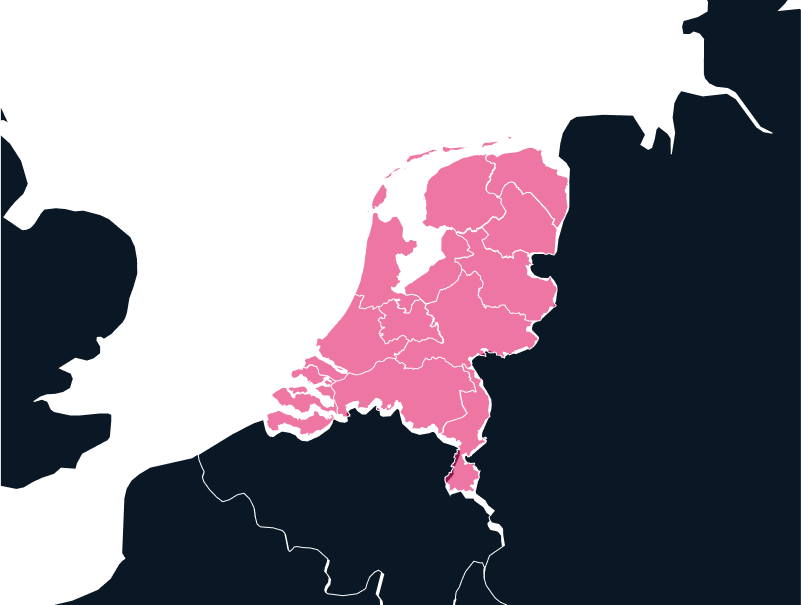

Europe

Export and Import to the Netherlands

Tap into the Netherlands, a critical EU trade hub with unmatched logistics and strategic positioning. Fully aligned with EU trade rules, it simplifies imports and exports. With innovation and sustainability at its core, the Netherlands opens doors to opportunities in green technology and digital services.

Tax

Up to 21%

Duties

Up to 7%

Lead times

1-2 weeks

Restricted Items

N/A

Best carrier option

Freight Forwarder or Courier

Non-Working Days

Sundays & Public Holidays

Prominent Languages

Dutch; English

Import Requirements for The Netherlands

When importing into the Netherlands, businesses must comply with several key requirements to ensure compliance with local and EU regulations.

First, any business wishing to import goods into the Netherlands must be registered within the European Economic Area (EEA). This includes obtaining an EORI (Economic Operators Registration and Identification) number, which is mandatory for submitting customs declarations. While having a registered entity and an EORI number is essential, businesses may still prefer to avoid the complexities and risks of acting as the Importer of Record themselves.

The customs declaration process involves submitting the Single Administrative Document (SAD), which serves as the primary declaration for all imports. The SAD outlines duties, VAT, and other applicable taxes. The Entry Summary Declaration (ENS) is also required as part of the Import Control System (ICS). This declaration must be submitted before goods arrive in the EU. To complete the SAD and ENS, businesses (including non-EU entities) must have an EORI number.

The Netherlands adheres to the EU’s Common Customs Tariff regarding import duties and VAT. The duties on goods can range from 0% to 17%, depending on the product, with an average tariff rate of 4.2%. Certain products like electronics or machinery may qualify for specific preferential rates. VAT is another key consideration, with a standard rate of 21%, though essential items like food and medicines are taxed at a reduced rate of 9%. Importers are responsible for paying both VAT and customs duties during customs clearance in the Netherlands.

Labeling and packaging requirements also play an essential role in the import process. Goods imported into the Netherlands must adhere to EU standards, which mandate clear product descriptions, usage instructions, and safety warnings in the official EU languages. Products like electronics, machinery, and chemicals are also subject to strict EU regulations, including compliance with CE marking standards. This ensures consumers have the information they need for safe usage and handling.

The ATA Carnet system offers a solution for businesses importing temporary goods, such as commercial samples or professional equipment. This system allows for temporary entry without the need to pay duties or VAT, streamlining the import process for such items.

Dutch Pain Points and Compliance Challenges

Due to the country’s highly regulated import/export environment, businesses often face unique challenges when conducting trade with the Netherlands.

One of the primary hurdles is the complex customs procedures. Despite the country’s reputation for efficiency, customs processes can still be detailed, with strict documentation requirements. Missing or incorrect paperwork, such as the SAD or the ENS, can result in significant delays or complications during customs clearance in the Netherlands.

Another challenge many businesses encounter is obtaining an EORI number. This number is required for imports and exports and is essential for lodging customs declarations. However, obtaining an EORI number can be time-consuming and complex, and any inaccuracies in the registration can lead to further delays or even the seizure of goods.

Additionally, understanding the complexities of VAT and tariff regulations can be a significant challenge. While the Netherlands adheres to the EU Common Customs Tariff policies, the specific rates and duties applied can vary depending on the nature of the imported goods. For example, special rules apply to temporary imports or re-exports, and businesses must be familiar with how VAT is applied to avoid costly mistakes.

Product safety and compliance are also crucial for businesses importing or exporting to the Netherlands. Many products must meet stringent EU safety standards, especially in the tech, machinery, and electronics sectors. Obtaining necessary certifications, such as the CE mark, is often required. This mark demonstrates that the product complies with EU health, safety, and environmental standards needed for legal import/export activities. However, this process can be time-consuming and costly, and failing to comply can prevent goods from entering or leaving the country.

Countries Associated with Netherlands

Europe

France

Europe

Germany

Export Requirements for Netherlands

The Netherlands is a major exporter of industrial products, machinery, chemicals, and electronics. To export from the Netherlands, businesses must comply with both national and EU regulations:

Export Documentation

Similar to imports, exports require proper documentation, including customs declarations and possibly export licenses, depending on the product category. Goods must meet EU product standards and regulations before they can be exported, especially for restricted items.

Export Restrictions

The Netherlands, as part of the EU, follows strict export controls for certain goods, such as military technology or dual-use items. These products require special licenses and export documentation.

Specialized Solutions for Importing to the Netherlands

TecEx offers a range of solutions to simplify the import process into the Netherlands and reduce the associated risks and complexities for businesses. One of the key services TecEx provides is acting as the Importer of Record (IOR) or Exporter of Record (EOR) on behalf of companies. This service ensures that the customs clearance process is handled smoothly while reducing the business’s liability. By taking on the IOR or EOR responsibilities, TecEx helps companies avoid unnecessary delays and complications associated with compliance and documentation requirements.

Our VAT reimbursement services allow businesses to recover VAT payments, reducing the overall cost of importing goods into the Netherlands. By navigating the VAT recovery process, TecEx helps businesses save money and streamline their financial operations related to imports.

Population

17.88 M

Biggest Industry by Export

Machinery and Equipment

Capital City

Amsterdam

Biggest Industry by Import

Crude Petroleum

Another valuable service TecEx offers is its Delivered Duty Paid (DDP) solution. This comprehensive service covers everything from pick-up and warehousing to final delivery. With DDP, businesses can be confident that all import duties, taxes, and compliance requirements are handled efficiently. We also conduct thorough pre-compliance checks before shipments are sent to further support businesses. We verify the accuracy of key documentation, such as the SAD and the ENS, helping you avoid any issues or delays at customs.

Complete Netherlands Import and Dual-Use Compliance Solutions

The Netherlands is a European logistics hub for fashion, technology, and electronics. TecEx simplifies entry with IOR/EOR services, ensuring full compliance with EU standards.

Our product compliance services include expedited audits, HS code reviews, and labeling checks. We also manage VAT registrations and provide temporary import solutions for events and exhibitions.

The Dutch Trade Landscape | Mainland Netherlands vs. Caribbean Territories

Mainland Netherlands | A Global Trade Powerhouse

The mainland Netherlands, part of the European Union, is a major global trading hub, recognized as “Europe’s gateway” due to its strategic location and world-class infrastructure, such as the Port of Rotterdam and Amsterdam Airport Schiphol. The country boasts a highly diversified economy, deeply integrated into global value chains, with a strong presence in sectors like logistics, finance, technology, and high-value agriculture.

As a full EU member, the Netherlands benefits from the free movement of goods, services, capital, and people within the EU Single Market. This status also means it follows EU customs laws, including the common external tariff, which enables seamless trade with other EU countries.

Caribbean Territories | Smaller, Regionally Focused Economies

In contrast, the Caribbean territories of the Kingdom of the Netherlands, which include Aruba, Curaçao, Sint Maarten, and the BES islands (Bonaire, Sint Eustatius, and Saba), have significantly smaller and less diversified economies. These territories primarily rely on a few core industries like tourism, oil refining (notably in Curaçao), and international finance (especially in Curaçao). While these economies benefit from preferential access to the EU market, they do not enjoy the same integration into global value chains as the mainland Netherlands. The territories are classified as Overseas Countries and Territories (OCTs) of the EU, meaning they are not part of the EU Customs Union and do not adhere to the same trade regulations as the mainland.

These island territories also have a degree of autonomy in setting local trade and tax policies. Unlike the mainland Netherlands, which adheres to EU laws, the Caribbean territories each have their own customs systems and tax regimes. The BES islands, for example, use a General Expenditure Tax (ABB), while Aruba, Curaçao, and Sint Maarten rely on turnover taxes. Despite these differences, all territories maintain close ties with the Netherlands and benefit from the kingdom’s support, but their trade and tax frameworks are distinctly separate from the mainland’s EU-based system.

Ready to Import to the Netherlands?

With our expertise in EU regulations, we ensure a smooth process for both imports and exports, reducing risk and optimizing efficiency. Fill in the form to get in touch, and we will contact you with a tailored solution that meets your needs.