Asia

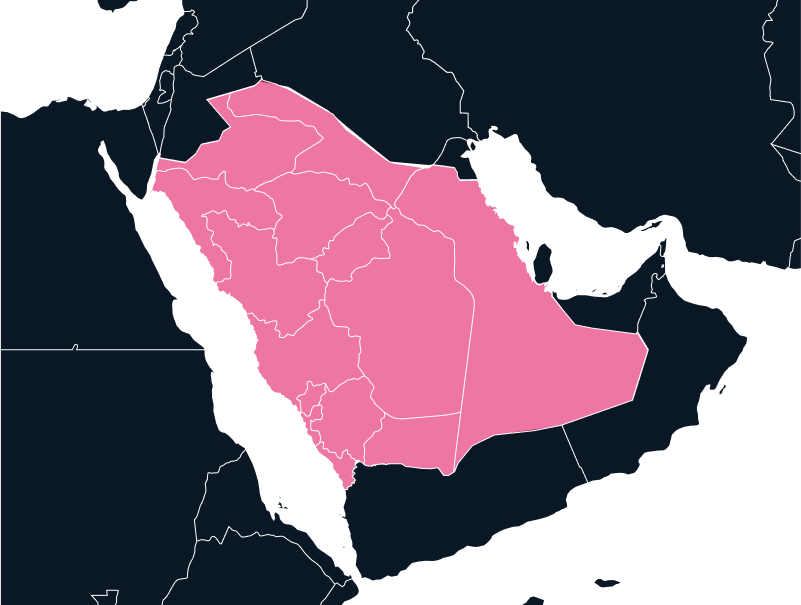

Importing to Saudi Arabia

Are you considering importing IT and tech products to Saudi Arabia? You must go through the SABER approval process and work with an IOR to clear customs compliantly. TecEx can help you with all the various compliance requirements and ensure seamless imports into the Kingdom.

Tax

up to 15%

Duties

up to 5%

Lead Times

6-7 weeks

Restricted Items

Second-Hand Goods, COO Prohibitions

Best Carrier Option

Freight Forwarder

Non-Working Days

Friday, Saturday, and Public Holidays

Prominent Languages

Arabic and English

IOR Services in Saudi Arabia

As Saudi Arabia continues to modernize its infrastructure and diversify its economy under its Vision 2030 plan, the demand for advanced technology is growing, but businesses must comply with various rules and standards.

The compliance requirements are highly complex, depending on the HS code of the product imported into Saudi Arabia. Furthermore, all importers entering the KSA must be registered with a Saudi-owned entity.

Zakat, Saudi Arabia’s tax and customs authority, requires the IOR to present a commercial invoice, bill of lading, and certification of origin when importing goods into Saudi Arabia.

Import success lies in thorough preparation, strategic partnerships, and a deep understanding of Saudi Arabia’s evolving policy landscape. TecEx is your trusted IOR service partner, with a strong presence in the Middle Eastern tech import/export scene. Having overseen numerous shipments into Saudi Arabia, trust us to secure prompt delivery of your goods. We handle all compliance aspects for you, ensuring a safe and hassle-free experience.

Population

36,95 M

Biggest Industry by Export

Petroleum Products

Capital City

Riyadh

Biggest Industry by Import

Machinery and Mechanical Appliances

Exporting from Saudi Arabia

Exporting technology from Saudi Arabia comes with its own set of challenges. As with most countries, exporting dual-use technologies is subject to stringent controls. Furthermore, Saudi Arabia’s participation in trade groups can affect trade regulations.

Saudi Arabia forms part of two significant trade groups, the Greater Arab Free Trade Area (GAFTA) and the Gulf Cooperation Council (GCC), which includes Kuwait, Qatar, Bahrain, the UAE, and Oman. Being a member grants certain trade and investment perks within these nations. Nonetheless, even with these privileges, you’ll require a locally registered entity to to navigate customs clearance for your goods.

Saudi Arabia and the Certificate of Conformity

A Certificate of Conformity (CoC) is proof that your product meets the strict technical and safety standards set by the Saudi Standards Metrology and Quality Organization (SASO). Complying with the CoC is crucial for getting your goods through Saudi Arabian customs.

The Product Certificate of Conformity

The Product Certificate of Conformity (PCoC) ensures that all tech goods imported into Saudi Arabia conform to SASO standards. Obtaining this certificate is lengthy and requires approval from the Conformity Assessment Body. The PCoC can only be obtained by a registered local entity in Saudi Arabia, which TecEx can do as an Importer of Record.

The three main Certificates of Conformity

Product Certificate of Conformity

Shipment Certificate of Conformity

Self Declaration of Conformity

The Shipment Certificate of Conformity

Once the PCoC has been approved, the next step is securing the Shipment Certificate of Conformity (SCoC). This document confirms that the shipment aligns with the approved product certification. Without these two documents, your tech gear cannot enter Saudi Arabian customs.

Gathering both the PCoC and the SCoC is a complex and lengthy process that, if not handled correctly, can delay your overall timeline.

With TecEx’s compliance team, you can rest assured that your shipments will have all the necessary CoCs to sail smoothly through the process.

Pain Points for Importing to Saudi Arabia

Importing IT and technology gear into Saudi Arabia is not simple. All imports must be registered with a Saudi-owned company, which is why acting as your own IOR can be very difficult. Furthermore, compounding compliance requirements, such as the SABER approval system and managing the Certificate of Conformity (CoC) process, can quickly become overwhelming.

Importing to Saudi Arabia and the SABER Process

Furthermore, all imported goods must go through the SABER approval process. The SABER process ensures that all imported products are not defective and protects Saudi businesses from fraud.

SABER covers a wide array of products, including electronic devices, industrial machinery, and construction materials. A conformity assessment process ensures that manufacturers, exporters, and importers demonstrate that their products meet the specific standards required by SABER.

Countries That Trade with Saudi Arabia

Asia

United Arab Emirates (UAE)

Asia

India

Specialized Solution for Importing to Saudi Arabia

Saudi Arabian customs procedures are detailed and require meticulous documentation. We often see delays or stuck shipments when there are mistakes or missing information on commercial invoices or non-compliance to import bans, particularly on certain encrypted goods.

Saudi Arabia has a broad list of restricted items, including second-hand goods and products from certain Countries of Origin, which will require additional compliance documentation. Any mistake or non-adherence can result in dealing with the burden of stuck shipments, delayed timelines, or potential fines/penalties.

When it comes to labeling and packaging requirements, due to the extreme weather conditions, all goods must be packaged to withstand rough handling, extreme heat, and high humidity. This is particularly important when shipping high-value technology gear. As an important global hub, this is extremely important as many shipments are transshipped en route to Saudi Arabia.

Importing to Saudi Arabia should not be a barrier to your business growing in this market. TecEx’s custom Delivered Duty Paid shipping to Saudi Arabia solution gets your gear where it needs to go. Following DDP incoterms, we take care of everything from checking the pre-compliance boxes and obtaining SABER approval to clearing customs and making sure your gear reaches its destination within the KSA.

Important Trade Dates for Importing to Saudi Arabia

During Ramadan and Eid al-Fitr, working hours are often reduced, which can affect logistics. For 2025, the Islamic holy month of Ramadan is expected to begin on 1 March 2025, and Eid al-Fitr is anticipated to commence on 31 March 2025 in Saudi Arabia.

Your global trade solution for Saudi Arabia

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.

.jpg)