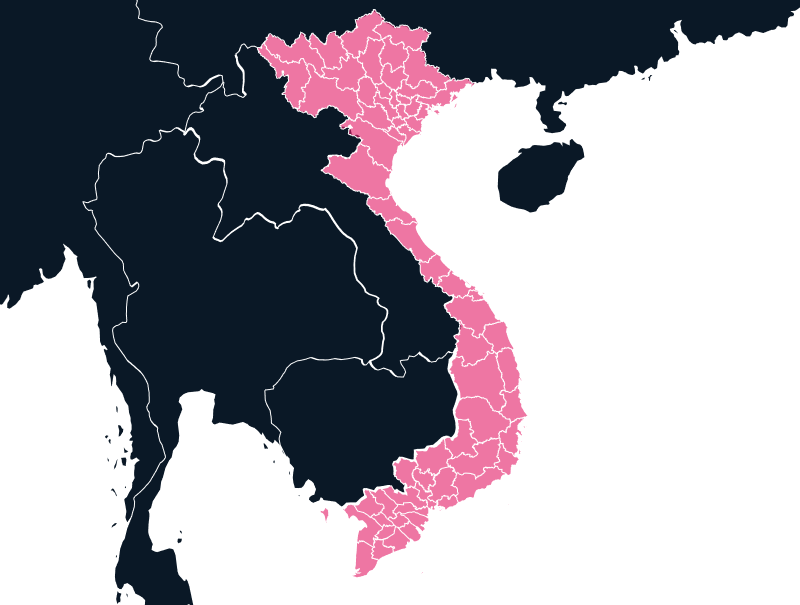

Asia

Exporting and Importing from Vietnam

Vietnam is rapidly emerging as one of Southeast Asia’s most dynamic trade hubs. With its strategic location, business-friendly environment, and growing digital infrastructure, Vietnam presents both opportunities and challenges for international trade.

Tax

Up to 10%

Duties

Up to 25%

Lead Times

4-5 Weeks

Restricted Items

OEM Restrictions; Wireless Products; Encrypted Goods; Second-Hand and Refurbished Goods

Best Carrier Option

Freight Forwarders

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

Vietnamese

The Rising Importance of Vietnam in Global Trade

Vietnam’s economy has been growing at an impressive pace, driven by its developing digital sector and robust manufacturing base. The country is attracting companies from around the world for IT outsourcing and hardware manufacturing. The Vietnamese government’s support for digital innovation, coupled with its competitive labor costs, makes it an attractive destination for businesses looking to scale their operations.

This progress, however, comes with its own set of challenges, especially for importers and exporters. Navigating the customs process and ensuring compliance with local regulations requires expertise.

Population

101.6M

Biggest Industry by Export

Phones and Accessories

Capital City

Hanoi

Biggest Industry by Import

Integrated Circuits

Importing into Vietnam | Key Considerations

For businesses looking to import into Vietnam, the process can be complex. One of the first things you’ll need is an Importer of Record (IOR) in Vietnam who is familiar with the country’s import regulations. Importing tech goods, particularly those related to wireless communication or encrypted products, requires specific documentation, such as the Certificate of Conformity (CoC). The Vietnamese government places stringent rules on these categories to ensure national security and consumer safety.

Another significant pain point for importers is the potential for customs revaluation, which often leads to adjustments in taxes and duties. These unexpected changes can disrupt your financial planning, making accurate cost forecasting crucial. Without proper guidance, businesses may face delays or increased costs due to misclassifications or errors in documentation.

Exporting to Vietnam | Meeting Compliance Standards

Vietnam’s export regulations are also structured to ensure the quality and safety of goods entering the country. Many imported products must undergo specialized inspections to confirm they meet the national technical standards. Items like electronics, pharmaceuticals, and petroleum products are subject to additional scrutiny. Navigating these inspections requires a deep understanding of Vietnam’s regulatory landscape.

Moreover, Vietnam has been part of multiple Free Trade Agreements (FTAs), including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA). While these agreements provide valuable opportunities for reduced tariffs, businesses must comply with specific rules of origin and provide the necessary documentation to take advantage of these benefits.

Pain Points for Importers and Exporters in Vietnam

Both importing and exporting to Vietnam can be fraught with obstacles. Some of the most common issues faced by businesses include:

Customs Documentation Errors:

Incorrect or missing details in customs declarations can lead to significant delays, fines, or even the rejection of shipments. With the complexity of Vietnam’s documentation requirements, accuracy is paramount.

Complex Tariff Classifications:

Misclassifying products is a common issue that can lead to disputes with customs authorities, causing additional inspections or financial penalties. Familiarity with the country’s tariff schedules is essential for ensuring that products are correctly classified.

Inspection and Certification Delays:

As mentioned, certain goods require specialized inspections before they can be cleared at customs. These inspections often cause delays, especially when documentation is incomplete or incorrect.

Export Tax Compliance:

For businesses exporting from Vietnam, maintaining accurate tax records and adhering to export tax regulations is critical to avoid penalties or disputes. While export tariffs are less common than import tariffs, they still apply to certain products.

Top Countries That Trade with Vietnam

Asia

South Korea

Asia

Japan

Successfully Import and Export in Vietnam

Navigating the import and export process in Vietnam can be daunting, but TecEx is here to help simplify the experience. With extensive experience in dealing with Vietnamese customs, we offer tailored solutions for both importers and exporters, ensuring seamless operations from start to finish.

Vietnamese Import Assistance:

Our team of experts at TecEx provides accurate cost calculations, ensuring that businesses can anticipate and plan for any adjustments to taxes and duties. We conduct thorough pre-compliance checks and take care of all documentation requirements, including the crucial Certificates of Conformity. By acting as your Importer of Record, we handle the complexities of Vietnamese import regulations, ensuring first-time clearance for your goods and minimizing the risk of delays or fines.

Vietnamese Export Assistance:

For exporters, we provide expert advice on the correct classification of goods and help you comply with Vietnam’s export tax regulations. Our team works closely with customs authorities to ensure your shipments pass smoothly through inspection and adhere to all necessary documentation standards.

Navigating FTAs:

With the help of TecEx, you can take full advantage of the preferential tariffs offered through FTAs such as CPTPP and EVFTA. We ensure your business complies with the rules of origin, providing you with the documentation needed to benefit from reduced trade barriers.

Vietnam’s role as a global trade destination continues to grow, offering significant opportunities for businesses. However, the import and export processes come with unique challenges that require specialized knowledge and experience. TecEx’s expertise in Vietnamese customs regulations, cost estimation, and documentation management helps mitigate these risks, allowing your business to navigate the complexities of trade with confidence.

Important Dates Impacting Vietnamese Shipping

Businesses are often closed for three days to celebrate Vietnamese New Year.

Your Global Trade Solution for Exporting and Importing from Vietnam

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.