Europe

Export and Import to the Faroe Islands

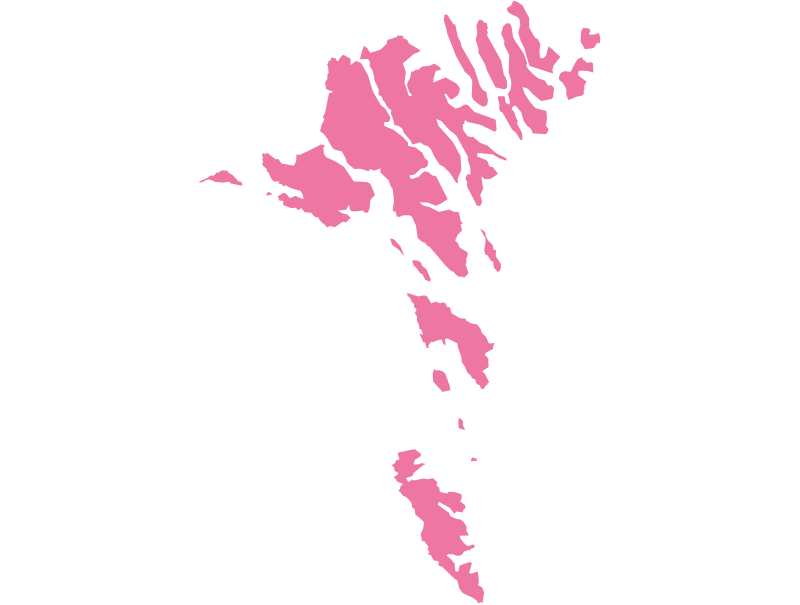

Nestled between Norway and Iceland in the North Atlantic, the Faroe Islands are more than a breathtaking archipelago. They’re a growing player in the European trade landscape. While the islands are known primarily for their fishing industry, their appetite for technology imports is steadily rising. If you’re looking to import to the Faroe Islands, you’ll need to understand the unique landscape of the Faroe Islands customs, trade regulations, and the region’s complex VAT structures.

Tax

Up to 25%

Duty

0

Lead Times

14-15 Weeks

Trade Restriction

N/A

Best Carrier Option

Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Faroese; Danish

The Trade Landscape | What You Should Know About the Faroe Islands

Despite their small size and isolated geography, the Faroe Islands maintain a highly open economy. They strongly rely on machinery and technology imports to support their core sectors, fishing, aquaculture, infrastructure, and a growing IT industry.

Importers must comply with Faroe Islands customs regulations, often requiring certificates of origin, compliance documentation, and product safety certifications.

Although not part of the European Union, the Faroe Islands benefit from EU-aligned trade regulations due to agreements negotiated through Denmark. The region also implements the Faroe Islands VAT, a local value-added tax that applies to most goods and services.

Population

0.056 M

Biggest Industry by Export

Salmon

Capital City

Tórshavn

Biggest Industry by Import

Fuel

Key Challenges When Importing Tech Hardware to the Faroe Islands

Strict Controls on Dual-Use IT Equipment

Many types of technology hardware, especially networking or telecommunications equipment, are considered dual-use goods. This means they have both civilian and potential military applications, triggering stringent controls and extensive compliance documentation.

Customs Clearance Complexity

Although customs in the Faroe Islands may seem similar to those in the EU, they operate independently. Without a local presence or deep understanding of the Faroe Islands customs, importers often face delayed shipments or rejected entries.

Geographic Isolation

As an island nation, the Faroe Islands experience limited logistics options and higher transport costs, especially for specialized goods that need careful handling or storage.

VAT and Taxation Confusion

Navigating the Faroe Islands VAT can be a minefield. It differs from Danish or EU VAT systems, and importers unfamiliar with local tax laws may face surprise fees or non-compliance penalties.

Top Countries Associated with the Faroe Islands

Europe

The United Kingdom (UK)

Europe

Russia

How TecEx Can Help You Import to the Faroe Islands

At TecEx, we simplify the most complex import scenarios, and the Faroe Islands are no exception. Our global IOR (Importer of Record) service, combined with our Delivered Duty Paid (DDP) shipping solution, ensures full compliance and hassle-free delivery of your IT equipment.

Delivered Duty Paid (DDP) Shipping

We take full responsibility for your shipment, handling everything from customs documentation, duty, and VAT payments to final-mile delivery in the Faroe Islands. Under DDP incoterms, the risk and paperwork are on us, not you.

Importer of Record (IOR) Services

As your IOR, we take legal responsibility for importing your goods into the Faroe Islands. This is especially critical for dual-use technology that requires a local importer and in-depth regulatory knowledge.

Compliance and Documentation Management

We handle all necessary pre-compliance checks, certifications, and import permits. We work closely with the Faroe Islands customs to ensure your shipment moves without delay or penalty.

Peace of Mind

You send us your goods, and we’ll take care of the rest, from origin to installation site on any of the Faroe Islands.

Opportunities in a Growing Faroese Digital Landscape

Though the Faroe Islands lag behind some European nations in terms of digitalization, recent government initiatives are bridging that gap. A national digitalization program now connects Faroese citizens under one unified portal, laying the groundwork for a more connected society.

Opportunities for IT and technology imports include:

- Infrastructure support for subsea tunnels and logistics networks

- Smart aquaculture technology for fisheries

- Telecommunication upgrades across remote islands

- Renewable energy systems, especially wind energy integration

- Software and digital services as the IT sector gains traction

The Faroese government’s focus on a knowledge-based economy and R&D makes this an ideal time to explore business growth in the region.

About the Faroe Islands | Political Status and Trade Autonomy

Although under the external sovereignty of the Kingdom of Denmark, the Faroe Islands are a self-governing nation with their own government, parliament, and trade regulations.

Key facts:

- Not a member of the EU, but enjoys trade agreements negotiated via Denmark.

- Maintains independent control over trade, customs, and VAT.

- Has the ability to enter trade agreements independently in areas under its jurisdiction.

This unique political setup means that the Faroe Islands don’t directly follow EU customs processes, yet they often mirror EU regulations, creating a complex blend of familiarity and red tape.

Let TecEx Be Your Compliance Partner for the Faroe Islands

If you’re moving high-value tech into the Faroe Islands, you don’t want to leave anything to chance. The compliance burden is heavy, and the penalties for getting it wrong are even heavier. TecEx ensures full regulatory compliance, on-time delivery, and zero headaches for you and your team.

Whether you’re an IT provider, telecom company, or infrastructure firm, we’re ready to help you navigate the full scope of Faroe Islands customs, VAT regulations, and import compliance requirements.

Ready to Export or Import to the Faroe Islands?

Let’s make it simple. Contact TecEx today and discover how we can handle every step of your shipment—from pre-compliance to final delivery in the Faroe Islands.