, and companies unfamiliar with local processes may face unexpected delays or added expenses. Preparation and local expertise are crucial for avoiding these pitfalls.

While Latvia’s domestic market is relatively small, its strategic location makes it a valuable gateway for trade between the EU, Russia, and Asia. For companies willing to navigate the initial complexities, Latvia offers a strong logistical advantage and access to broader regional opportunities.

Challenges for Latvian Imports and Exports

EORI Number in Latvia

One of the key requirements when importing into Latvia is obtaining an Economic Operator Registration and Identification (EORI) number. This number is mandatory for tracking shipments across the EU and ensures that customs officials can efficiently monitor goods as they enter and leave the country. If you’re a non-EU company, securing this registration can sometimes be a bit of a bureaucratic process, but it’s essential to ensure that your shipments pass through customs without unnecessary delays.

VAT on Imports to Latvia

In addition to the EORI, companies importing goods into Latvia must also be aware of VAT (Value Added Tax) regulations. Latvia applies a VAT on imports, and businesses need to account for this in their pricing and overall cost structure. The standard VAT rate in Latvia is 21%, though certain goods, such as foodstuffs or medical products, may qualify for reduced rates. Businesses that import goods regularly can register for VAT in Latvia to reclaim any VAT they pay on imports, but this process requires careful management of records and filings to avoid any compliance issues.

Dual-Use Technologies Entering Latvia

In cases where businesses are importing specialized goods, such as dual-use technologies, the regulations become even more stringent. Dual-use goods require special permits and licenses from authorities to ensure that they aren’t being used for unauthorized purposes. This means that businesses must ensure they comply with export control regulations, both in Latvia and throughout the EU. If your product falls under the dual-use category, you’ll need to go through a detailed approval process, ensuring that the product is only being used for its intended purpose.

Latvian Language Barriers

For non-Latvian speakers, all product documentation—including user manuals, labels, and safety instructions—must be translated into Latvian. The failure to do so can result in delays, fines, or even the rejection of shipments. While many Latvians are fluent in English, complying with local language regulations is non-negotiable for ensuring smooth entry of goods.

Top Countries Trading with Latvia

Europe

Germany

Europe

Estonia

Trade Opportunities in Latvia

Despite these challenges, Latvia offers numerous trade opportunities, especially for industries involved in logistics, technology, and infrastructure. One of the most significant opportunities for international trade comes from Latvia’s participation in the Rail Baltica project, which aims to create a high-speed rail link between the Baltic States and the rest of Europe. This project will boost infrastructure and logistics opportunities, particularly in the transport of goods by rail.

Furthermore, Latvia’s port facilities and location on the Baltic Sea provide excellent access to international shipping routes. The country’s ports, including the Port of Riga, handle a significant volume of freight each year, making it a key transit point for goods moving between the EU and Russia or Asia. This makes Latvia an attractive destination for businesses involved in shipping, freight forwarding, and logistics services.

Let Us Help You with Latvian Imports and Exports

With all of these regulatory challenges and opportunities in mind, partnering with a trusted tech logistics and compliance expert is essential. That’s where TecEx comes in. We provide tailored solutions for businesses looking to import into Latvia, offering Delivered Duty Paid (DDP) services that cover everything from pre-compliance checks and customs clearance to final delivery.

As your Importer of Record (IOR), TecEx ensures that all local labeling requirements are met to align with both EU and Latvian import standards, that you comply with VAT regulations, and we facilitate VAT recovery opportunities available to you. Our team is deeply familiar with the intricacies of Latvian trade compliance, and we work closely with you to ensure a seamless, compliant import process every time.

Expand into Latvia

Whether you’re bringing in tech equipment, machinery, or specialized goods, we understand the importance of accuracy and efficiency in the import process. With TecEx as your partner, you can be confident that your shipments will clear Latvian customs quickly and without issue, giving you peace of mind as you expand your business into the Latvian market.