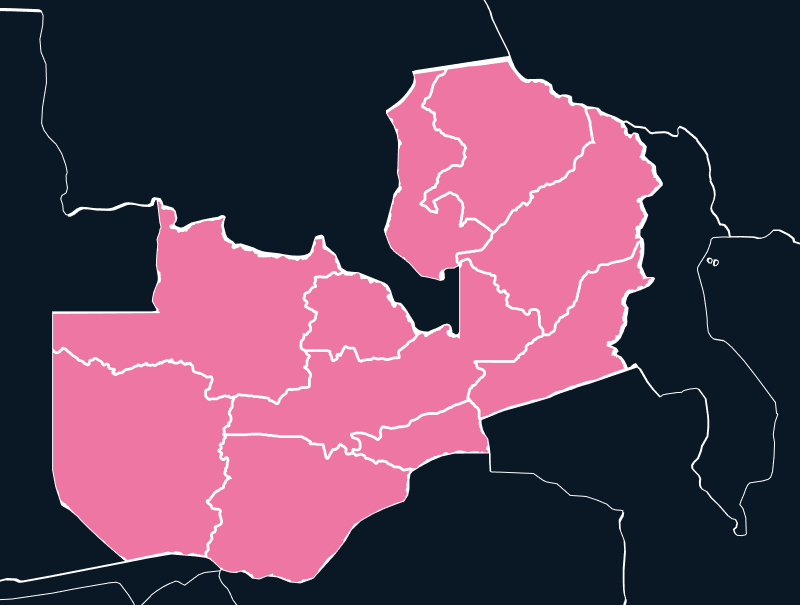

Africa

Import and Export to Zambia

Zambia is fast becoming a strategic hub for trade in Africa. With a growing technology sector, a liberalized economy, and strong ties to regional trade blocs like COMESA and SADC, the country offers vast potential for businesses looking to export to Zambia.

Tax

16%

Duty

25%

Lead Times

6-7 Weeks

Restricted Items

N/A

Best Carrier Option

Courier or Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

English

Zambia’s Trade Landscape

Zambia’s government is actively promoting digital infrastructure, aiming to transform into a “Smart Zambia.” As part of this digital shift, there’s been a noticeable increase in the demand for data storage and telecommunications equipment. Imports of such technologies are not only welcomed, they’re incentivized.

Population

21.9 M

Biggest Industry by Export

Copper Mining and Processing

Capital City

Lusaka

Biggest Industry by Import

Industrial Machinery

In fact, telecommunications equipment has been zero-rated for import duty, including telecom masts and related hardware. This move is part of a broader strategy to attract foreign investment and modernize the country’s ICT backbone.

Still, the road to successful importation is not without bumps. Alongside these opportunities come complex challenges in navigating Zambia’s import regulations and customs procedures.

Whether you’re moving IT infrastructure, telecom equipment, or specialized machinery, understanding the import and export procedure in Zambia is crucial to avoid costly delays and compliance risks. Without an experienced local partner, compliance challenges can quickly escalate into costly problems.

Common Trade Challenges in Zambia

Lack of a Local Legal Entity

To import dual-use or sensitive technology goods into Zambia, you must be a registered local entity or work through a compliant Importer of Record (IOR). Without this, your shipment won’t clear customs.

Customs Classification Complexity

Zambia’s customs regulations demand accurate product classification. Errors in Harmonized System (HS) codes can lead to delays, fines, or even product seizure. Our proprietary TecEx compliance database ensures all goods are accurately classified from the start.

Regulatory Hurdles and Corruption

Non-tariff barriers such as arbitrary regulatory practices, administrative corruption, and preferential treatment of state-owned enterprises remain an issue. Partnering with an experienced IOR reduces your exposure to these risks.

Labeling and Quality Standards

The Zambia Compulsory Standards Agency (ZCSA) has the authority to confiscate or destroy improperly labelled goods without compensation. For pharmaceuticals and consumables, all labeling must be in English and meet strict guidelines.

Top Countries That Trade with Zambia

Asia

China

Asia

United Arab Emirates (UAE)

The Import and Export Procedure in Zambia

Understanding the import and export procedure in Zambia helps prevent missteps. Here’s what a typical import process entails:

- Register with the Zambia Revenue Authority (ZRA)

– Only registered importers can bring goods into the country. - Use the ASYCUDA System

– Zambia uses the Automated System for Customs Data to streamline declarations and tax payments. - Ensure Compliance with ZCSA

– Products must meet national standards, including labeling, quality control, and technical specifications. - Calculate and Pay Import Duties

– Duties are based on Customs Value + Customs Duty + Excise (if applicable) + 16% VAT. - Clear Through Customs

– Inspections may occur. TecEx’s local knowledge ensures your documentation and declarations are air-tight. - Final Delivery to Site

– Once cleared, goods are delivered to their final destination—whether that’s Lusaka or a remote data center.

Export to Zambia with Confidence | TecEx Has You Covered

At TecEx, we do more than facilitate imports; we ensure your business succeeds in Zambia’s dynamic trade environment.

Our DDP and IOR/EOR Service Includes:

Pre-compliance Checks

We identify and mitigate potential customs issues before your goods ship.

HS Code Classification

Our compliance database matches your goods to the correct customs codes for Zambia.

Tax & Duty Management

We handle all VAT, customs duty, and surtax calculations and payments.

Regulatory Support

We ensure your goods meet all ZCSA and labeling requirements.

Final Mile Delivery

From Lusaka to Kitwe, we manage secure delivery right to your site.

Whether you’re deploying cloud infrastructure, shipping medical equipment, or delivering ICT solutions, exporting to Zambia is simpler, faster, and safer with TecEx at your side.

Ready to Export to Zambia?

Don’t let paperwork, local laws, or compliance headaches slow you down. Let TecEx handle the import and export procedure in Zambia while you focus on scaling your business.