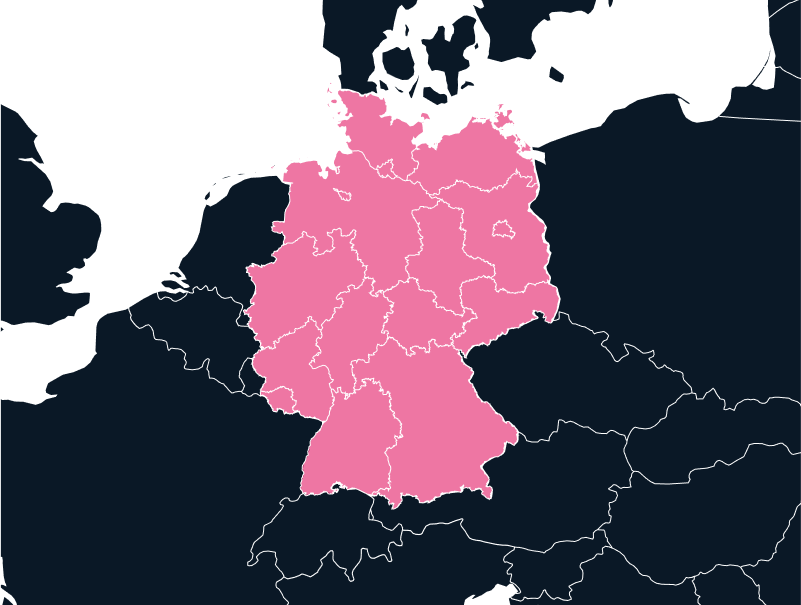

Europe

Importing to Germany

Germany is a powerhouse for international trade—renowned for world-class manufacturing, cutting-edge technology, and a strategic EU location that streamlines cross-border business. As Europe’s largest economy, it offers unparalleled opportunities for global companies seeking to import, export, and expand into one of the world’s most lucrative markets.

Tax

Up to 19%

Duties

Up to 7%

Lead times

2-3 weeks

Restricted Items

N/A

Best carrier option

Freight Forwarder or Courier

Non-working days

Saturday, Sunday, and Public Holidays

Prominent Languages

German

Key Requirements for Importing to Germany

Businesses outside the EU must meet several key regulatory compliance requirements when importing goods into the EU. First, they must register for an Economic Operators Registration and Identification (EORI) number, which is mandatory for customs declarations. Obtaining the EORI number typically takes two weeks, but accuracy is critical to avoid delays, fines, or even the seizure of goods.

In addition to the EORI number, certain products—such as IT equipment, machinery, and electronics—may require certifications like the CE mark, which indicates compliance with EU safety standards. Products like chemicals or medical devices may need additional certifications like REACH compliance or specific health-related approvals.

Customs declarations also play a significant role in German customs. The Single Administrative Document (SAD) must be completed for all imports, and an Entry Summary Declaration (ENS) must be filed before goods enter the EU. These declarations ensure that imports meet legal requirements.

Import duties and taxes should also be considered. Duties range from 0% to 17%, with an average rate of about 4.2%. In addition, imports are generally subject to a 19% VAT. Businesses need to account for these costs in their pricing and planning.

Additionally, proper packaging and labeling, including product origin, manufacturer details, and safety warnings, are essential for compliance.

For ecommerce businesses, understanding the specific import regulations for online retail shipments is crucial. Germany’s booming ecommerce market requires adherence to these procedures to ensure successful operations.

German Export Requirements

When exporting goods from Germany, businesses must navigate several regulatory requirements to ensure smooth clearance and compliance. One key requirement is obtaining a Movement Reference Number (MRN), which is essential for customs clearance. Without the MRN, shipments cannot pass through customs.

In addition, certain goods—particularly sensitive or high-tech items like encrypted software—may require specific export licenses or permits. It’s important to check whether the exported goods fall under these categories to ensure compliance with regulations.

Customs declarations are also vital; all exports must be declared to German customs, with details about the goods, their value, description, and destination. Correctly filing customs forms and securing export licenses are necessary to meet German and EU regulations.

Population

84.48 M

Biggest Industry by Export

Motor vehicles

Capital City

Berlin

Biggest Industry by Import

Vehicles and Vehicle Parts

Exports from Germany are typically exempt from VAT, but businesses must follow proper procedures to apply this exemption and avoid complications.

Lastly, businesses should be aware of export restrictions on certain items, such as military goods, dual-use technologies, or products subject to international sanctions. Staying informed about these restrictions is crucial to avoid violations.

Solutions for Exporting and Importing to Germany

One of the key solutions TecEx provides is the Delivered Duty Paid (DDP) service, which ensures that businesses can import goods into Germany with ease. This service covers all aspects of the import process, including customs clearance and delivery to your specified destination or data center, all while ensuring full compliance with local regulations.

In addition to the DDP service, we also offer VAT reclaim services. Many businesses may not be aware that they can reclaim VAT on goods shipped to Germany, but with the help of our VAT recovery services, companies can successfully recover these costs. If you’re unsure how to proceed, we are available to guide you through the process.

For businesses needing to register for an EORI number, we provide assistance to ensure the registration is completed accurately and efficiently. This is an essential part of trading with EU countries, and our expertise can help avoid common pitfalls.

Export compliance is another area where we can provide valuable support. Navigating the complexities of export regulations, including obtaining the necessary licenses and permits for controlled products, can be a challenge. We help businesses manage these requirements, ensuring compliance with all relevant laws and regulations.

Finally, we are well-equipped to handle data center logistics, with access to over 400 data centers across Germany. This means businesses can expect smooth delivery and installation of IT hardware and technology products.

Unique Pain Points and Challenges for German Imports and Exports

EORI Registration Complexity in Germany

Businesses outside the EU often struggle with the intricacies of EORI registration, which can delay shipments if the number is incorrectly filed. Companies should allow ample time for EORI registration and ensure accuracy in the application process.

Mandatory Compliance with CE Marking & Certifications

Many industries in Germany, particularly technology and manufacturing, face stringent product safety and quality standards. Products without the CE mark or necessary certifications can face delays in customs or be denied entry into the country.

Customs Delays in Germany

While Germany is known for its efficient customs processes, there are still potential delays due to incomplete documentation, incorrect tariff classification, or disputes over product valuations. Ensuring accurate customs declarations is critical.

German Export Challenges for Sensitive Goods

When exporting technology, encrypted products, or chemicals, additional permits and licenses are required. Businesses must navigate the complex regulations surrounding the export of controlled goods.

Germany’s Top Trading Partners

Europe

Switzerland

Europe

The Netherlands

German-Specific Trade Compliance Regulations

VAT on Imports

Goods entering Germany are subject to VAT at a rate of 19%. Businesses must be aware of their VAT obligations when importing goods and manage the VAT exemption for exports.

Export Control Regulations

Germany enforces EU-wide export controls on sensitive products, including military goods and dual-use technologies. Businesses must ensure compliance with export control laws, particularly when dealing with high-tech or encrypted items.

REACH Compliance

Products containing hazardous chemicals must meet the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations. Companies exporting such products to Germany must ensure their goods are registered and compliant.

Germany’s Trade Landscape

Germany is one of the largest economies globally, boasting a diverse industrial base, including automotive, aerospace, machinery, chemicals, electronics, and renewable energy. As a leading exporter in Europe, Germany has established strong trade relationships with major economies, including the US, China, France, the UK, and other EU countries. Its strategic location in the heart of Europe makes it an ideal logistics hub, with well-developed infrastructure facilitating both road and rail transport across the continent.

Germany is part of the European Union’s Common Customs Area and follows the EU’s customs regulations, making it essential for businesses to understand EU-wide standards and compliance requirements. The country is also subject to international trade agreements, including the EU’s free trade agreements with several non-EU countries, which can impact duties and tariffs for goods entering Germany.

By leveraging expert solutions and adhering to Germany’s comprehensive trade regulations, businesses can successfully import and export goods with minimal risk. Whether navigating EORI requirements, obtaining export licenses, or ensuring product certifications, working with an experienced partner like TecEx can ensure smooth and efficient trade operations.

Simplified Services to Bring your Goods into Germany without hassle

Germany is a central hub for many of Europe’s supply chains, especially in retail, apparel, and consumer goods. With strict EU regulations, product compliance and proper certification are essential.

TecEx acts as your IOR/EOR, taking on the legal responsibility for your goods. Our services include expedited audits and labeling verifications to ensure product compliance. We also assist with VAT registrations, local invoicing, and return logistics for unsold or seasonal stock.

Ready to Export and Import to Germany?

Connect with our team today to streamline your import or export operations in Germany and unlock new growth opportunities with expert support every step of the way.

.jpg)