North America

Export and Import to Turks and Caicos

The Turks and Caicos Islands (TCI) are emerging as an intriguing hub for technology trade and import opportunities. Whether you’re a business looking to tap into the region’s growing tech ambitions or a supplier wanting to serve this unique market, understanding the ins and outs of importing to Turks and Caicos is essential.

Tax

8%

Duty

20%

Lead Times

2-3 Weeks

Restricted Items

Trade War COO Items

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

English

Understanding Import and Export Trade Climate in Turks and Caicos

Situated south of the Bahamas and north of the Dominican Republic and Haiti, the islands serve as a gateway for regional trade, especially within the Caribbean.

One of the first hurdles businesses face when importing to Turks and Caicos is navigating the local customs framework. The Turks and Caicos customs authority governs the importation process, enforcing regulations that include import duties ranging from 5% to as high as 40% on various technology products.

Population

0.047 M

Biggest Industry by Export

Tourism

Capital City

Cockburn Town

Biggest Industry by Import

Petroleum and Related Products

The Turks and Caicos Islands heavily rely on imports, as the small domestic market limits local production. Most technology and goods used in the country are imported, mainly from the United States, supporting sectors like tourism, infrastructure, and emerging tech initiatives.

While tech exports are currently minimal, the government’s focus on fintech, e-governance, and digital marketing points toward a future with growing export potential in technology and digital services.

Despite being a small island nation with a population of just around 50,000, the Turks and Caicos Islands boasts an impressive internet penetration rate of 96%, making it the most connected Caribbean country. This connectivity lays the foundation for a budding digital economy and a growing demand for technology imports, but it also comes with its own set of challenges.

Unique Customs Pain Points in Importing to Turks and Caicos

Infrastructure Gaps:

Despite improvements in telecommunications, connectivity infrastructure — including data centers and inter-island networks — remains underdeveloped.

Varied Import Duties:

Different tech products attract different tariffs, impacting overall import costs. This wide duty range means your cost calculations and pricing strategies must be precise to remain competitive in this market.

Licensing and Registration:

Specific technology imports — including telecommunications equipment, encryption devices, and radiofrequency tools — require specialized permits and must comply with TCI’s registration requirements.

Regulatory Flux:

The regulatory environment is evolving, particularly around data protection and cybersecurity. Keeping up with these changes is crucial to avoid delays or compliance issues.

Documentation Complexity:

Customs clearance demands accurate documentation and adherence to local standards, which can be time-consuming and complicated without the right expertise.

Top Countries That Trade with the Turks and Caicos Islands

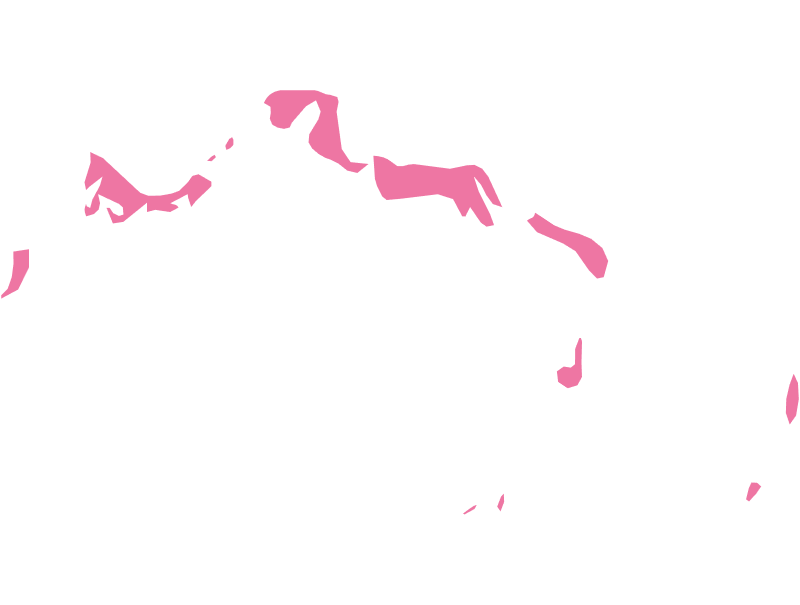

North America

The Bahamas

Europe

Switzerland

How TecEx Simplifies Importing to Turks and Caicos

Importing to Turks and Caicos is an adventure full of opportunities — but also one fraught with regulatory and logistical twists. With TecEx as your Importer of Record (IOR), you gain a Caribbean trade expert:

Customs Clearance Expertise:

We decode duty rates, customs procedures, and licensing requirements to ensure your imports comply fully and clear smoothly.

Tailored Delivered Duty Paid (DDP) Solutions:

From customs clearance and inland transport to local taxes and documentation, we handle the entire import process, so you can focus on growing your business.

Minimized Costs and Delays:

Leveraging our extensive regional network and expertise, we optimize your supply chain to reduce import taxes and avoid costly hold-ups.

Ongoing Regulatory Monitoring:

As rules evolve, we keep you informed and compliant, safeguarding your shipments and reputation.

TCI’s Government Initiatives and Opportunities

The Turks and Caicos Islands are poised for transformation, evolving from a tourism-reliant economy into a promising regional player in technology trade. While infrastructure and market size challenges remain, the government’s proactive initiatives and the islands’ strategic location create a fertile ground for growth.

From computers and software to telecom infrastructure, most tech products are brought into the country, reflecting the TCI’s ambition to build a digital economy. The Turks and Caicos government actively promotes technology development through strategic initiatives such as the National ICT Strategy and Tech Hub TCI. These programs encourage investment, innovation, and partnership opportunities, with incentives including:

- Reduced import duties for technology businesses

- Exemptions from business license fees

- Support for fintech, e-governance, and digital tourism technologies

The tourism sector’s dominance also drives demand for tech solutions that enhance visitor experiences, opening exciting avenues for specialized technology providers.

Ready to import to Turks and Caicos?

Unlock the full potential of import to Turks and Caicos and turn complexities into opportunities in this stunning Caribbean paradise. Contact TecEx today and let us navigate the customs maze for you!