Value Added Tax (VAT) is a crucial consideration for tech companies engaged in global shipping. Understanding the impact of VAT, how it differs from other taxes like Good and Services Tax (GST) and sales tax, and how to calculate VAT is essential for ensuring smooth international operations.

Let’s explore the complexities of Value Added Tax when shipping across borders with examples of countries that use VAT or GST and how TecEx can assist with compliance, deferment, and recovery.

What is VAT?

VAT, or Value Added Tax, is a consumption tax levied on goods and services at each stage of production or distribution. It’s designed to be a tax on the value added to a product rather than a sales tax, which is only applied at the point of sale.

For tech companies shipping internationally, navigating the complexities of VAT along with other import taxes and duties can be challenging but is essential for maintaining compliance and managing costs effectively.

As of June 2023 and since the first introduction of a Value Added Tax in France in 1954, VAT has now been adopted by 175 countries around the world. – VAT Calc

VAT vs. Sales Tax vs. GST: What’s the Difference?

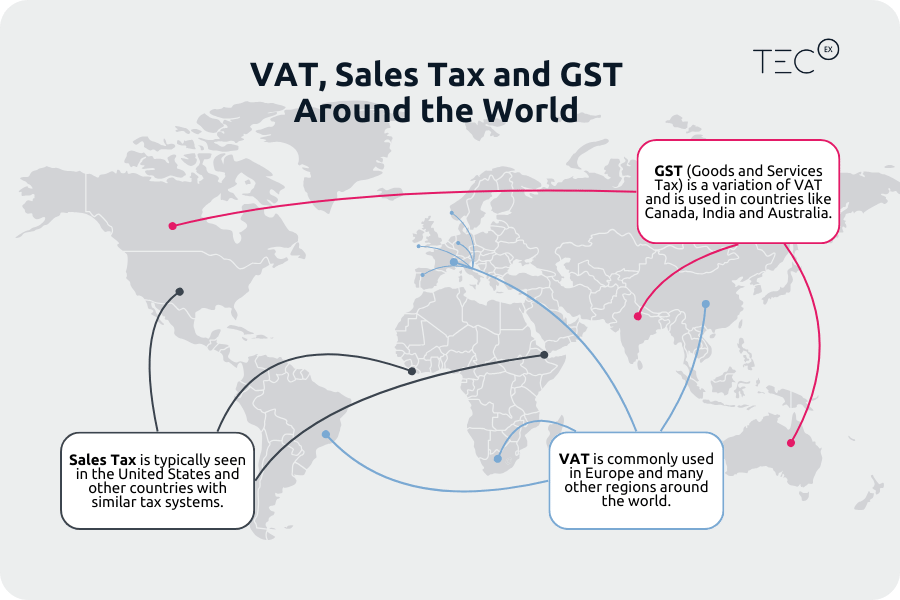

While Sales Tax, Value-Added Tax, and Goods and Services Tax are all consumption taxes, they differ in their application and collection methods. Here’s a quick comparison to help you understand how each system works:

Sales Tax

Type: Single-stage tax

Application: Applied only at the final point of sale to the end consumer.

Collection: Handled by the retailer.

Adopted By: Most U.S. states implement sales tax, such as California’s 7.25% rate.

Value-Added Tax

Type: Multi-stage tax

Application: Applied at each stage of the production and distribution process, from raw materials to the final sale.

Collection: Businesses collect VAT at each stage of production and distribution, but the final cost is borne by the consumer.

Adopted By: Common across Europe and many other regions, like the UK’s 20% standard rate.

Goods and Services Tax

Type: Multi-stage tax

Application: Similar to VAT, GST is applied at each stage of production and distribution.

Key Difference: GST typically has a more streamlined structure with fewer exemptions and rates compared to VAT.

Adopted By: Used in countries such as India (ranges between 0.25%-28%) and Singapore (9%).

Key Differences Between VAT, GST, and Sales Tax

- When the Tax is Applied: Sales tax is collected at a single stage (the final sale), while VAT and GST are collected throughout multiple stages of production and distribution.

- Who Collects the Tax: Retailers handle sales tax, while businesses at each stage of the supply chain manage VAT and GST.

- Complexity: GST typically has a more streamlined structure with fewer exemptions and rates compared to VAT.

Understanding these differences can help you navigate global shipping and tax compliance more effectively.

Which Countries Have Sales Tax and not VAT?

There are countries that have sales tax and not Value Added Tax or Goods and Services Tax, including:

How to Calculate VAT for Global Shipping

Calculating VAT can vary depending on the country of destination and the nature of the goods being shipped. Generally, VAT is calculated as a percentage of the invoice value, including shipping costs.

Calculating VAT can be straightforward if you understand the basics. Here’s a simple formula:

- Determine the VAT Rate: This varies by country.

- Calculate the VAT Amount: Multiply the product or service price by the VAT rate.

- Add VAT to the Price: This gives you the final price the customer will pay.

Did You Know?: Some goods that are exempt from VAT may not be exempt from GST, and vice versa.

Why VAT Compliance Matters in International Shipping

“VAT will typically take up the majority of the duties and taxes on charged” – Ariel Garber, TecEx Head of Tax

VAT is a complex part of the import process that can throw your whole timeline out if not done correctly. Non-compliance with VAT regulations can lead to significant fines, delays, and even seizure of goods.

Ensuring that your shipments meet the required VAT standards is not just about avoiding penalties but also about maintaining smooth operations and customer satisfaction.

Common VAT Challenges with Dual-Use Technology

- Classification Challenges: Correctly classifying dual-use items for VAT/GST purposes can be difficult. Misclassification can lead to incorrect tax calculations, tariff charges, delays, and potential legal issues.

- Export Controls and Tax Compliance: Adhering to both export control regulations and VAT/GST requirements can be burdensome. Errors in one area can impact the other.

- Customs Procedures: Customs authorities play a crucial role in verifying both the commercial and strategic value of goods. This process can be time-consuming and subject to delays.

- Country-Specific Rules: VAT/GST rules and export controls vary widely between countries, making global trade in dual-use technology even more challenging.

- Incorrect Valuation: Over or undervaluing goods for customs purposes can impact VAT/GST calculations and potentially trigger export control violations.

- Origin Determination: Determining the origin of a product for VAT/GST purposes can be complex, especially for goods with components from multiple countries.

- Temporary Imports: Shipping dual-use technology for temporary use in another country can involve complex VAT/GST and customs procedures.

- Free Trade Agreements: While designed to facilitate trade, free trade agreements often contain specific rules for dual-use technology, adding to the complexity.

VAT is a complex part of the import process that can throw your whole timeline out if not done correctly. Non-compliance with VAT regulations can lead to significant fines, delays, and even seizure of goods.

Ensuring that your shipments meet the required VAT standards is not just about avoiding penalties but also about maintaining smooth operations and customer satisfaction.

Tax policies can also change rapidly, and the specific VAT rates on imported tech goods can vary significantly within and between emerging economies. Therefore, it’s essential to consult industry experts on global tax structures.

How TecEx Can Help with VAT Deferment, Recovery, and Compliance

TecEx specializes in providing comprehensive solutions for tech companies navigating the complexities of VAT. Our services include VAT deferment, allowing you to delay VAT payment until goods are sold, VAT recovery, helping you reclaim VAT paid on business expenses, and ensuring full compliance with local VAT regulations.

Partnering with TecEx ensures that your company remains compliant with VAT regulations, minimizes costs, and avoids unnecessary delays in your global shipping operations.

VAT and Sales Tax FAQs

What is VAT, and how does it differ from GST?

VAT (Value Added Tax) is a tax levied on the value added to goods and services during production and distribution. GST (Goods and Services Tax) operates similarly but is used in countries like Australia, New Zealand, and India.

What is the difference between VAT and sales tax?

VAT is a multi-stage tax applied at every stage of production and distribution, whereas sales tax is only applied at the final point of sale.

How can I calculate VAT for my shipments?

VAT is typically calculated as a percentage of the total invoice value, including shipping costs. The exact rate depends on the country of destination.

What happens if my company fails to comply with VAT regulations?

Non-compliance can lead to fines, delays, and even the seizure of goods. It is crucial to ensure that all shipments meet the required VAT standards.

How can TecEx assist with VAT compliance?

TecEx provides services such as VAT deferment, recovery, and full compliance support, helping you navigate the complexities of VAT in global shipping.