Asia

Export and Import to South Africa

Tax

up to 15%

Duties

up to 22%

Lead Times

2-3 weeks

Restricted Items

Secondhand goods and used tech equipment

Best Carrier Option

Freight Forwarder or Courier

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Languages

English, Afrikaans, IsiZulu, isiXhosa, isiNdebele, siSwati, Sepedi, Tshivenda, Xitsonga, Sesotho and Setswana

Exporting and Importing To South Africa

South Africa’s top exports include gold, platinum, coal, cars, and diamonds to China, the US, India, Germany, and Japan. South Africa’s top imports include cars, motor vehicle parts, broadcasting equipment, and refined and crude petroleum, mainly from China, Germany, India, the US, and Saudi Arabia.

Before importing to South Africa, it’s necessary to register as an importer and nominate a local agent with permanent residence in the country to assume liability for customs clearance – a role that TecEx South Africa can fulfill as your Importer of Record. Exporters must also register with South African customs and nominate a local agent.

South Africa complies with the General Agreement on Tariffs and Trade (GATT) / WTO customs valuation codes. Correct HS codes for imports and exports are vital for South African customs clearance.

Goods imported to South Africa that are not declared on time risk detainment in a state warehouse. They may also be detained so that other government departments can examine them and ensure their compliance with trade regulations.

As a member of the ATA Convention, South Africa accepts ATA Carnets for temporarily importing commercial samples, exhibition goods, and specific professional equipment. However, to clear customs, the exporter must provide an authorization letter.

A Provisional Payment (PP) is then required upon import to cover applicable customs duty and VAT. The temporary import must be exported within 6 months unless an extension is applied for and granted. Once exported, the PP will be refunded. The South African Chamber of Commerce and Industry (SACCI) deals with ATA Carnet imports.

Various provisions must be met when exporting goods for repair to be returned to South Africa. Goods exported for repair under warranty are not dutiable, but VAT may be payable on the cost of repairs.

Delivery Duty Paid (DDP) Shipping With TecEx South Africa

With TecEx DDP shipping to South Africa, we can facilitate your door-to-door shipment. This includes compliance requirements like obtaining permits and preparing necessary documents under the correct HS codes, managing the logistics of your shipment, and delivering it to your warehouse or completing the last-mile delivery. We take on your risks and shipping responsibilities.

Only companies registered in South Africa can apply for permits like ICASA certificates, ITAC permits, and NRCS LOAs. Our offices in the country can easily fulfill these requirements and navigate all trade regulations. We are always up-to-date with the latest trade compliance requirements to ensure seamless shipments.

SARs may request proof of Insurance at their discretion. When you use TecEx liability cover, we can supply this for smooth South African customs clearance.

TecEx can also assist you with Return Merchant Authorisation (RMA) to import repaired goods to South Africa. The regulations are strict, and specific documents and permits are required to re-import repaired goods. We have the experience to help you complete these shipments.

Lastly, we can simplify your temporary imports to South Africa. With a strong understanding of the necessary documents, required permits, and limitations, we can ensure your temporary imports are compliant and successful.

Unique Pain Points Impacting South African Trade

Importing Used Goods to South Africa

All restricted goods require an export or import permit to leave or enter South Africa. The permit is only valid for the specific class of goods it was issued for, must be used by the person it was issued for, and can only be used within the calendar year when it was issued.

The Director of Import and Export Control at the Department of Trade and Industry issues South African import and export licenses.

To comply with the Basel Convention, various used and secondhand goods are restricted from being imported to South Africa. Used tech equipment is controlled to prevent the dumping of electronic waste. Used aircraft, waste, and scrap are also controlled. These items would require import/export permits.

Intricate Tax Structures

South Africa’s tariff schedule is remarkably complicated, with almost 40 different tariff rates ranging from 0% to 30%. Import duties on original equipment components are currently 20%. VAT is payable on most imports at 15%. However, certain imports may be eligible for a duty rebate.

With the TecEx South Africa DDP shipping solution, we can navigate its complex tax structures to seamlessly import your goods while you focus on your core operations.

CBCU Inspection and State Warehouses

The CBCU, a department of SARS, may choose to detain and inspect any shipments at any time while they are under customs control. If they decide to inspect all cargo on any given plane, the shipments can be delayed by up to 2 weeks, costing up to $33 per day.

Additionally, goods that arrive in South Africa but are not claimed promptly can be sent to a State Warehouse after 14 days, where they will incur additional fees. If the goods are not claimed within 6 months, they will be auctioned off.

Further Reading on Imports to South Africa

North America

United States of America (USA)

Africa

Namibia

South Africa Free Trade Agreements

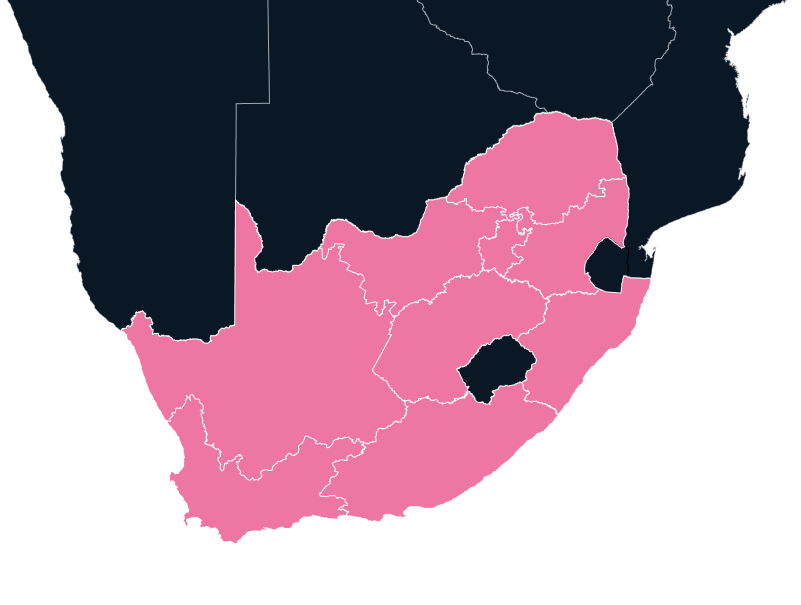

South Africa is a member of the Southern African Customs Union (SACU), which consists of Botswana, Lesotho, eSwatini, and Namibia. Under SACU, these countries administer a consistent external tariff, excise duties, and ad valorem customs duties on non-members. Members of SACU also do not trade under rules of origin. The International Trade Administration Commission of South Africa (ITAC) carries out tariff investigations, changes, and remedies for SACU. ITAC also issues permits to import restricted goods into South Africa.

Population

60.41 M

Biggest Industry by Export

Mineral Fuels

Capital Cities

Pretoria

Cape Town

Bloemfontein

Biggest Industry by Import

Mining

Additionally, the Southern African Development Community (SADC) has a Free Trade Area that allows free trade between Botswana, Comoros, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Tanzania, Zambia, and Zimbabwe.

The FTA aims to identify and remove non-tariff barriers to increase trade with a smoother movement of goods. While Angola and the Democratic Republic of Congo are members of the SADC, they do not participate in the FTA.

South Africa is also a member of the African Continental Free Trade Area (AfCFTA). This FTA aims to eliminate non-tariff trade barriers, enable free trade, and facilitate tariff liberalization.

Specific Compliance Regulations

Single Administrative Document (SAD)

The South African Revenue Service (SARS) uses a SAD500 for customs clearance for imports, exports, or cross-border trade. A SAD for export or import to South Africa has stringent requirements, with specifications like four copies and one original Commercial Invoice for any shipment or an insurance certificate for sea freight.

ITAC Permit for Resale Goods and Certain HS Codes

An ITAC permit is needed to import secondhand goods and goods with specific HS codes. Applications require supporting documents to prove that your shipment complies with South Africa’s trade regulations.

NRCS LOA (Letter of Authority) for Tech Goods

This is critical to import electronic goods for resale and any laptops successfully. This can take up to 120 days to obtain. Non-South African companies need to apply for this through a South African entity.

South Africa’s Independent Communications Authority (ICASA) Certification for Wireless Goods

ICASA testing includes performance, Electromagnetic compatibility (EMC), and safety testing. The ICASA certificate signifies your credibility and acts as quality assurance.

Radiofrequency (RF) items for electronic communication, broadcasting, and postal service goods may require an ICASA Certificate to be imported to South Africa. This includes wireless goods like cell phones, WiFi, and Bluetooth devices. An application requires various documents, including a declaration of conformity and a customs clearance letter.

If you are not based in the country, a South African-registered entity must apply for the certificate on your behalf.

Opportunities For Tech Importers and Exporters in South Africa

South Africa is brimming with opportunities for tech importers and exporters. More than 75% of South African households have internet access, and digital consumption is continuously growing through streaming platforms and social media. According to Tech Central, online shopping is widespread and growing, with eCommerce sales reaching around $4 billion in South Africa in 2023.

In addition, the Department of Communications and Digital Technologies (DCDT) has launched many initiatives to boost South Africa’s digital economy. With their Digital Economy Mission Plan (DEMP), they aim to build digital infrastructure, develop digital skills, boost digital innovation, enhance digital government services, improve cybersecurity, and encourage widespread digital transformation across critical sectors of the economy

According to the International Trade Association, South Africa’s digital economy is predicted to account for up to 20% of the country’s GDP by 2025. Digital payments are expected to grow at a compound annual growth rate (CARG) of 12.88% annually between 2023 and 2027, while cloud computing is predicted to grow at a CAGR of 25% until 2025.

South Africa’s government initiatives, investments in digital infrastructure, and increasing mobile connectivity and internet access make it an ideal environment for tech startups and innovators. The country has many untapped trade opportunities for various technologies, like telecommunication technology, AI-powered solutions, Internet of Things (IoT) solutions, and even Human-Machine Interfaces (HMI).

Your Global Trade Solution for South Africa

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your South African import/export needs.