Europe

Importing to Spain

Tax

up to 21%

Duties

up to 7%

Lead Times

2 - 3 weeks

Restricted Items

N/A

Best Carrier Option

Freight Forwarder

Non-Working Days

Saturday, Sunday, and Public Holidays

Prominent Language

Spanish

TecEx Delivery Duty Paid DDP Shipping to Spain

Importing tech goods to Spain is complex. Between a web of EU compliance regulations and separate Spanish customs requirements, importers and exporters face many hurdles.

With our DDP shipping to Spain, TecEx takes on your compliance, logistics, and post-clearance responsibilities. This means we will source the required licenses and certificates, arrange secure shipping channels, and even arrange your goods’ storage, installation, or last-mile delivery once they have cleared customs. We also offer door-to-door liability cover to protect you against any potential damage or loss of your goods.

As a member of the EU, Spain is part of many Free Trade Agreements (FTAs). Our extensive understanding of these allows us to ascertain whether you qualify for these benefits and utilize them if you do.

Don’t let complicated compliance regulations prevent you from profiting from Spain’s emerging opportunities for tech traders. As experienced global compliance experts, we have solutions to import advanced tech goods like AI and GPUs safely.

Furthermore, temporary imports to Spain can be tricky, and you may need an ATA Carnet. This allows you to import goods duty-free into Spain and other countries temporarily. TecEx can help you temporarily import items seamlessly and re-export them on time to avoid penalties.

Export licenses and compliance requirements for seamless exports can take months to obtain. With our Exporter of Record (EOR) capabilities, TecEx can get the required documents on your behalf and facilitate a streamlined export process.

AI Hardware, Handled Like Gold

Importing cutting-edge AI equipment? We specialize in transporting mission-critical, high-value technology with full-service precision and care. From fragile components to sensitive systems, our white-glove control tower solution ensures your shipments arrive safely, compliantly, and on time—no matter the destination.

Unique Pain Points for Spanish Trade

Importing to Spain requires shippers to comply with both EU trade regulations and Spanish trade requirements. These can be tricky to navigate as a non-EU member. Importers must be well-researched and well-prepared to successfully clear Spanish customs.

Exporting and importing to Spain requires many documents, from a SAD to import and export licenses to Dual-Use Declarations and Mill Test Certificates. Attempting to import to Spain without the necessary documents can result in lengthy delays, stuck shipments, and high demurrage fees. Partnering with a compliance specialist like TecEx will ensure your shipment fulfills all requirements to enter or leave Spain smoothly.

Specific Compliance Regulations

Import Authorization (Autorización Administrativa de Importación or AAI)

Import Authorization is necessary to control imports against Spanish quotas. There are no quotas on US imports. However, this authorization is still required for goods originating from a third country and US-originating goods for national security and trade data collection.

License from CDIU

If a shipment consists of software that will be distributed electronically, an import license must be obtained from the CDIU. The license-holding entity must also file this in its bi-annual reporting.

Dual-Use Declaration

Spain follows European Dual-Use Export Controls. Export licenses for restricted and controlled items must be obtained from Spain’s Ministry of Economy, Department of Foreign Trade in Defense and Dual-Use items.

Spain EORI

Importing to the EU requires an Economic Operator Registration and Identification (EORI) number, which is used for Customs Declarations. The EORI can also be used to apply for Authorized Economic Operator (AEO) status, which helps streamline customs processes. TecEx can assist you with these applications to ensure smooth shipping to Spain.

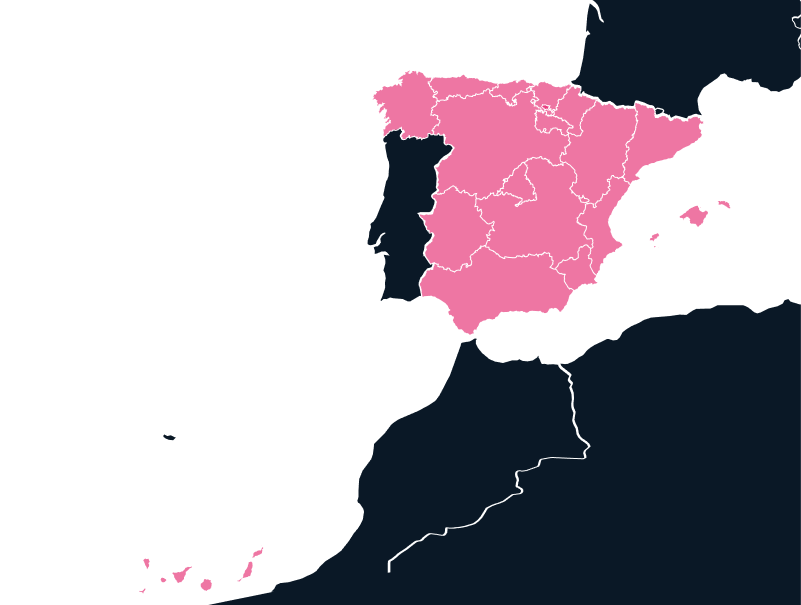

Countries Associated with Spain

Europe

Germany

Europe

Portugal

Exporting and Importing to Spain

According to the Observatory of Economic Complexity (OEC), Spain’s top exports include cars, refined petroleum, motor vehicle parts and accessories, and medical items like packaged medicaments, vaccines, blood, antisera, toxins, and cultures, mainly to France, Germany, Portugal, Italy, and the UK. Spain’s main imports include crude petroleum, petroleum gas, cars, packaged medicaments, and motor vehicle parts and accessories, mainly from Germany, China, France, Italy, and the US.

With 70% of Spain’s GDP coming from the service sector, the International Trade Administration notes many tech import opportunities for sectors like information and communication technology, security, and renewable energy.

Trade between Spain and other EU members is streamlined. As a member of the EU and the European Economic Area (EEA) member, transactions between Spain and other EEA members are duty-free. However, utilizing these benefits requires various documentation that an Importer of Record (IOR) can help you with.

All imports to and exports from Spain require permits, and re-exports require a certificate. These will need to be acquired from Spain’s Secretariat of Commerce. Other documents, such as the commercial invoice, airway bill, packing list, insurance documents, description of goods, and certificate of origin, are critical to avoid delays at customs. Additionally, importers must use Spain’s online EDI system, Sistema de Intercambio Telemático, to declare their goods’ value and HS codes before their arrival or departure.

To know if you need an export license, you’ll need to check if your goods are restricted and have an Export Control Classification Number (ECCN) on the Commerce Control List (CCL). Restricted goods include dual-use items and even video game consoles.

Population

48,37 m

Biggest Industry by Export

Automotive Sector

Capital City

Madrid

Biggest Industry by Import

Crude Petroleum

Spain Digital Economy

Using 26% of the EU’s post-COVID recovery program funds, Spain is building digital infrastructure and advancing its digital economy. According to the International Trade Administration (ITA), Spain plans to make digital advancements in their infrastructure, 5G, Cybersecurity, AI, public administration, SMEs, audiovisual, and skills development through their roadmap to digital development, España Digital 2026.

According to the IMF, roughly 45% of Spain’s exports are medium-high-tech goods, with low-tech exports growing. With programs like Strategic Projects for Recuperation and Economic Transformation (PERTE), Spain invests in semiconductor chip design and production. Initiatives like this open doors for OEMs to import components to Spain and for value-added resellers to export advanced tech goods from Spain around the globe.

Trade Differences Between Mainland Spain and Its Overseas and Special Territories

Political and Administrative Distinctions

Spain’s territorial structure includes both its mainland regions and several overseas or special territories, each with distinct political and administrative arrangements. Mainland Spain, along with the Balearic Islands, functions fully within the framework of the European Union (EU), adhering to all EU fiscal, customs, and trade policies. In contrast, the Canary Islands, Ceuta, and Melilla hold unique statuses due to their geographical remoteness or strategic locations.

The Canary Islands are classified as an EU Outermost Region (OR), meaning they are part of the EU but benefit from exemptions to certain EU laws to account for their isolation. Ceuta and Melilla, autonomous cities located on the North African coast, are also integral parts of Spain and the EU, but are excluded from the standard customs and tax regimes. Additionally, Spain maintains the Plazas de Soberanía—small, uninhabited territories under military administration along the Moroccan coast, which have limited economic roles.

Economic and Trade Differences

The mainland and Balearic Islands are fully integrated into the EU Customs Union and VAT (IVA) area, enabling the free movement of goods across member states. Conversely, the Canary Islands, Ceuta, and Melilla are excluded from these frameworks. The Canary Islands apply a local tax called IGIC (General Indirect Canary Tax), while Ceuta and Melilla use IPSI (Tax on Production, Services, and Imports), both offering substantially lower rates than the mainland’s VAT. This results in goods traded between these territories and mainland Spain being treated as imports and exports, subject to customs checks and special tax conditions.

Economically, these territories also exhibit distinct structures. Mainland Spain’s economy is diversified, led by industries such as automotive manufacturing, pharmaceuticals, and machinery exports. The Canary and Balearic Islands rely heavily on tourism, making them more sensitive to global travel and economic trends. Ceuta and Melilla, positioned as trade gateways with Morocco, depend on cross-border commerce and services rather than large-scale manufacturing. To stimulate growth, the Canary Islands operate a Special Economic Zone (ZEC) offering one of Europe’s lowest corporate tax rates—around 4%, compared to the mainland’s 25%. These differentiated fiscal and trade regimes underscore Spain’s strategy to support the economic sustainability of its geographically remote and strategically positioned territories.

EU Regulations in Spain

Single Administrative Document (SAD)

The SAD is a vital basis for customs clearance in Spain and the rest of the EU, as well as Iceland, Switzerland, Serbia, and the Republic of North Macedonia. The document minimizes administrative hassle and improves the standardization of trade data. It applies to any goods undergoing any customs procedure – export, import, warehousing, or temporary import.

EU Batteries Directive

The directive stipulates specific labeling and packaging requirements when importing batteries and requirements for facilitating their repair and reuse. You can learn more about shipping batteries here.

Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH)

REACH restricts certain chemicals imported into EU members over one metric ton.

Waste Electrical and Electronic Equipment (WEEE) Directive

Extended Producer Responsibility (EPR) requirements under the WEEE Directive stipulate that certain products must be registered before they can clear customs. This is arranged with a national authority or local partner. The products or packaging must also display the universal recycling icon, as consumers must be informed that their purchase should be recycled.

The Restriction on Hazardous Substances in Electrical and Electronic Equipment (RoHS) Directive

Certain chemicals may not be used in electrical and electronic equipment, which must be marked CE to certify compliance before it may be imported to Spain.

Mill Test Certificate (MTC)

Also known as a Material Test Report (MTR), an MTC is required when importing iron and steel goods to the EU. This prevents goods made from materials originating from Russia from entering the EU. Ideally, this is sourced from a manufacturer, but TecEx can help you navigate this complex requirement.

Ready to Ship to Spain?

Fill in the form to get in touch, and our expert team will contact you with a bespoke customs compliance solution to suit your needs.

.jpg)