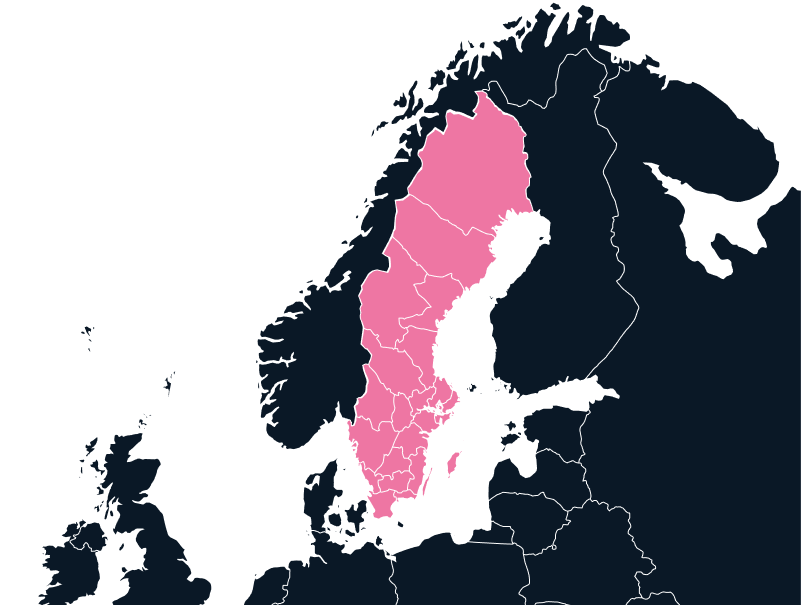

Europe

Export and Import to Sweden

Sweden is a technology hub and sustainability leader with a tech-savvy population, making it a desirable destination for tech importers and innovators. However, many compliance regulations must be navigated for seamless tech imports to Sweden.

Tax

Up to 25%

Duties

Up to 7%

Lead Times

2-3 Weeks

Restricted Items

N/A

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Swedish; English

Exporting and Importing to Sweden

According to OEC, Sweden’s top exports include refined petroleum, cars, packaged medicaments, electricity, and sawn wood, mainly to Germany, Norway, the USA, Denmark, and Finland. Sweden’s top imports include crude petroleum, cars, refined petroleum, broadcasting equipment, and motor vehicle parts and accessories, mainly from Germany, Netherlands, Norway, China, and Denmark.

As a member of the European Union, trade between Sweden and EU members is less complex. As a member of the European Union and the European Economic Area (EEA), transactions between Sweden and other EEA members are duty-free. The EEA extends the EU’s Free Trade Area to Iceland, Liechtenstein, and Norway.

While Sweden has no Free Trade Agreements (FTAs), it benefits from various trade agreements as a member of the European Union and the European Economic Area (EEA). However, to benefit from this, you’ll need documentation like Proof of Origin, which an Importer of Record (IOR) can help you with.

Population

10,54 M

Biggest Industry by Export

Machinery and Transport Equipment

Capital City

Stockholm

Biggest Industry by Import

Electrical, Electronic Equipment

TecEx DDP Shipping to Sweden

Importing tech goods to Sweden can be challenging as importers must traverse EU trade regulations. With TecEx Delivery Duty Paid (DDP) shipping to Sweden, you can comply with all import and export regulations to join this flourishing, tech-savvy market.

With our DDP shipping to Sweden, TecEx will take on all of the intricate import responsibilities to streamline your shipments. Our experts will source the required licenses and certificates, optimize shipping routes, and organize your goods’ storage, installation, or last-mile delivery once they have cleared customs. Our thorough compliance preparations and in-country customs broker will ensure your goods clear customs seamlessly.

We also know that some issues are unpreventable. Our optional door-to-door liability cover protects your goods against potential damage or loss.

As a member of the EU, Sweden benefits from many Free Trade Agreements (FTAs). Our knowledge and experience with these allow us to ensure you benefit from them when possible.

Furthermore, temporary imports to Sweden have certain requirements, and you may need an ATA Carnet. This allows you to temporarily import goods duty-free into Sweden and around 78 other countries for purposes like exhibitions and trade shows. TecEx can facilitate seamless temporary imports and re-exports of goods to avoid penalties.

In addition, we offer a warehousing solution that will enable you to deconsolidate your shipment before reaching Sweden. With our strong relationship with the Netherlands and network of warehousing hubs, you can import via the Netherlands. Conversely, if your exports need to stop at a warehouse, TecEx can export your goods via the Netherlands as your EOR. We can also help you correctly label, package, and palletize your goods.

Lastly, export licenses and compliance requirements for compliant exports can take months to obtain. With our Exporter of Record (EOR) capabilities, TecEx can get the required documents on your behalf and facilitate a streamlined export process.

AI Hardware, Handled Like Gold

Importing cutting-edge AI equipment? We specialize in transporting mission-critical, high-value technology with full-service precision and care. From fragile components to sensitive systems, our white-glove control tower solution ensures your shipments arrive safely, compliantly, and on time—no matter the destination.

Compliance Challenges Facing Swedish Imports and Exports

Importing to Sweden requires shippers to comply with complex EU trade regulations, which can be challenging to navigate as a non-EU member. Importers must be well-researched and well-prepared to clear Swedish customs successfully.

Exporting and importing to Sweden requires many documents, from a SAD to import and export licenses to Dual-Use Declarations and Mill Test Certificates. The high taxes and costly requirements can be overwhelming.

Partnering with a compliance specialist like TecEx will ensure your shipment fulfills all requirements for smooth imports to and exports from Sweden.

Countries Associated with Sweden

Europe

Norway

Europe

The Netherlands

Specific Compliance Regulations

License from CDIU

If a shipment consists of software that will be distributed electronically, an import license must be obtained from the CDIU. The license-holding entity must also file this in its bi-annual reporting.

Dual-Use Declaration

Sweden follows European Dual-Use Export Controls. Certain items require export licenses from the Swedish Inspectorate of Strategic Products (ISP) to exit the EU, and some goods may even need a license to travel within the EU. This prevents dual-use goods like nuclear equipment, electronics, computers, telecommunications devices, sensors, and aviation and aerospace items from falling into the wrong hands.

EORI Sweden

Non-EU companies need an Economic Operator Registration and Identification (EORI) number to export and import to the EU. Obtaining this number can be time-consuming, but TecEx can help you acquire it.

With an EORI number, a company can acquire Authorised Economic Operator (AEO) status, simplifying customs processes. An application and submission can take up to a year, with an additional 120 days for site visits and customs assessments afterward.

Sweden’s Digital Economy

In 2021, around 5.6% of Sweden’s GDP came from the ICT sector. Global Data states that Sweden’s ICT market was worth around $27.18 billion in 2023. According to the International Trade Administration (ITA), Sweden holds around 40% of the Nordic region’s entire ICT market share.

As one of the most digitized countries in the world, nearly 99% of Swedish households have internet access. With this digitization came cyber attacks, which increased by 144% from 2019 to 2023. With this vulnerability, there is an opportunity to import cybersecurity solutions to Sweden.

Sweden is also a global leader in sustainability. By 2045, it intends to achieve net-zero emissions, opening up many opportunities to import clean, energy-efficient technologies and green data centers.

EU Regulations Affecting Imports to Sweden

Single Administrative Document (SAD)

The SAD is a vital basis for customs clearance in Sweden and the rest of the EU, as well as Iceland, Switzerland, Serbia, and the Republic of North Macedonia. The document minimizes administrative hassle and improves the standardization of trade data. It applies to any goods undergoing any customs procedure – export, import, warehousing, or temporary import.

EU Batteries Directive

The directive stipulates specific labeling and packaging requirements when importing batteries and requirements for facilitating their repair and reuse. You can learn more about shipping batteries here.

Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH)

REACH restricts certain chemicals imported into EU members over one metric ton.

Waste Electrical and Electronic Equipment (WEEE) Directive

Extended Producer Responsibility (EPR) requirements under the WEEE Directive stipulate that certain products must be registered before they can clear customs. This is arranged with a national authority or local partner. The products or packaging must also display the universal recycling icon, as consumers must be informed that their purchase should be recycled.

The Restriction on Hazardous Substances in Electrical and Electronic Equipment (RoHS) Directive

Certain chemicals may not be used in electrical and electronic equipment, which must be marked CE to certify compliance before it may be imported to Sweden.

Mill Test Certificate (MTC)

Also known as a Material Test Report (MTR), a MTC is required when importing iron and steel goods to the EU. This prevents goods made from materials originating from Russia from entering the EU. Ideally, this is sourced from a manufacturer, but TecEx can help you navigate this complex requirement.

Ready to Import to Sweden

Reach out today, and our expert team will contact you with a tailored customs compliance solution to suit your Swedish import and export needs.

.jpg)